Ethereum ETFs Are Taking Over Wall Street – Sorry Hedge Funds, Hello Advisors! 🚀💸

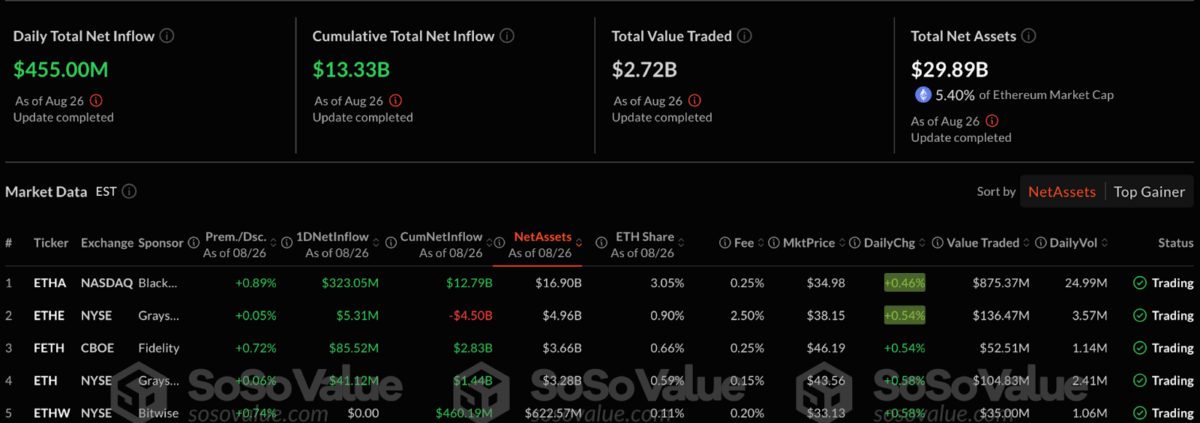

According to Bloomberg’s crystal ball, Goldman Sachs is not just a pretty face – it’s got $721 million worth of ETH, adding more than 160,000 ETH to its collection. Jane Street and Millennium are sneaking in with $190 million and $187 million like the cool kids at the party. Other heavy hitters? Capula, DE Shaw, HBK-basically the Avengers of Ethereum staking.