Ethereum ETFs Outshine Bitcoin in August 2025 Financial Farce

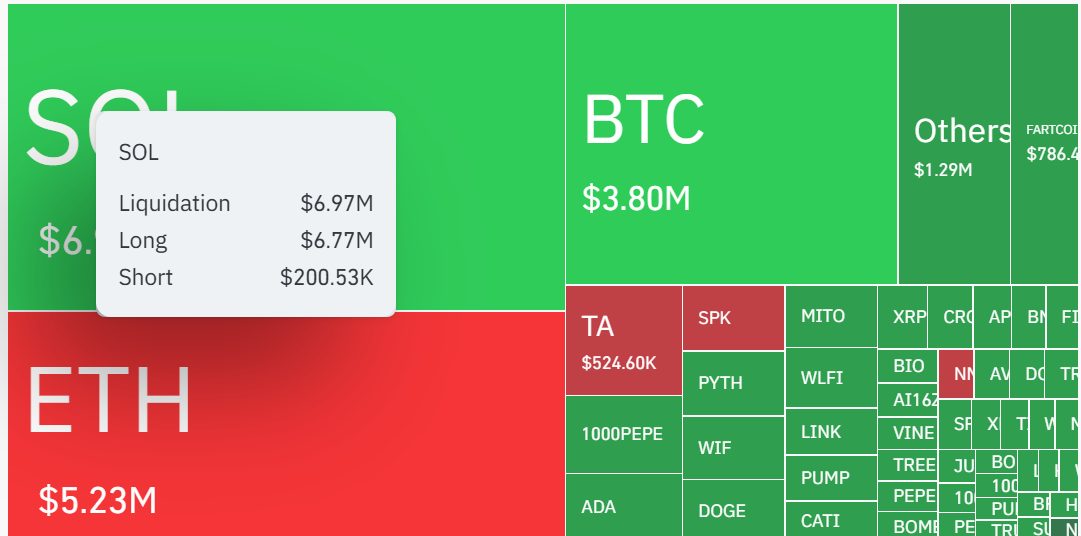

According to SoSoValue, the Ethereum ETFs have attracted a princely sum of $4.04 billion, while the Bitcoin ETFs, in a display of financial modesty, have managed to shed $628 million in August. One might say it’s a tale of two cryptos-though one is clearly more popular at the party.