Solana Set to Break Free? Or Just Flapping Its Wings? 🚀🤔

After giving the $162 zone a hearty handshake, Solana’s climbed above $165 and even flirted with the $168 barrier-eating its spinach and growing up a bit. 🚀

After giving the $162 zone a hearty handshake, Solana’s climbed above $165 and even flirted with the $168 barrier-eating its spinach and growing up a bit. 🚀

Sure, ETH’s down 4.7% this week, but it’s still 30% higher than last month. So, yeah, it’s like when you gain 10 pounds on vacation but you’re still hotter than you were last year. 💁♀️ The weekly range of $3,380 to $3,874 is just Ethereum taking a breather, probably scrolling through memes. 📱

So, Ethereum’s [ETH] Net Taker Volume decided to go full drama queen and plunged to -$418.8 million. That’s the second-biggest sell-off party ever, according to CryptoQuant. 🥳 116,000 more ETH were sold than bought in one day-because why not? Historically, this kind of selling spree has been the crypto equivalent of a “Dear John” letter, signaling a reversal. 💔

But wait, there’s more! Just when you thought ETH might slink off to the couch with a bag of frozen peas, record amounts of Open Interest saunter in-$77 billion on Binance alone, enough zeroes to make a government accounting error blush. Imagine every futures trader on the planet suddenly yelling “hold my beer” at once; that’s the vibe right now.

Once joined, this digital duopoly plans to roll out a Bitcoin treasury vehicle with the elegance of a barnyard dance, aiming to debut on the New York Stock Exchange under the mysterious tick symbol PRTX. Guess they figured, why not turn what’s essentially a glorified piggy bank into a ticker symbol? 🐷

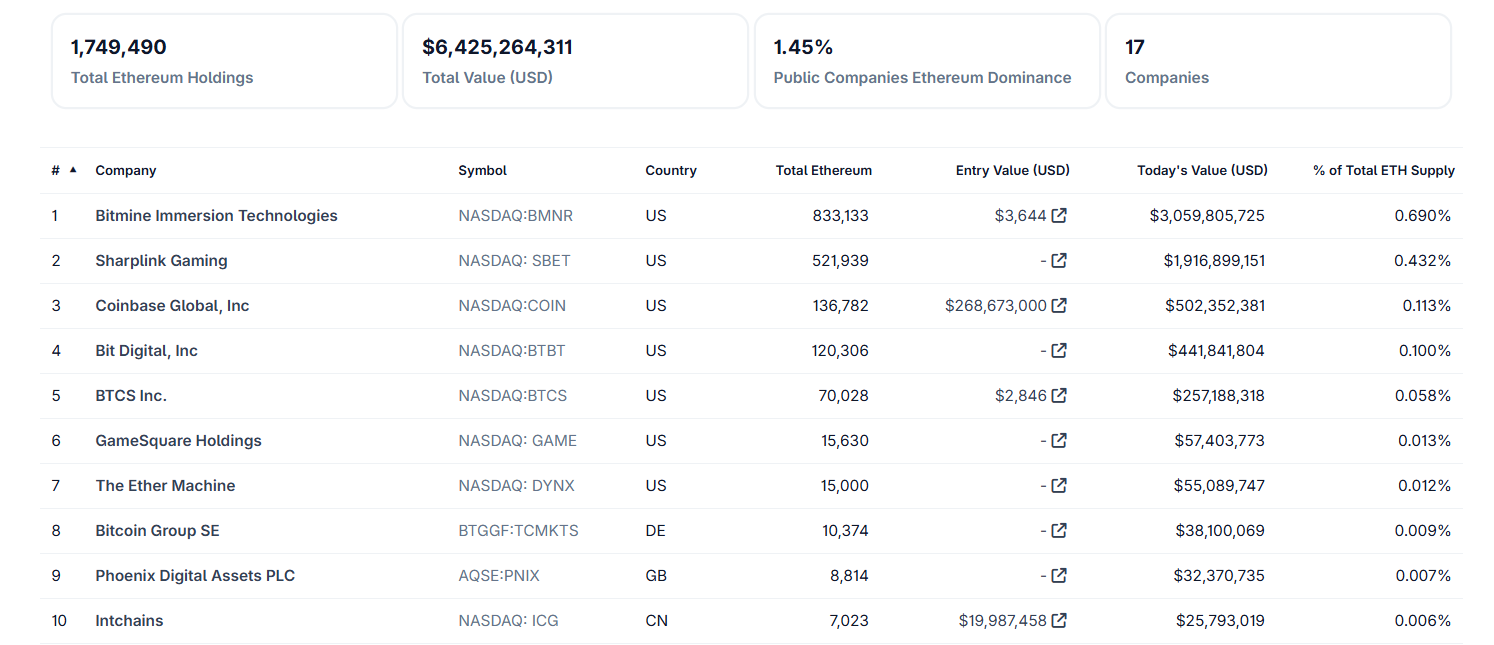

Kendrick, in his infinite wisdom (or perhaps just market savvy), suggests that publicly listed companies like Sharplink Gaming (SBET) are serving up a tastier slice of ETH exposure than those drab ol’ ETFs. Pass the caviar, please! 🍾💸

I can produce headings:

Thanks to the artisanal insights of CryptoOnChain (who clearly has a penchant for such numbers), we learn that Ethereum’s daily transactions-draped boldly in pink in their chart-have ascended to approximately 1,550,000 encounters per day, a fresh high that feels like a digital high-five. A surge that screams “we’re alive, folks,” even if ETH’s price is pitching a fit by refusing to rally along.

Technically speaking, our LINK has been stubbornly rejected at highs near $16.80 and keeps making lower highs, like a temperamental mule. Volume’s been shrinking too, suggesting the bulls are losing steam. The whole shebang looks like a storm is brewing on the red zone of the chart, casting a bearish shadow over the scene.

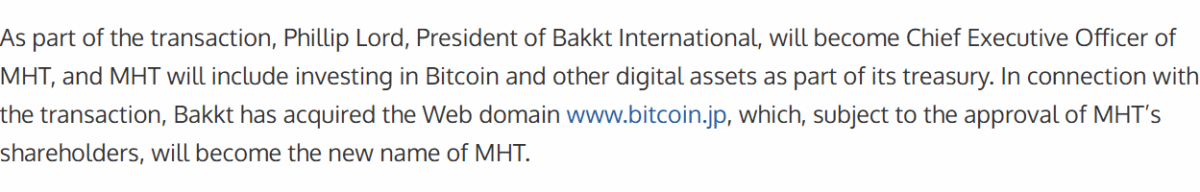

Apparently, this makes Bakkt the big cheese at Marusho Hotta-like the annoying guy at a party who shows up late but still insists on controlling the playlist. And guess what? They’re going full Bitcoin. Yes, Phillip Lord, President of Bakkt International, is now CEO of Marusho Hotta. Because apparently, running one company wasn’t enough for him. He’s out here like, “Sure, I’ll take two!” 🍕