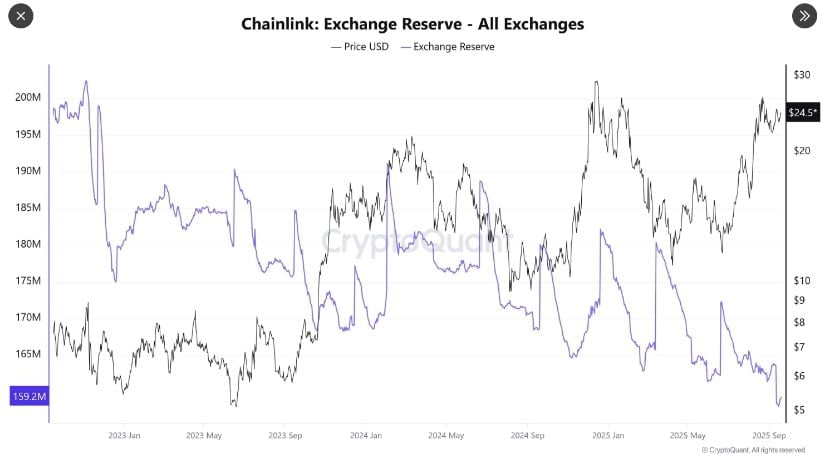

Well, butter my biscuit and call me a wizard, because Degen Sing (what a name, eh? 🧙♂️) reckons there’s a supply squeeze tighter than a dwarf’s wallet at a jewelry shop. Exchange reserves are lower than a snake’s belly, apparently, and haven’t been this scarce since 2022. Toss in the growing love for Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and the staking v0.2 upgrade locking tokens away like a nanny goat guarding her kids, and you’ve got a recipe for a breakout spicier than a dragon’s sneeze. 🔥

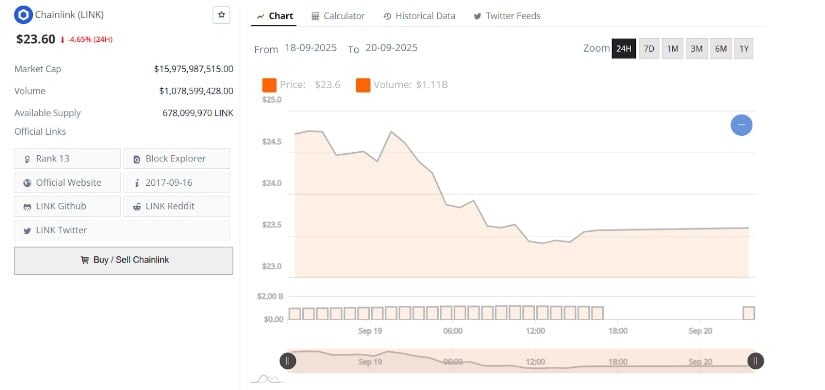

Analyst Ali, who probably has a crystal ball or just a really good guess, says the asset’s sniffing around the $25 mark like a troll at a treasure chest. If it breaks through, we’re looking at targets of $26.17, $27.84, and $30.13. But, oh ho! A pullback to $23.3-24 is still on the cards. Current price action’s hovering near $23.6, and trading volume’s over $1 billion-more attention than a wizard at a hat convention. 🎩💰

Exchange Balances: Lower Than a Gnome’s Self-Esteem

Chainlink’s exchange reserves are down to levels not seen since 2022, which means tokens are scarcer than a honest politician. Degen Sing (still chuckling at that name) says holders are hoarding their LINK like it’s the last pie at a goblin feast. Even a modest buying spree could send prices soaring like a broomstick with a rocket strapped to it. 🚀

And let’s not forget the CCIP, which banks, real-world asset platforms, and gaming projects are adopting faster than a witch adopts a black cat. 🖤 Meanwhile, the staking v0.2 upgrade’s locking up tokens like a dungeon master with a grudge, tightening the supply squeeze and making the market’s foundation sturdier than a dwarf-built bridge. 🏰

LINK Breakout: Will It Fly or Flop? 🦅💥

Degen Sing (yep, still giggling) reckons the breakout area’s near $47. If it clears that with the momentum of a charging troll, we could see targets at $47.15 and $88.26. Shrinking supply and growing utility? Sounds like the perfect storm for a rally, assuming the market doesn’t decide to take a nap. 😴

This all lines up with exchange balances dropping like a rock and accumulation steadier than a tortoise on a Sunday stroll. If buying pressure kicks in and LINK smashes through resistance, we could see its strongest rally since 2022. Traders are watching these levels like a hawk eyeing a particularly plump rabbit. 🦅🐇

Symmetrical Triangle: The Market’s Favorite Shape? △

Analyst Ali (probably wearing a monocle for effect) spots a symmetrical triangle on the 12-hour chart, with Chainlink cozying up to the $25 resistance like a cat to a sunny windowsill. Break above that, and we’re looking at $26.17, $27.84, and $30.13. Consolidation’s tighter than a bard’s lyrics, setting the stage for a move as dramatic as a dragon’s entrance. 🐉

If it holds above $25, the next stop’s $27-28, with $30 in the crosshairs. Higher lows suggest the bulls are still in the ring, but a pullback to $23.3-24 is possible. Keep an eye on that rising trendline-if it holds, the bulls might just charge again. 🐂💨

Recent Price Action: A Rollercoaster or a Merry-Go-Round? 🎢

Chainlink’s 24-hour chart took a dip after an early spike to $24.6, sliding below $24 and settling around $23.6-a 4.65% drop, but hey, who’s counting? Trading volume hit $1.11 billion, proving the market’s still got its popcorn out. 🍿

Market cap’s sitting pretty at $15.97 billion, with 678 million tokens in circulation. Analysts are eyeing the $23 support like a hawk-if it breaks, we could see more selling. But a bounce back above $24 might just set the stage for another run at $25 and beyond. 🏃♂️💨

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- USD TRY PREDICTION

- DOGE PREDICTION. DOGE cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- EUR UAH PREDICTION

2025-09-21 01:52