Ethereum’s Bounce: A Descent to $2,200? 🐍💸

$2,200, a key support zone that’s been napping since June. 🛌

$2,200, a key support zone that’s been napping since June. 🛌

Social media is ablaze, rumors swirling around like old men at a tavern-“The dollar’s dying, I tell ya!” Bloomberg and Google Trends have become the oracle and the oracle’s informant combined, telling us that the only thing rising faster than the virus in a sci-fi flick is the fear of debasement. It’s an encore of 2012 with a new cast, but this time, the stakes feel more like a Greek tragedy with a touch of slapstick comedy.

Behold! Prediction markets, those modern-day soothsayers, whisper of an 86% chance of a 25-basis-point cut, while 14% cling to the hope of status quo. The US, it seems, teeters on the brink of a Great Recession, and the Fed, ever the reluctant savior, must choose between mercy and madness. 🕵️♂️

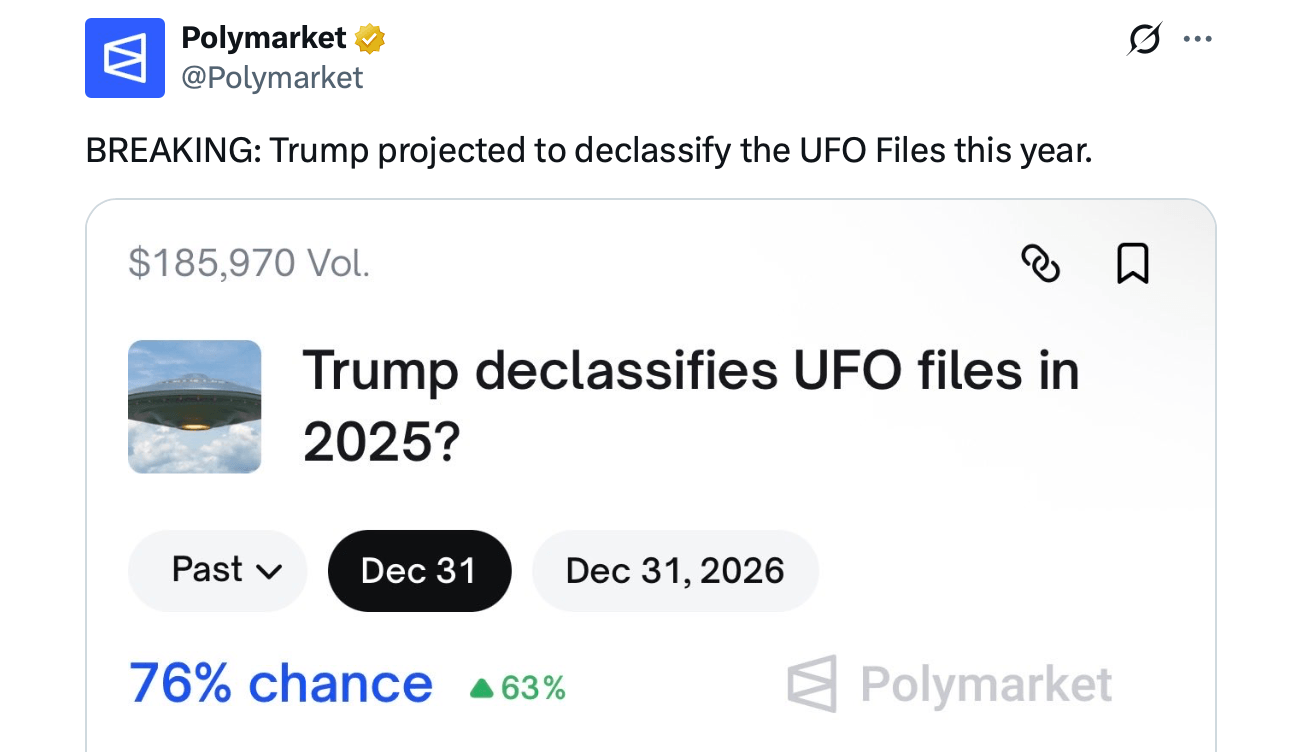

Polymarket traders are piling into the “Yes” side of a high-stakes wager: Will President Trump declassify UFO, or UAP, files before 2025 ends? The market’s implied probability shot from single-digits early Dec. 7 to the mid-70s within hours, briefly touching 81%, an eye-catching vertical leap for a contract that had drifted quietly for months. 📈

Meanwhile, the undeterred flow of over ten million dollars into Spot ETFs continues unabated-perhaps revealing that the true narrative lies not in the capricious charts but in the unwavering faith of those who still adore their digital treasures. With Open Interest standing firm and funding holding slightly positive, one cannot help but wonder-perhaps there is more beneath the surface than a simple price dip.

Yet, like a one-act farce, the euphoria crumbled faster than a poorly timed soufflé. Cue the heaviest selling spree since the invention of the wheel-six months ago, if you’re keeping score.

In his latest intellectual escapade, Buterin has proposed an on-chain prediction market that is “trustless,” which, according to him, will help users predict and secure future gas prices. After all, who doesn’t want to plan for volatility, instead of just reacting to it like a befuddled schoolmaster caught off-guard by a misbehaving pupil?