Finding MEV in a Harsh, Daring, and Complex World

Key Observations

Key Observations

On a Thursday most splendid, Bitwise took up its quill and submitted its Form S-1 to the U.S. Securities and Exchange Commission, thus initiating the grand process of creating a product designed to track the spot market price of the SUI token-our little gem from the layer 1 Sui blockchain network.

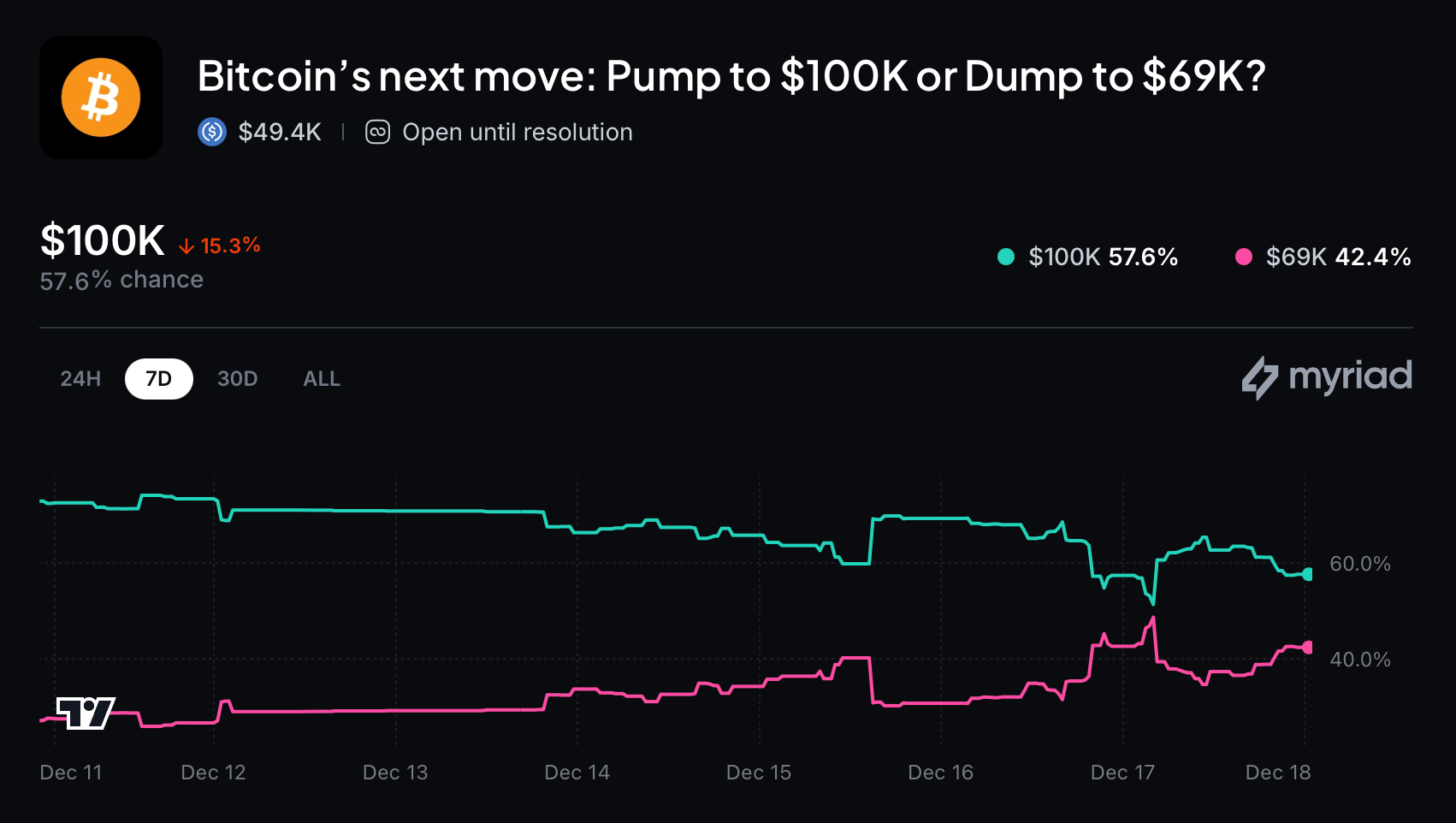

On Dec. 18, 2025, bitcoin (BTC) sits just above $85,000 after a brisk rise and a quiet retreat in the same session. To read the tea leaves, we consulted the Myriad marketplace wager titled “Bitcoin’s next move: Pump to $100K or Dump to $69K?,” which has chalked up 49.4K in USDC volume today. The crowd assigns a 57.6% chance to $100K and 42.4% to $69K-a small edge, like a waiter who’s certain but not certain enough to quit his day job. Over the past week, belief in $100K has faded by 15.3 percentage points, a quiet shrug that says, perhaps, not all dreams end in champagne. 🍷

As the clock struck midnight on Thursday, the ledger of dreams recorded a paltry $2.93 trillion-its weakest pulse since April, as chronicled by the scribes of CoinGecko. 📉

Behold, Zcash (ZEC), that privacy-peddling parvenu, has ascended in 2025 with the alacrity of a .edu student spotting NFTs. Yet Pal, ever the stoic, insists even a 699% rally is but a hare’s gambit. “Until the entire market walzes higher, we cannot confirm this is not a rotation,” he said, musing over tea and a cryptic spreadsheet.

The SEC has sued VBit and its founder, Danh Vo, in a Delaware federal court, accusing them of fraud and misappropriating $48 million in investor funds between 2018 and 2022. The alleged crime? Selling more hosting agreements than there were mining rigs. It’s like promising everyone a seat at the Restaurant at the End of the Universe, only to reveal it’s actually a phone booth. ☎️🌌

And thus, Bitcoin limps through a fragile juncture where capitulation and recovery might kiss or part ways-a drama best suited for the grandest stages. Axle Adler’s analytical theatre stages another act with the STH-SOPR 30D-a pendulum that sways precariously between profit and loss. Values that glide above one bubble with glee at joyful gains, while those ducking below impart tales of sorrow and distress. The tip of this financial double-edged sword is nothing short of a grand stage trifle, for should prices reclaim the hallowed land above one, hope might yet blossom like a daffodil in spring.

But wait! There are analysts out there tossing around ambitious upside targets like confetti! 🎉 Fresh gossip about utility, adoption, and yield generation keeps this digital token in the limelight, as the market tries to juggle immediate pressures with long-term dreams-talk about a circus act!

As we meandered through his house, he gestured toward an off-white wall, its companion a sofa so uncomfortable it seemed to mock the very notion of repose. This monstrosity of furniture had not budged in over a decade, a silent sentinel of ugliness. The wall, however, held secrets. A small square door, when pressed, revealed a crawl space-a time capsule of sorts. Inside lay relics of the 1970s: gnawed board games, forgotten documents, and the faint scent of mildew. It was as if he’d prepared for a winter that never came. 🕰️

MoonPay is dreaming big-aiming for a valuation of five billion dollars, as if that’s some kind of magic number, easy pickings in the game of fools. Bloomberg, ever the reliable source, whispers this in hushed tones, yet refuses to dish out the actual dollar amount. Typical, isn’t it? 💸