Bitcoin’s September Swoon: Will It Dive or Survive? 🌊💰

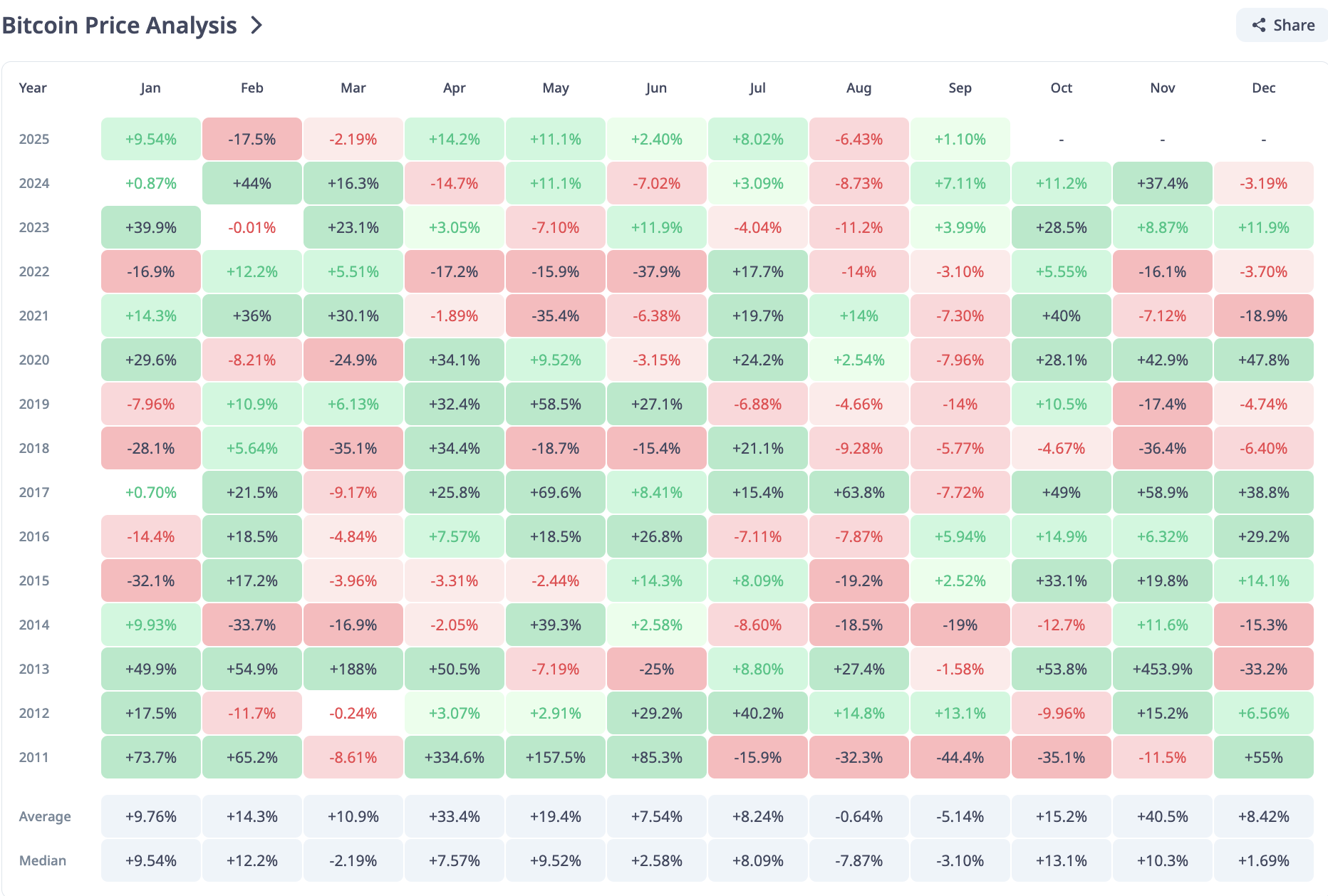

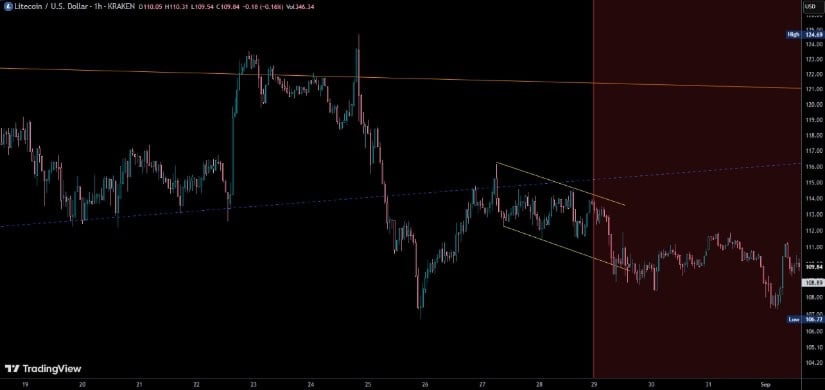

Now, with the leading coin trading beneath $110,000, and considering its historical penchant for September melancholy, the outlook appears as dreary as a Russian winter. ☠️

