Jane Austen Would Shake Her Head at Today’s Crypto Follies – But Would She Click?

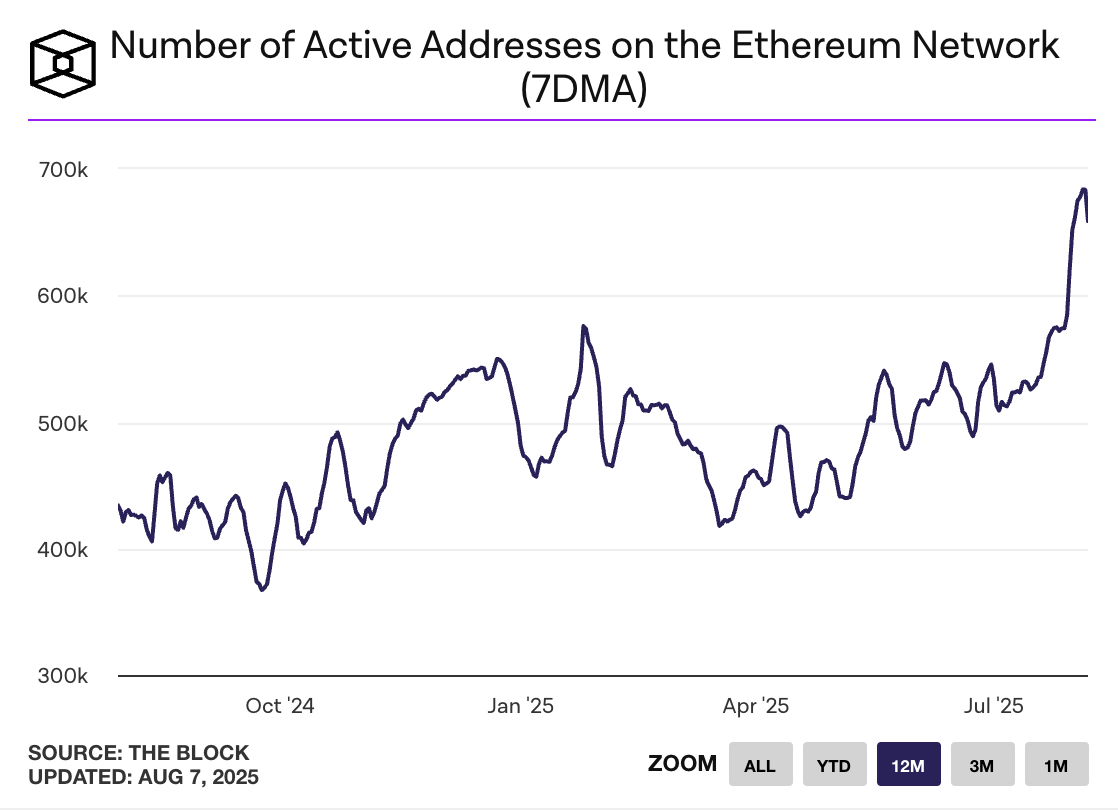

Meanwhile, the on-chain excitement continues to simmer-Ethereum’s active addresses have politely climbed to a rather impressive 658.6K on average over the past week. One might venture to say the market is quite eager for a bit of “action,” don’t you think? At $3,900 and edging ever closer to the coveted realm of price discovery, ETH’s momentum has historically been a herald of rallies in those more whimsical altcoins and meme tokens that, like uninvited guests at a ball, unexpectedly steal the spotlight.