ETH in a Rut: Will This Cat Ever Claw Its Way Out? 🤷♂️🐱

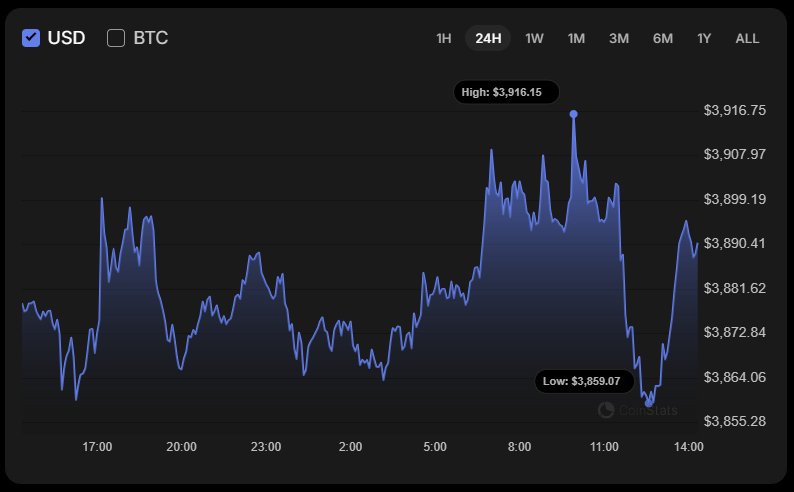

Ethereum (ETH) just did a 0.28% shuffle this week. That’s like asking if your coffee cup spilled a teaspoon of joy. 😒

Ethereum (ETH) just did a 0.28% shuffle this week. That’s like asking if your coffee cup spilled a teaspoon of joy. 😒

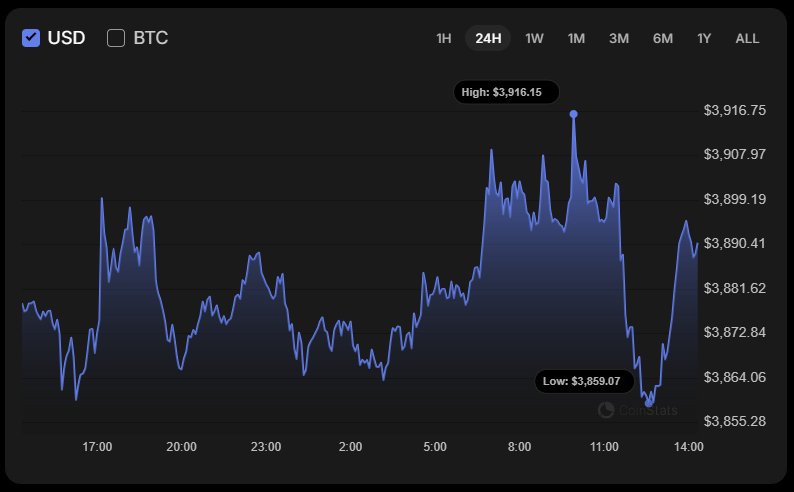

According to frantic scribblings on those aforementioned regulatory documents, Canary Capital’s version looks set to burst forth around the 13th or 14th of November. Bitwise’s will waddle along a few days later, between the 19th and 20th. Dates dictated by a 20-day timer that started ticking down now the SEC has momentarily run out of things to delay. (The government shutdown helped, oddly enough. Sometimes doing nothing is the best policy. Who knew? 🤔).

Why, in October, does one see that XRP has, alas, dropped by a further 11 percent, a development which could only be welcomed by the most sympathetic of financial analysts? This unsavory decline can largely be traced back to the noble efforts of long-term holders, who sought to distribute their fortune in the wake of an impending ether tempest.

While the exodus of funds has, thankfully, slowed to a mere trickle, a select coterie of traders appear determined to maintain the status quo of melancholic stagnation. Such dedication to the mundane is…fascinating.

The trouble first brewed when nimble fingers danced harder than a drunk flea on keyboards, pulling out coins like they were playing pin-the-tail on the calf. By some miracle, MEXC don’t seem to croak like a cat in a bag about its wallet. To sweeten the deal, they promised to shine light on their Merkle tree, giving everyone a peek at their stash of crypto coins. You know, so we can make sure Uncle Jeb did not squirrel them away.

The response of Bitcoin-along with its big-cap cousins-is enough to make one question the very essence of crypto. Is it a bubble, or just a really bad dream? Some are worried that the crypto market is going the way of all things that eventually burst. However, in a remarkable display of unwavering optimism, one CEO from a prominent blockchain company has come out to declare that, while the bull cycle might be nearing its end, the pinnacle of Bitcoin’s glory could be just around the corner-perhaps only days away from hitting a new all-time high. Who’s ready for the next rollercoaster ride?