Now, with the leading coin trading beneath $110,000, and considering its historical penchant for September melancholy, the outlook appears as dreary as a Russian winter. ☠️

Mr. Rahul Jogani, the chief financial official (whose title is most impressive, even if his sense of humour is perhaps untried), declared that this great decision springs from a desire to satisfy the whims of “digitally savvy investors.” In a tone not unlike Mr. Collins extolling Lady Catherine, he assures us they are “opening the door to a modern ecosystem”-though whether this ecosystem includes deer and hedgehogs remains unclear. Still, for those who fancy value in digital assets, the door is now flung wide (mind your bonnet).

Ah, the glorious dance of the crypto world, where fortunes rise and sink in a night, and the shadowy figures of cybercrime sharpen their knives, feasting on the naïve and the greedy alike. PeckShield, that ever-watchful sentinel, counted the spoils: $163 million stolen, vanished into the darkness.

Look out, folks – Sonic Labs is taking its biggest leap yet! They’ve planted a flag in the U.S., popped open a New York office, and thrown in some Wall Street magic, all while waving their new token design. Who knew expansion could sound this fancy? 🤩

Ah, Holesky! Launched back in September 2023, it was a bright-eyed and bushy-tailed testnet meant to give developers a safe space to experiment with Ethereum blockchain’s shiny new features and services. Its primary role? To give staking infrastructure and validator operations a nice little stress test. And what a test it was! Much like a carriage ride through a muddy field, it was bumpy, but ultimately, it did the job.

