Tether’s Last Stand?

adapt, exit, or launch a fully compliant product. 🤝

adapt, exit, or launch a fully compliant product. 🤝

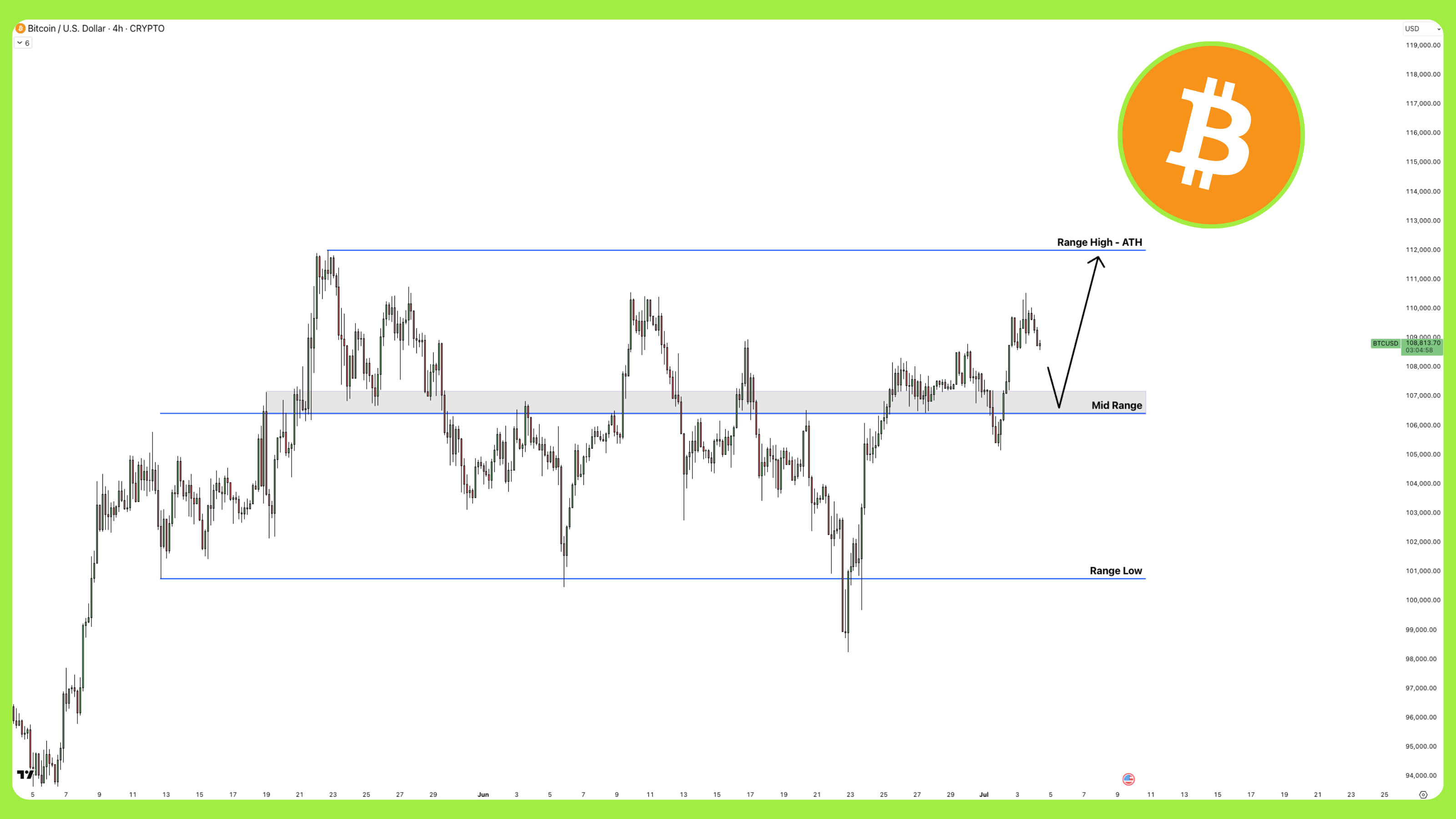

Freshly into a new quarter where numbers are reset and optimism is legally required, Bitcoin has played footsie with its favorite levels: caressing $105,000 for support, romancing $110,000 for resistance, and, on Tuesday, plummeting to a two-week low—it just needed a nap, really. The rollercoaster continues as Analyst Sjuul from AltCryptoGems bravely declares that BTC needs a solid rebound from the all-important $104,000-$106,000 zone, otherwise things could fall to the murky depths of $101,000, a price floor so forlorn only lost socks and unfulfilled ICOs reside there.

Recall the days when self-checkout was heralded as salvation? Alas, Walmart hath cast out these metal jesters—Princeton, New Jersey, now free from their robotic tyranny; Albuquerque, thrice so. The devil, as ever, lies not in efficiency, but in theft and shopper fury. Meanwhile, in the province of Texas, Sam’s Club hath raised a super-store with as many lanes as Molière’s wardrobe—none! AI now waves us through like aristocrats with a fast pass. 🛒

As we observe the chart (oh, such delightful art it is!), Dogecoin appears to be making a valiant attempt to rise from the ashes, creating higher lows—truly a mark of an uptrend. The $0.165 level, once a barrier, has been both broken and retested, as shown in the chart below. This area had previously served as a launching pad for Dogecoin’s heroic rally to $0.259 in May. And now, dear readers, this formation of higher highs and lows suggests that things may indeed look up… for the moment.

So, Moria. The protocol that, much like Raskolnikov with a conscience, accepts Bitcoin Cash as collateral, dispensing something called MUSD—a “stablecoin” clinging to the dollar by sheer willpower (and, allegedly, smart contracts). Moria’s raison d’être, apparently, is to let traders enjoy liquidity without selling the family silver. Or, in this case, their digital tchotchkes. Freedom cries out, “Have your BCH and spend it too!” 🤑

But guess what? Fidelity’s BTC ETF fund (FBTC) is outshining BlackRock’s IBIT. It’s like a high school popularity contest, but with billions of dollars on the line. 🏆

Analyst Crypto Joe, the self-proclaimed guru of all things crypto, shared a 1-hour chart of WIF/USDT, highlighting an inverted head and shoulders pattern — a classical reversal formation typically appearing after prolonged downtrends. The neckline, positioned between $0.89 and $0.90, has been broken, confirming the pattern’s validity. WIF is currently trading around $0.924, indicating bullish continuation following the breakout. Or so we hope! 🙏

If passed, the vote would also initiate token transfer rights for early supporters and begin shaping a long-term unlock schedule for founders, contributors, and advisors — ensuring long-term alignment with the project’s growth. 🤝

This tale begins, as so many do, with an announcement: DeFi Technologies, a Nasdaq-listed prophet of modern finance, establishes itself in the labyrinthine corridors of Dubai. Their offices, opened within the infamous DMCC, mark nothing less than an exodus from the familiar cold rationality of Wall Street to the dazzling, sun-bleached ambitions of the UAE.

Why Dubai, you ask? Why not, answers the business logic: If the soul of man can be traded, surely bitcoins and tokens can be too.

Now we got “momentum.” Everyone’s bullish. Bulls as far as the eye can see. Some technical thingamajig says we could get another 52% gain in three months. Three months! Because if there’s one thing the crypto market loves, it’s doing what analysts say on a timer. Like my mother with gefilte fish—ready in exactly 45 minutes or it never happens.