🤴 Royal Crypto: Malaysia’s Crown Prince Mints Money, But Will It Rule? 🤑

Its treasury, a fortress of Zetrix tokens, stands guard to ensure the blockchain kingdom runs like a well-oiled machine. ⚙️🛡️

Its treasury, a fortress of Zetrix tokens, stands guard to ensure the blockchain kingdom runs like a well-oiled machine. ⚙️🛡️

In a move that screams, “Look at me, I’m transparent!” Ledn, one of the globe’s most prominent bitcoin lenders, has unveiled its Open Book Report. This document, as dry as a martini but twice as revealing, lays out the nitty-gritty of its BTC loan book, collateral levels, and loan-to-value ratios. The inaugural report boasts $868 million in outstanding loans, backed by 18,488 BTC, with every last satoshi verified by The Network Firm LLP. Because, you know, trust but verify. 🔍✨

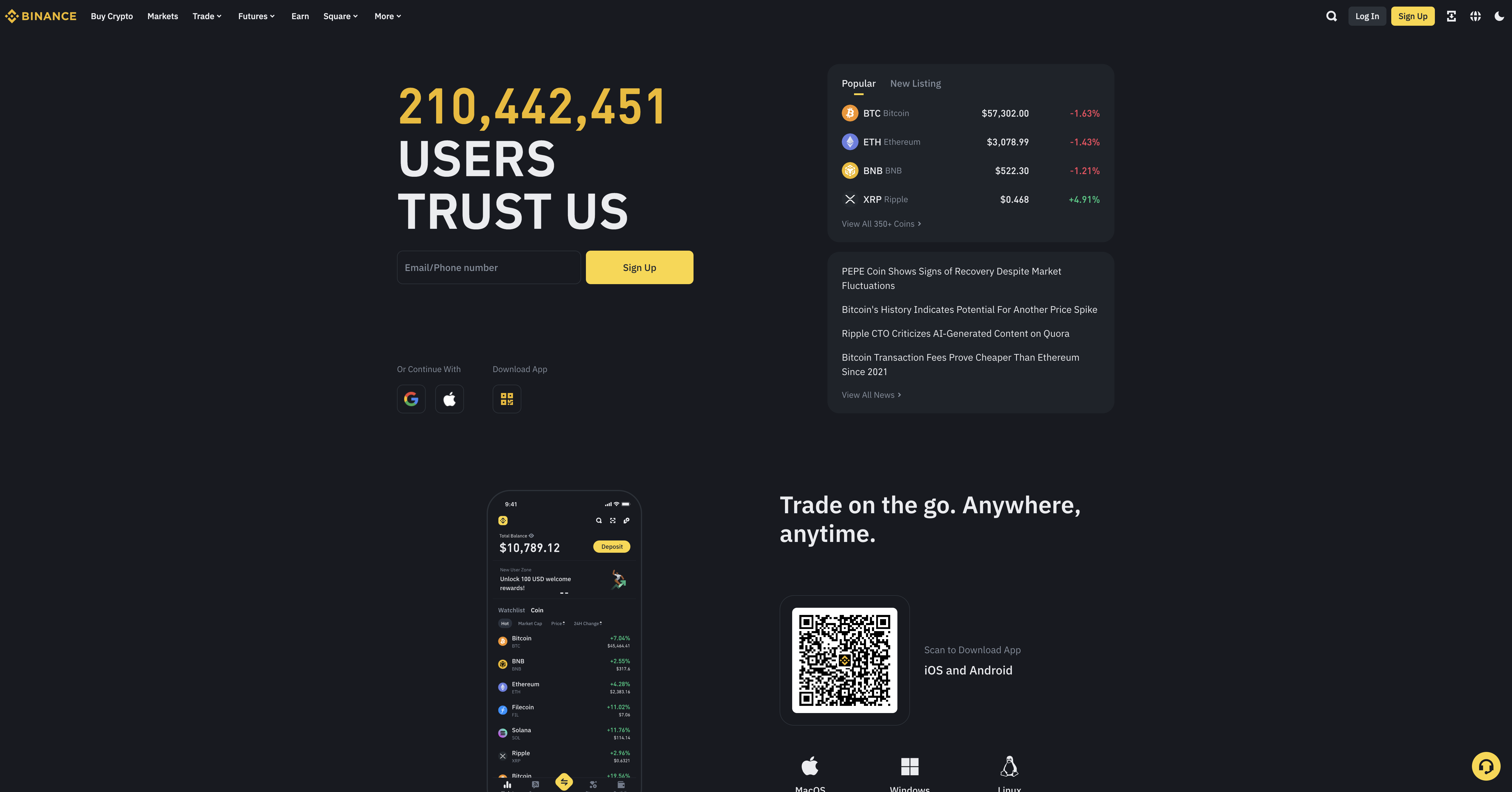

The top crypto exchanges of December 2025 are closing out the year with such momentum, one might think they’re training for the Olympics of blockchain. Trading volumes remain high, liquidity improves like a well-aged wine, and platforms roll out new products faster than a meme coin’s price drop. 🎢

Look at that four-hour chart – Bitcoin is doing a cha-cha within a bear flag, which is just a fancy way of saying it’s trapped in a little box of its own making. The bottom of this bear flag hangs just below the giant trendline, like a bad roomie refusing to leave, but oh! The downtrend is still whispering sweet nothings, dragging the price lower. Combine that with a stubborn resistance at $88,000, and you’ve got a squeeze tighter than a clam at high tide. If Bitcoin keeps heading for the apex, we’re talking about just five days before the big “break” – or a nosedive into oblivion. Who will blink first? Stay tuned – popcorn not included. 🍿

A prominent crypto trading firm, Jump Trading, finds itself at the center of a legal storm, accused of orchestrating a financial tragedy that has left countless investors in a state of bewilderment. The collapse of Terraform Labs, a once-great empire, now serves as a cautionary tale for those who believed in algorithmic stability. 🧠

Memecoins, like the weeds in a neglected garden, sprout with relentless vigor. Yet, some manage to transcend their ephemeral nature. Behold, the frontrunners of this circus: PENGU, Official Trump, Memecore, Fartcoin, and Pippin. A lineup so absurd, it could only exist in the crypto realm. 🦜💨

Now, the good folks at Wells Fargo and Bloomberg have kindly handed us a shiny, shiny chart-like a GPS but for doom-showing how Americans have more of their net worth tied up in stocks than in their beloved, ever-humble homes. Yes, dear reader, the very situation that caused the long winter of bear markets in those swinging decades. As Burry points out, “This ain’t no coincidence, folks.”

The Central African Republic is reportedly skidding perilously close to a “grave risk of state hijack” by foreign rogues, due largely to its rather enthusiastic embrace of murky cryptocurrency escapades. Such is the conclusion of a report released on Dec. 17, its tone one of melodramatic indignation.

Key Observations

On a Thursday most splendid, Bitwise took up its quill and submitted its Form S-1 to the U.S. Securities and Exchange Commission, thus initiating the grand process of creating a product designed to track the spot market price of the SUI token-our little gem from the layer 1 Sui blockchain network.