Ethereum’s $6.4B Meltdown: Whales Are Buying Big

Ether has an acute leverage reset. Open interest fell across boards as values fell between $4,830 and $2,800. But institutional buyers continue to add ETH. 🐸💸

Ether has an acute leverage reset. Open interest fell across boards as values fell between $4,830 and $2,800. But institutional buyers continue to add ETH. 🐸💸

Yet here we are, tethered to the whims of central banks, as markets bet heavily on the Fed’s December pivot. O’Leary, ever the skeptic, claims Bitcoin will meander within 5% of its current price-a testament to the resilience of a currency unshackled by the chains of traditional finance. Or perhaps, it is merely the echo of a system too vast to be swayed by a single decision.

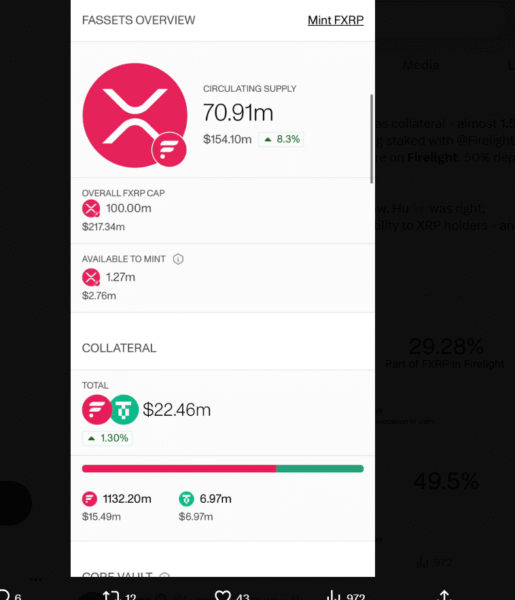

In the murky waters of DeFi, where sharks circle and hacks lurk like shadows, Firelight emerges as a beacon of hope-or so they claim. Built by the wizards at Sentora and blessed by the Flare Network, this protocol dares to offer XRP holders a chance to stake their tokens. 🤑 But wait, there’s more! It also promises a shield against the marauding bandits of the digital realm. A noble endeavor, or a fool’s errand? Only time will tell.

U.S. Solana Spot ETFs just raked in those dollars faster than a squirrel on espresso, celebrating a hefty inflow after a mysterious “outflow” on December 1, 2025 (time travel, anyone?). SoSoValue reported a cool $45.77 million flooding in on December 2, turning Wall Street from skeptics into believers faster than you can say “bull run.” With demand hotter than grandma’s Sunday pie, Solana’s party shows no signs of slowing.

In a recent chat with Bloomberg, Gensler was quick to remind everyone-those with ears to listen, of course-that most of these digital tokens are nothing more than a house of cards, waiting for the inevitable gust of wind to blow them down. He scoffed at the rising enthusiasm, fueled by political promises and buzzword-laden headlines, claiming that the public, from America to the far corners of the globe, has been too easily beguiled. 🙄

And what, you ask, is the shining beacon of hope? A report from Arab Chain on CryptoQuant, which, in its infinite wisdom, shows that the Coinbase Premium Index has returned to positive territory at +0.03. A veritable triumph! After a month of U.S.-led selling in November (how quaint), this positive premium signifies renewed demand from U.S. institutions and traders who prefer Coinbase as their liquidity playground. One wonders how long this will last. ⏳

A new report from Cryptoquant’s research team outlines a significant restructuring of Strategy’s treasury design, highlighting the company’s move to establish a dedicated U.S. dollar reserve alongside its long-standing bitcoin ( BTC) holdings. 🤯

Such drama in under 48 hours! One can’t help but chuckle at the poor souls who were convinced the downtrend would persist. CoinGlass, that ever-so-reliable gossip, reveals $223 million in liquidations, with a staggering $209.5 million in short liquidations. Oh, the schadenfreude! 😈

Key takeaways:

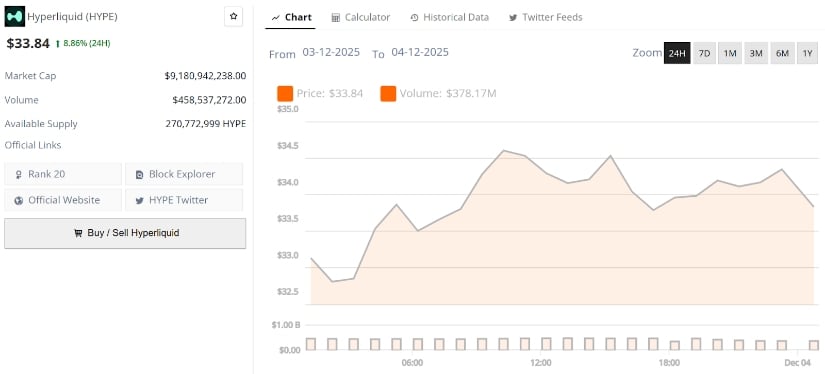

As of today, HYPE is trading around $33.84, up a respectable 8.8% in the last 24 hours. 🎉 Traders are now eyeing what they call the “accumulation band,” which sounds like something you’d find in a gym but is actually just a fancy way of saying, “Hey, maybe buy some of this before it gets too pricey.” Liquidity is trickling back into mid-caps, and analysts are spotting bullish structures like they’re birdwatching. 🦉📈 The question now is: Can HYPE keep this up, or will it face-plant into overhead resistance like a clown at a circus? 🤡