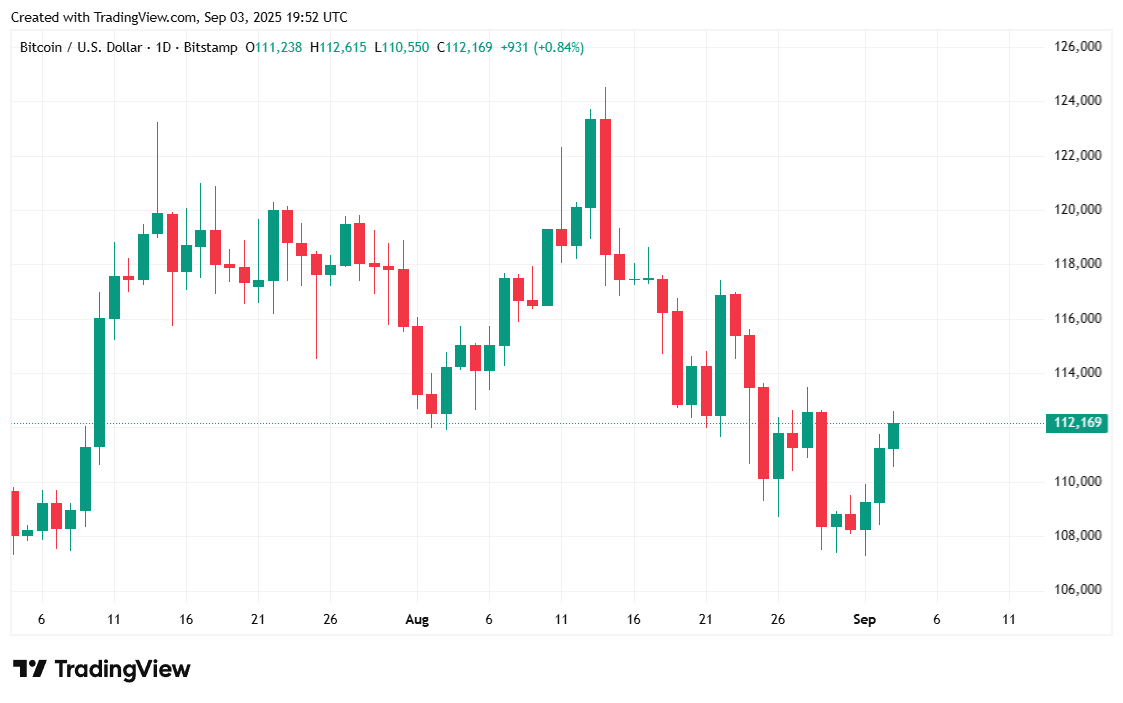

In the Depths of BTC’s $111K Resurgence: A Bull Trap or Redemption?

In the shadow of despair, when Bitcoin [BTC] plummeted to $107,270, it clawed its way back to $111,787, a feeble echo of hope against the abyss.

In the shadow of despair, when Bitcoin [BTC] plummeted to $107,270, it clawed its way back to $111,787, a feeble echo of hope against the abyss.

Our dear Shiba Inu finds itself at a crossroads, much like a socialite choosing between two equally dreadful suitors. Trading at a positively pedestrian $0.0000123, it’s trapped in a triangle tighter than a Victorian corset. The bears are circling like disapproving aunts at a garden party.

Riot Platforms, with a flair for the dramatic, mined a whopping 477 BTC in August, a 48% leap from the meager 322 BTC they managed to scrape together in the same month last year. They sold 450 BTC for a staggering net proceeds of $51.8 billion, which, if true, might just make them the most profitable company in the universe. 🌌 Now, they proudly hold 19,309 BTC, a 92.7% increase over the past 12 months. Who knew mining could be so lucrative? 💰

In a dramatic 48 hours, mighty whales have swooped down and bought a staggering 1.25 million LINK, as if to say, “We’re in it for the long haul-don’t bother trying to scare us off!” Meanwhile, exchange outflows hit $1.84 million-because nothing screams confidence like disappearing tokens. It’s like playing hide and seek with your wallet, and the tokens are winning. 😅