In a Saturday episode of Anthony Pompliano’s podcast, Visser, a man whose knowledge of finance is rivaled only by his ability to speak in riddles, declared that dormant coins are “on the move, not in a panic, but with the grace of a well-trained penguin.” New investors, he claims, are “accumulating on dips,” a phrase that sounds suspiciously like “buying low and hoping for the best.” 🐧📉

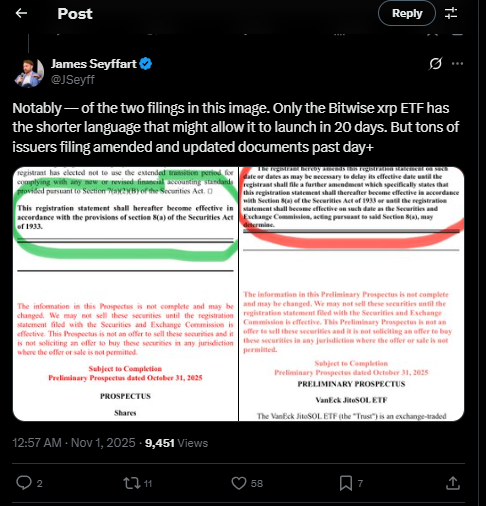

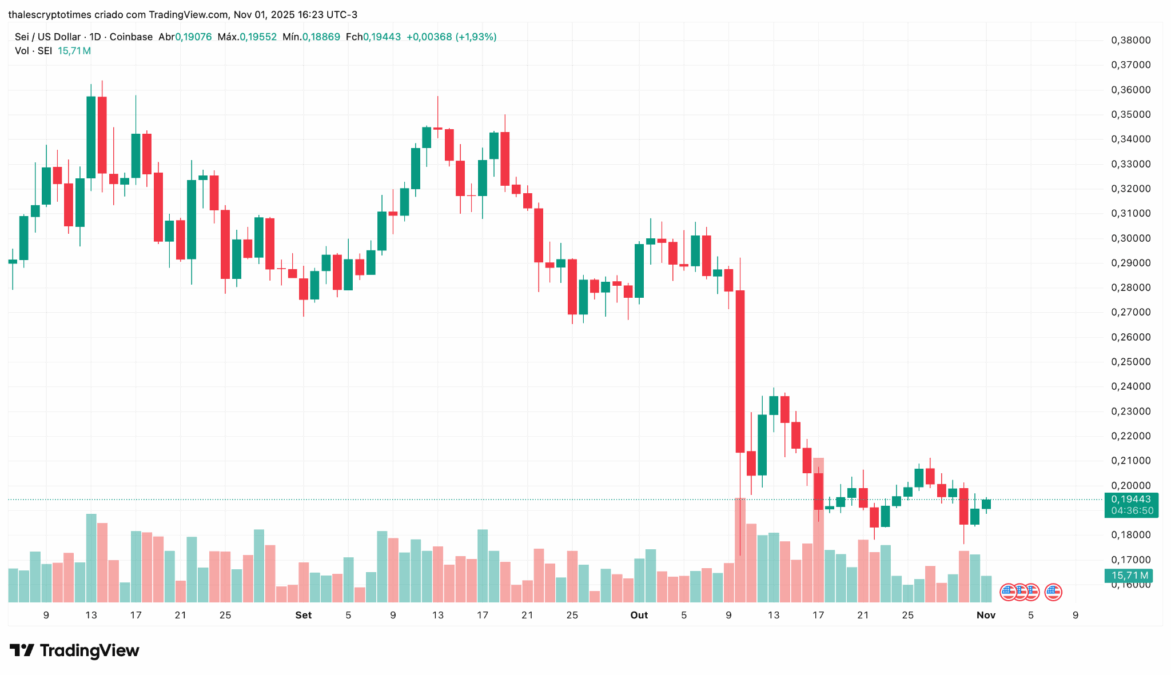

Unfortunately, the debut coincided with the broader crypto market’s midlife crisis. Within 24 hours, SEI plummeted like a poorly timed dad joke, dropping between 4% and 10% to hover around $0.19. 🎢 On-chain data? Active. Investor confidence? Not so much. It’s like showing up to a pool party with a fanny pack in 2025.

According to the meticulous records of the blockchain security firm PeckShield, the total value siphoned through illicit means amounted to a mere $18.18 million, a figure that would make even the most stoic of investors weep with relief. 🤡

According to Hal (who clearly has a PhD in “I’m Definitely Not a Scammer”), if you throw $3,700 at Litecoin and wait for it to drop to $30, you could theoretically sell it at $9,000 and… poof! You’re a millionaire! 🎉 But let’s be real, this is about as reliable as a toddler with a calculator. 🤡