Fartcoin’s Existential Crisis: Will It Rise or Plunge into the Abyss? 🌪️💨

And so, dear reader, let us descend into the abyss of charts and predictions, to unravel the enigma of Fartcoin’s fleeting destiny. 📉📈

And so, dear reader, let us descend into the abyss of charts and predictions, to unravel the enigma of Fartcoin’s fleeting destiny. 📉📈

Key takeaways:

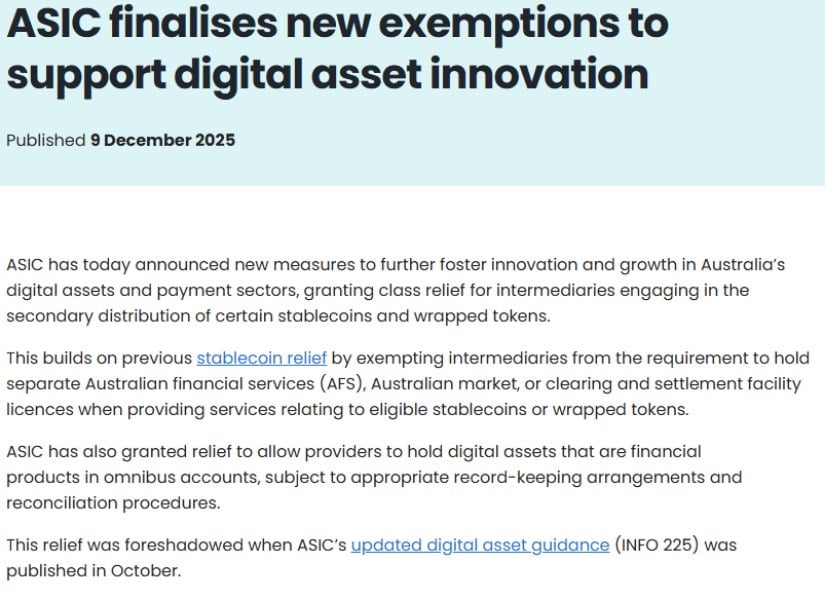

The exemptions? They’re like a spa day for stablecoin distributors, wrapped token intermediaries, and digital asset custodians. But here’s the catch: Companies have until June 30, 2026, to secure licenses before these temporary measures vanish like my willpower during a chocolate sale. ⏰

Behold the weekly ADA/USDT chart-a canvas where Cardano, that aging ballerina of blockchain, executes a pirouette upon a rising trendline, that ancient ballet barre of market whimsy. The $0.45-$0.47 zone, once a fortress of resistance, now blushes like a maiden at her first masquerade. 🎩💃

According to the noble onchain analysts at Capriole Investments, the obscure and seemingly mystical “Hash Ribbons” metric, which sounds like a fancy coffee blend but is actually about Bitcoin miners, has struck again. Not once, not twice, but the fifth time in 2025, it has issued a “buy” signal. Yes, a sign so accurate that even your skeptical uncle could be persuaded to toss a few bucks its way. Or at least that’s the hope.

Behold, the seer Pumpius, whose mind is a labyrinth of cryptic prophecies, unveils a scenario so grand it could rival the visions of the prophets. He claims that a single regulatory decree-a bank charter from the Office of the Comptroller of the Currency-shall transform XRP’s fate. Ah, the sweet promise of a national trust bank charter! With it, Ripple shall wield the power of the mighty banks, and the Federal Reserve shall tremble at its feet. What a glorious day it will be, or perhaps a nightmare of regulatory overreach!

On December 8, 2025, Pye Finance, that cheeky little startup, pulled in a whopping $5 million in seed funding. Who’s backing them? Oh, just a few small names like Variant and Coinbase Ventures, plus some other deep-pocketed investors, including the Solana Labs. They’re on a mission to totally change the game for Solana’s staking ecosystem, by turning the $75 billion locked up in static Solana stakes into something way more exciting. You guessed it-something programmable, something tradeable. What a concept, right? 🤔

The stage is set for a tango of chaos and calm, a falling wedge that mocks the notion of resolution. Buyers and sellers duel like dueling banjos, yet the curtain remains unlifted.

At the ungodly block height of 80,084,800, this hardfork has wrought changes as profound as they are tedious. The block gas limit, once a modest 30 million, has been inflated to 45 million, allowing for a staggering 33% more transaction data per block. Consensus time, in a fit of bureaucratic precision, is now pegged at one second, ensuring blocks are finalized with all the haste of a man fleeing a dull dinner party.

Huang, in a post on X (formerly known as Twitter, because why not rename everything?), declared that crypto is “facing its ‘Netscape’ or ‘iPhone’ moment.” 🍎🔮 “It’s working bigger than ever before, far beyond our wildest dreams,” he gushed. “Both the institutional parts and the cypherpunk parts.” Because nothing says “mainstream adoption” like a mix of suits and hoodies. 👔🎩