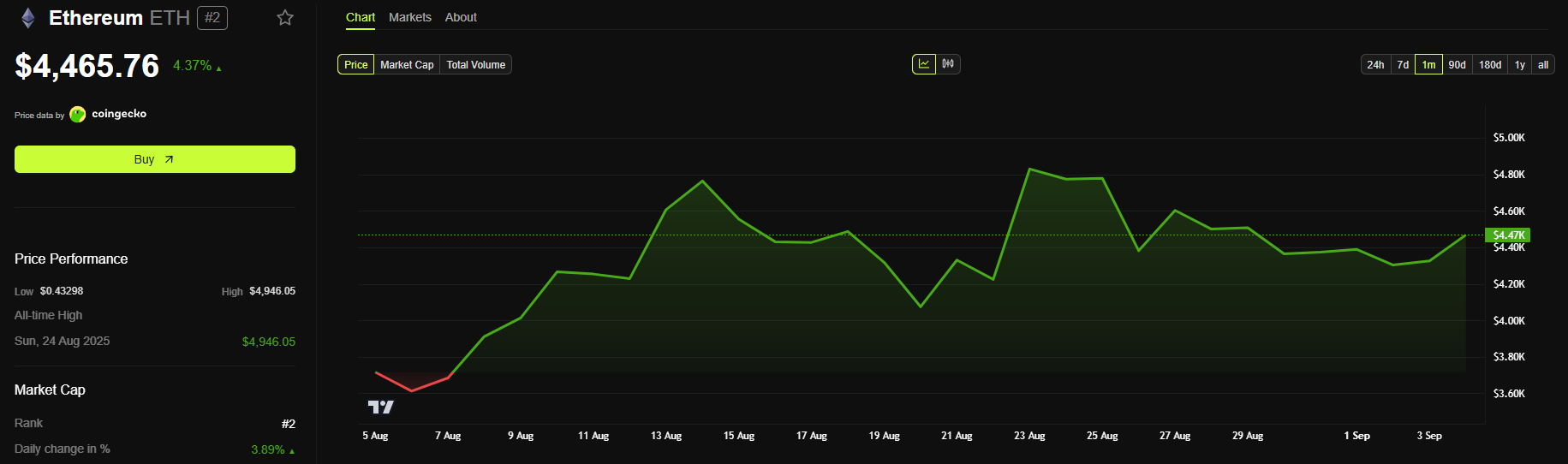

Ether surged towards $4,500 after scooping up liquidity around $4,200. A Cinderella moment? 🧐

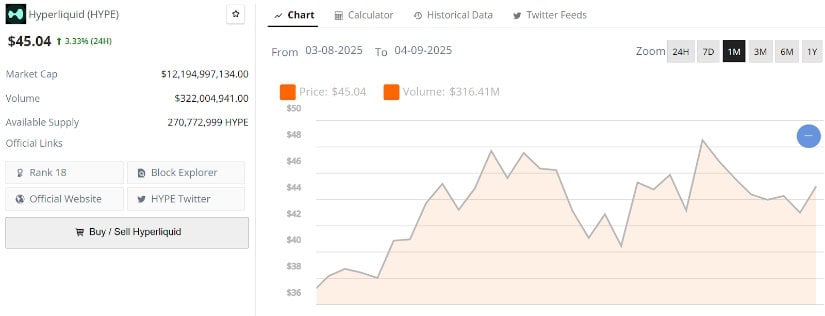

So it’s sitting at $45.04, up a modest 3.33% today. Big deal. The chart? Oh, it’s just dancing between $42 and $48 – classic volatility; the crypto version of “Are we there yet?” While support’s been tested at $44, sellers are lurking closer to $48. Surprise! 😲

Now the ball’s in the Senate’s court, where Senator Tim Scott is probably juggling this bill like it’s a hot potato. 🥔 Hill’s like, “Hey Senate, just take my bill, tweak it a little, and call it a day.” Sounds easy, right? Wrong. This is Congress we’re talking about. They’ll probably turn it into a debate about whether pineapple belongs on pizza. 🍍🍕

In a move that can only be described as “daring” (and perhaps “ludicrous” depending on your perspective), the Trump family has once again thrown their weight behind bitcoin, supporting the latest digital asset treasury firm to grace the Nasdaq. The grand unveiling of American Bitcoin (Nasdaq: ABTC) came after a merger with Gryphon Digital Mining, Inc., and naturally, the new entity’s mission is crystal clear: become a “differentiated, pure-play bitcoin accumulation platform.” Because, well, what’s the point of being a platform if you’re not accumulating bitcoin? After all, what else do you need in life?

Dear reader, picture this: Sanjay Shah, a sage of Silicon Valley’s crypto oracle, opines that Ethereum’s architecture is “uniquely advantaged.” One might say it’s the Rolls-Royce of blockchains-polished, pedigreed, and perpetually late to dinner due to its own popularity.

Ah, the fickle mistress of technical analysis-she shows us a splendid cocktail of cautious optimism and impending doom. The MACD has recently bowed below its signal line, with a histogram whispering of -0.0111, hinting at a short-term bearish flirtation, like a lovesick cat staring wistfully at a mouse. Meanwhile, both MACD lines remain above zero, suggesting that, like Old Man Jupiter, the broader outlook retains a bullish glow, even if the market’s Stochastic RSI shrieks in volatility, a theatrical warning of chaos yet to come, or perhaps just market indecision dressed in finery.