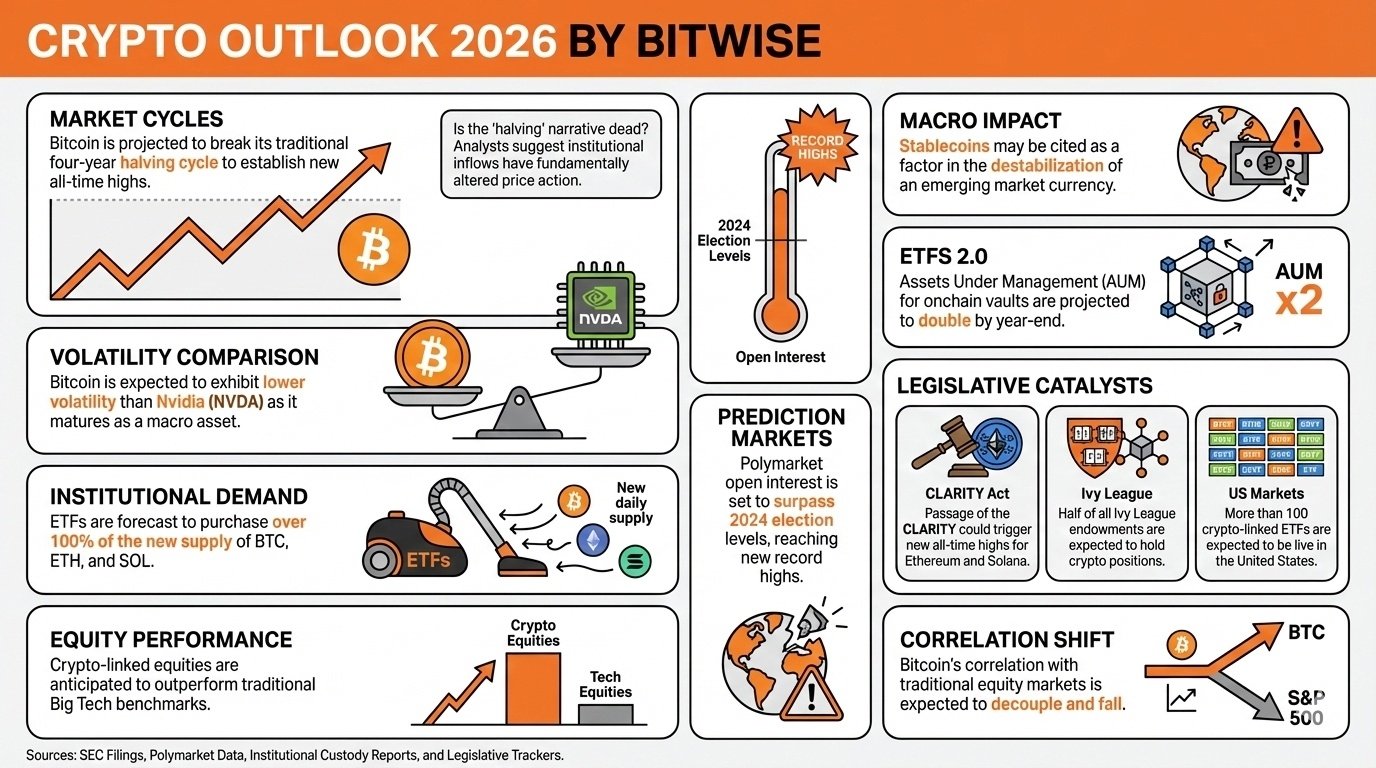

Bitwise’s 2026 Crypto Prophecies: Bulls on Steroids, BTC Soaring 🚀

Bitwise Asset Management, that paragon of U.S. asset management, has published its “10 Crypto Predictions for 2026” report on Dec. 15, a document so bullish it makes a Siberian winter seem warm. Chief Investment Officer Matt Hougan and Head of Research Ryan Rasmussen, with the gravitas of Tolstoy dissecting peasant life, declare: