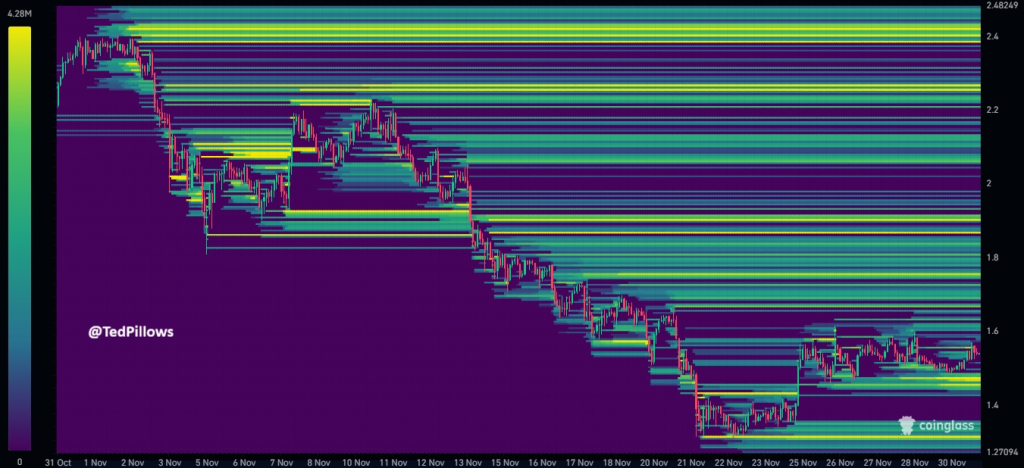

BTC held firm above $90,000 over the weekend, as investors, ever the optimists, anticipated a relief rally. However, the week began with a major crash, driving the flagship cryptocurrency to a low of $85,732. BTC is down nearly 6% over the past 24 hours, trading around $85,984. Meanwhile, ETH has slipped below $3,000, down 5.50% and trading around $2,828. Ripple (XRP) is down nearly 8% as it struggles to stay above $2, while Solana (SOL) is down over 7%, trading around $126. Cardano (ADA) is down almost 8% and Chainlink (LINK) is down 7% at $12.09. Stellar (XLM), Hedera (HBAR), Litecoin (LTC), Toncoin (TON), and Polkadot (DOT) have also started the week in the red. What a merry band of losers! 🐍