CRO’s 16% Surge: Trump, Whales, and a Crypto Treasury That’s Not a Joke!

//media.crypto.news/2025/08/Screenshot-2025-08-27-121714.png”/>

//media.crypto.news/2025/08/Screenshot-2025-08-27-121714.png”/>

The dynamic duo-Potapenko and Turõgin-spent a blissful 16 months in custody in their home country, Estonia, after their surprise arrest in October 2022. Fast forward to May 2024, and voilà, they’re in the US, pleading guilty to conspiracy to commit wire fraud. Everyone’s favorite kind of fraud, right? 😏

SharpLink Gaming seems determined to turn its treasury into an Ethereum-themed art installation. Despite the market behaving like a rollercoaster designed by a madman, the company proudly announced yet another ETH purchase. This marks their fourth consecutive weekly binge on the digital asset. Joseph Chalom, Co-Chief Executive Officer, offered some flowery words about the matter:

According to Kendrick, Ethereum treasury companies have slurped up 2.6% of the world’s ETH like it was grandma’s homemade gravy, all in three months. Spot ETFs apparently saw that and tried to one-up them, gobbling 2.3%, because nothing says FOMO like Wall Street buying digital tokens it can’t actually pronounce. BitMine Immersion is taking things very literally and wants 5% of Ethereum, probably to build a pixelated Scrooge McDuck swimming pool.

Nate Geraci, who heads up NovaDius Wealth Management – apparently a place where wealth is managed by wild optimism and Excel spreadsheets – has beamed about XRP futures crossing $1 billion in open interest on the CME faster than toast pops out of a quantum toaster. With another $800 million lounging in futures-based XRP ETFs, Geraci suspects that, if spot funds were unleashed, demand might resemble the Black Friday queue outside a shop that sells gold-plated unicorns.

Oh, the heights Ethereum has scaled! A new all-time high above $4,950, only to succumb to a downside correction, a fate Bitcoin has thus far avoided. Below $4,650 and $4,550 it fell, like a tragic hero in a poorly written play. Yet, it tested the $4,320 zone, formed a low at $4,310, and began its ascent anew, breaking above $4,400 and $4,450 with the grace of a well-rehearsed monologue.

Let’s be real, Wall Street’s been stuck in a Bitcoin-Ethereum loop like a bad rom-com. 💔 But now, asset managers are spicing things up with tokens that actually do stuff (gasp!). Chainlink’s the cool kid here, acting as the oracle network that delivers real-world data to blockchains. Basically, it’s the gossip queen of Web3, and institutions are here for it. 👑

Currently, our dear SHIB is caught in a rather tight embrace between support and resistance lines, trapped in a symmetrical triangle pattern that’s more dramatic than a soap opera. The tip of this triangle hasn’t been reached yet, so a major breakout-upward or downward-is still in the works. Until that happens, those bullish signals are about as significant as a whisper in a thunderstorm.

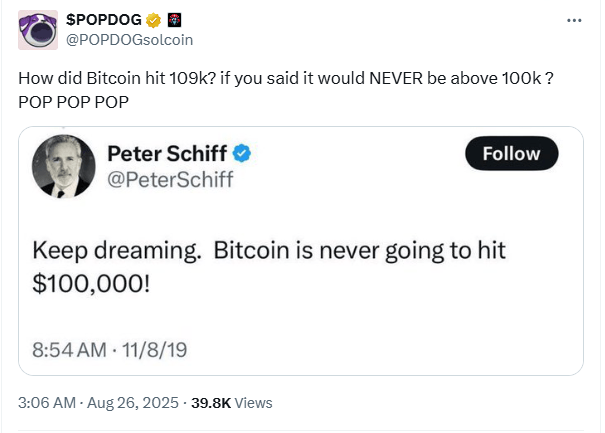

Picture this, dear reader: Peter Schiff, the man who once bet his socks that Bitcoin would *never* breach $100K (spoiler: it did 🙃), now claims the “sky is falling” at $109K. He’s forecasting a plunge to $75K-below the average cost of those pesky MicroStrategy nerds. Because nothing says “financial genius” like repeatedly betting against a digital gold rush. 💸

The SEC, in its infinite wisdom, decided to push back its decision on the much-anticipated Grayscale Cardano ETF, pushing the timeline to October 26, 2025 – because what’s another couple of years in crypto years? While this is standard operating procedure for federal agencies(we’re looking at you, DMV), it’s like telling an impatient kid at Christmas, “Just wait, Santa’s got a delay.” Naturally, investors are clutching their FOMO-and their wallets-waiting to see if this delay will turn into a gift or a lump of coal.