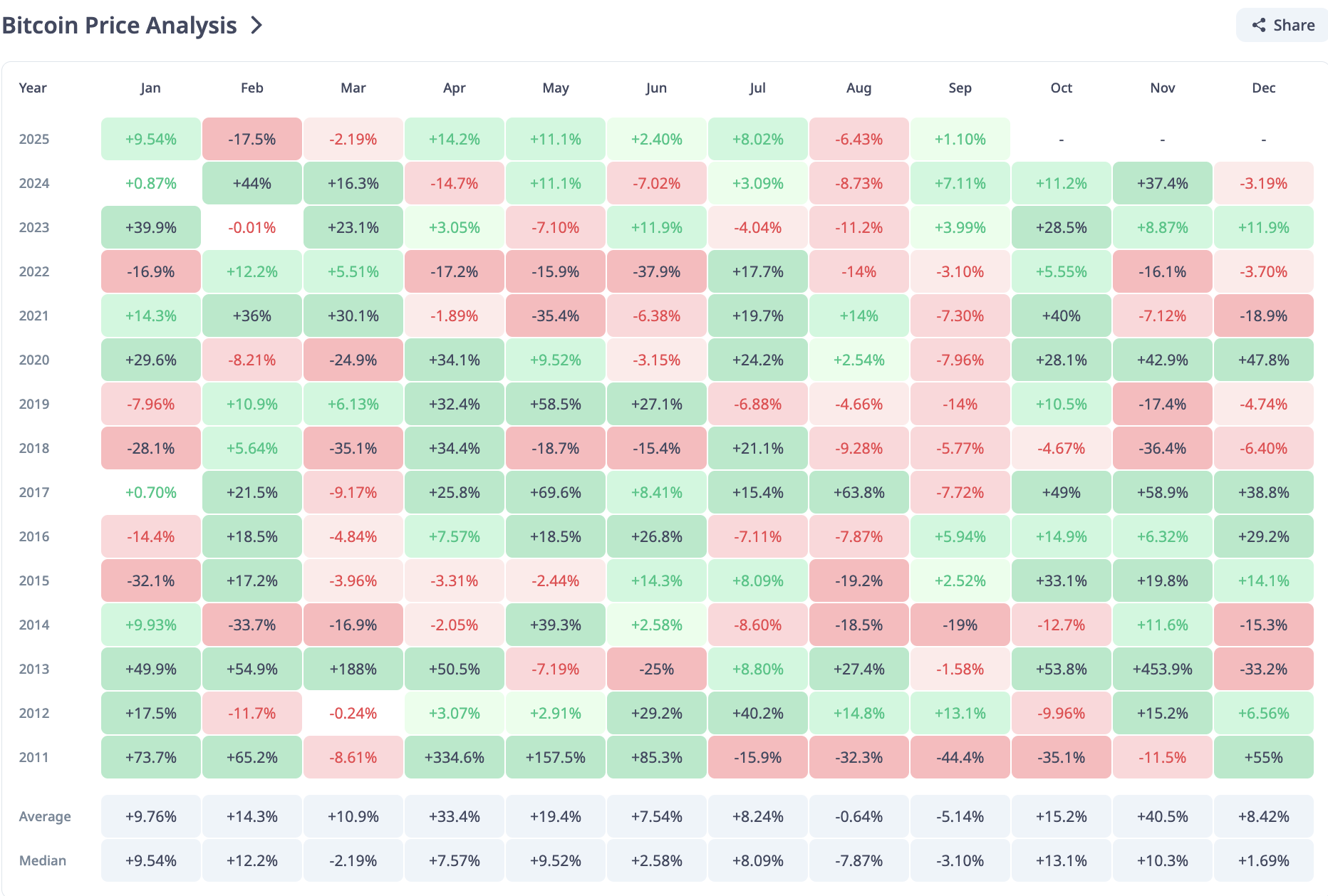

The company, not content with just sitting on a pile of digital gold, also issued 11.5 million new shares when an investor, the ever-so-cleverly named Evo Fund, decided to use special buying rights called warrants. For this privilege, Evo Fund forked over about $65.73 million. Metaplanet, in turn, used this cash to pay back $20.4 million in bonds it had previously issued. It’s like paying off your credit card with another credit card, but somehow it works! 🤷♂️

Now, ol’ Justin Sun didn’t just dip his toes-he cannonballed into the pool, claiming a cool 600 million WLFI tokens, worth a jaw-dropping $200 million at the TGE. That’s 3% of the 20 billion unlocked tokens, making him a big fish in this crypto pond. 🤑 And get this: Arkham Intelligence reckons he’s sitting on nearly $1 billion worth of the stuff, acquired from who-knows-where. Before the TGE, WLFI was already trading like hotcakes in derivatives markets, surging 500% just before the big event. Talk about a gold rush!

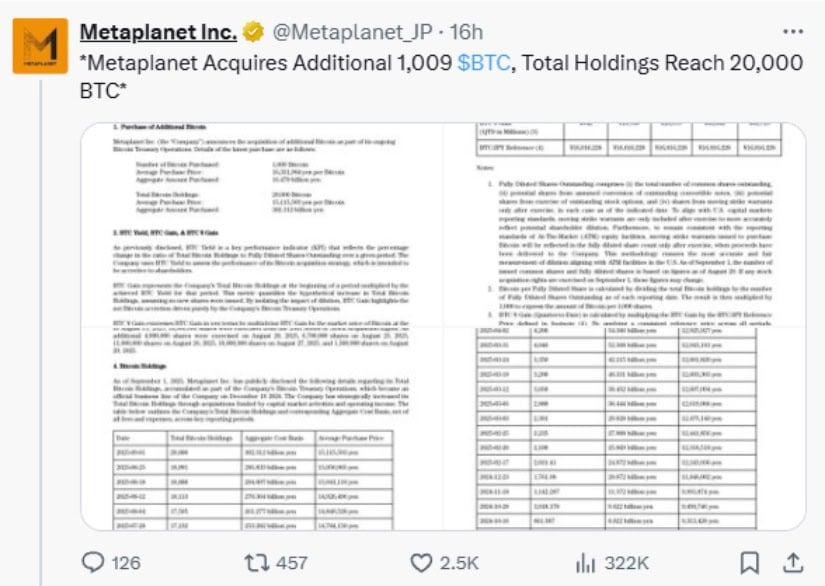

The market is as unpredictable as a cat on a hot tin roof, bouncing between $107.24 and $111.90. The daily ATR of $5.80 is a reminder that this is no sleepy market – brace yourselves for some wild swings. Analysts, with their crystal balls (read: charts), believe it’s all about short-term positioning, nothing more.

But wait, there’s more! It turns out that 43% of all crypto activity in the region is now dominated by stablecoins. That’s like 43% of the local currency going straight to the digital wallet, bypassing the usual “volatility” dance. Other countries are getting in on the action too, with South Africa, Kenya, Ethiopia, Ghana, Uganda, and Zambia all reporting increasing adoption. South Africa, in particular, has been seeing a 50% monthly growth in stablecoin transactions since October 2023. Apparently, folks there are desperate for a little stability in their lives. Who can blame them when the local currency is as predictable as a soap opera plot twist? 📈

In the vast expanse of the crypto universe, Ethereum (ETH) has been observed to follow the cosmic tides of global M2 liquidity. According to the chart shared by the intergalactic analyst Merlijn The Trader, the price of ETH has been rising in tandem with the broader liquidity growth.