Crypto Gets $76B?! 🤯

USDT and USDC are basically flexing their financial muscles. Investors are apparently betting the market is going to…go up. Groundbreaking. Next you’ll tell me water is wet.

USDT and USDC are basically flexing their financial muscles. Investors are apparently betting the market is going to…go up. Groundbreaking. Next you’ll tell me water is wet.

And why, you ask? Well, the bulls have been gobbling up perpetual futures like they’re Everlasting Gobstoppers, and the miners-those sly Oompa Loompas of the crypto world-have stopped hoarding their stash. Their reserves are shrinking faster than the BFG’s ears in a cold breeze, which means less selling pressure and more room for the price to zoom higher. Hooray for the plot twist! 🎉

Apparently, they scribbled something down for those nosey parkers at the SEC (that’s the Serious Eeyore Committee, if you ask me) admitting they’ve got their mitts on a few of these Bitcoin ETFs. The biggest pile of shares – 51,679 of them! – is in BlackRock’s iShares Bitcoin Trust. That’s worth a rather flashy $3 million as of June 30th. Honestly, you’d think they’d have something better to do with the money… like buying a decent chocolate factory. 🍫

On-chain data analyst ‘Yonsei_dent’ (sounds like the kind of name you whisper to a bouncer) from CryptoQuant decided to investigate whether Bitcoin’s latest bull market is less pub crawl, more chess tournament. Apparently, the Net Unrealized Profit/Loss (NUPL) indicator is screaming, “Maturity!” – which is less Madonna, more Meryl Streep. So, welcome to the era of fewer booming rallies and a vibe that feels like the WiFi’s gone slow but “it’s okay, just be patient”.

Ah, Thumzup Media Corporation, that beacon of social media marketing, has decided to dip its toes into the turbulent waters of Bitcoin mining. On the fateful day of August 13, 2025, they announced their grand plan, as if the world was waiting with bated breath. This is no small feat, my friends! Previously, they dabbled in the storage of cryptocurrencies like Bitcoin, Ethereum, and Solana, but now they wish to construct their very own mining empire. Yes, they aim to mint Bitcoin, as if it were a new currency of the realm! 💰

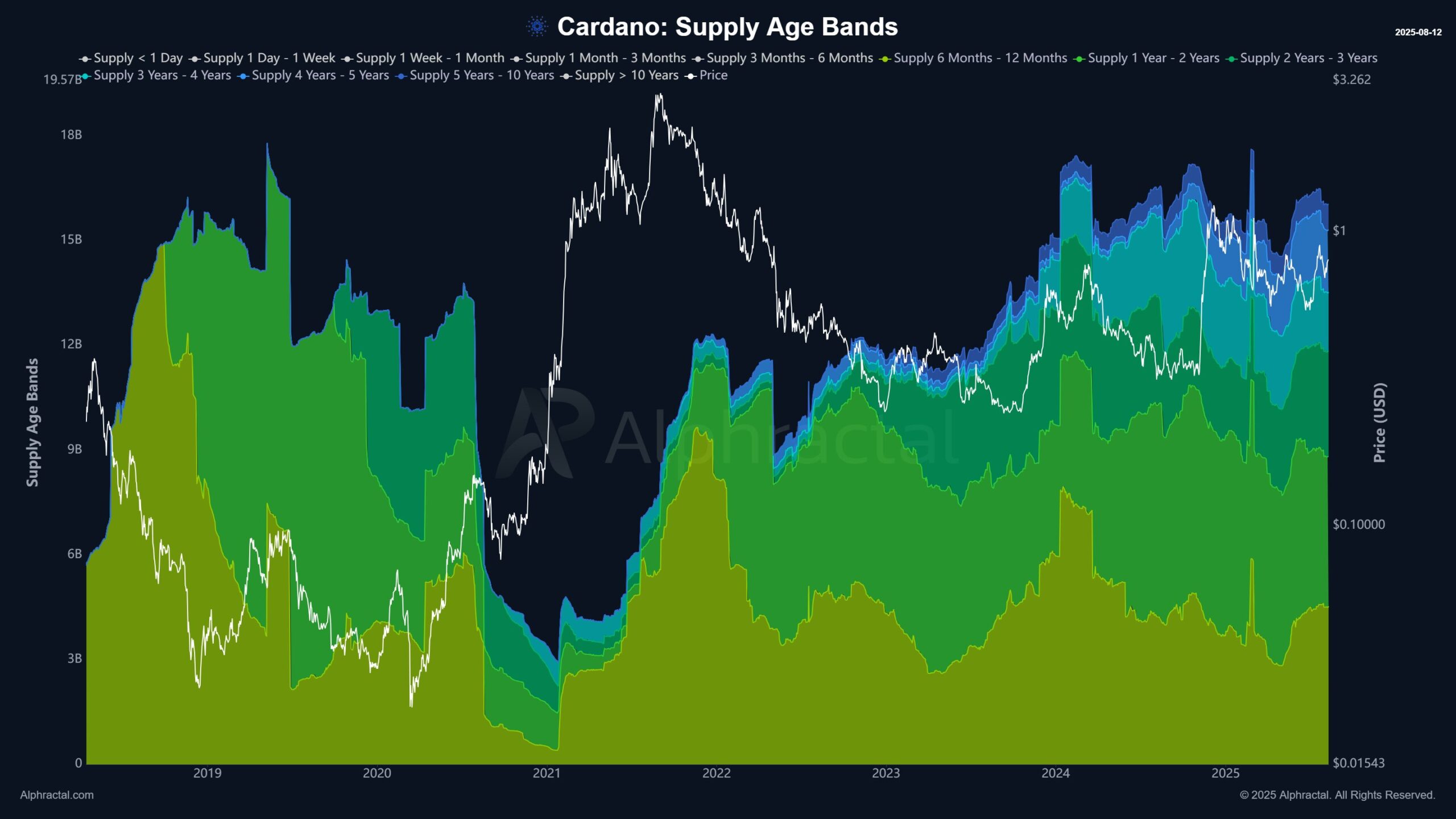

Sure, ADA still trades miles below its glorious 2021 high of $3.09, but what is money anyway if not a loud toddler promising ice cream later? The long-haul crowd is clinging like barnacles to the hull of a ghost yacht, whispering, “Just one more pump and we’ll finally buy that alpaca farm in Vermont.” I admire the optimism; I also admired my neighbor who insisted raw milk would cure his sciatica. Spoiler: the alpaca still isn’t toilet trained, and the sciatica is downgraded to ‘weepy knee.’

This mUSD, they say, might make its debut as early as this very week. Or perhaps next month. No one knows, and honestly, if you’re waiting for certainty, you’re likely to be disappointed-just like expecting a sunny day in April.

The weight of his offenses, as detailed in court documents, is as heavy as the silence that now fills the once bustling halls of Terraform. One hopes that this confession brings a semblance of solace to those who found themselves ensnared in Kwon’s intricate web of deceit.

The Cayman Island-based exchange priced its IPO above expectations, landing at $37 per share when they were hoping for a mere $32-$33. At that point, the company’s market value surged to a cool $5.4 billion. It’s like showing up at a garage sale and finding a Picasso-everyone’s eyeing that treasure now.

Mainland China is like your overly strict parent, giving that “no” to all things crypto-trading, mining, you name it! Meanwhile, Hong Kong is over here hosting a party for regulated digital assets like it’s the new rave scene. 🕺