Ethereum’s $183B Reserve Gambit: Outshining Nations! 🎩💰

A top trader with a 100% track record is holding 39,000 ETH long ($151M). One wonders if they’ve finally cracked the code to Ethereum’s cryptic riddles. 🧠

A top trader with a 100% track record is holding 39,000 ETH long ($151M). One wonders if they’ve finally cracked the code to Ethereum’s cryptic riddles. 🧠

Ah, Jelle, the bard of charts, sings of FLOKI’s resilience-a ballet dancer spinning gracefully while the altcoin orchestra collapses in a cacophony. Above its long-term higher low it stands, a monument to structure and buying support. Long-term holders, those stoic patrons of the crypto arts, accumulate like collectors at a Pasternak book signing, taming the beast of downside volatility. 🕺💼

It’s hard to deny that the structure is looking weak. But wait, don’t throw in the towel just yet! A tiny glimmer of hope might just be lurking on the charts, suggesting a slight rebound before the inevitable plunge. No promises of a bullish turnaround just yet, though – let’s not get ahead of ourselves! 😅

On November 1st, he scrawled on X: “Move your money into hard assets!”-as if he’s the financial equivalent of Charlie Bucket’s grandpa, selling golden tickets to disaster. He even dares to suggest Bitcoin might hit $1 million! Silver? “The biggest bargain!” he croons. Triple in price? Pfft. Maybe it’ll triple in confusion instead. 🤡

In a move as swift as a vampire’s strike, Romania’s ONJN has blacklisted Polymarket, the so-called “prediction market.” The regulator, with a flick of its bureaucratic wrist, deemed the platform a gambling parlor masquerading as a blockchain visionary. 🃏✨ This, my dear readers, comes on the heels of a $600 million betting frenzy during the Romanian elections. Democracy, it seems, is not just a game of thrones but also of tokens! 🏛️💰

“Next week’s looking real XRP coded”

Though the US and China now whisper of a truce, the cryptocurrency realm remains shrouded in gloom. Alas, the data reveals that American investors, once champions of digital gold, now tread with the caution of a mouse near a cat. The Coinbase Premium Gap, that fickle barometer of sentiment, has plunged into the crimson abyss, as if to mock the optimists who still cling to hope.

Ethereum. Two years of sighs and complaints from investors who prefer instant gratification. While Solana and its kin hog the headlines with their speed – flashy, like a cheap circus trick – Ethereum’s own fields have appeared fallow. NFTs collecting dust, DeFi volumes… wheezing. They call it the ‘old guard’ now, overvalued. Hmph. Like a well-worn boot is ‘overvalued’ compared to a pair of flimsy slippers. They’ll learn.

And the stories spilling forth! A Thodex CEO, rotting in a Turkish jail for eleven THOUSAND years… eleven thousand! One begins to wonder if the laws are meant to imprison or simply forget. Then there’s Custodia, banging on the Federal Reserve’s door-denied, of course. The powerful protect their own. And Tether? Laughing all the way to the bank, boasting profits that shame even the old, established institutions. The world is upside down, I tell you! 🙃

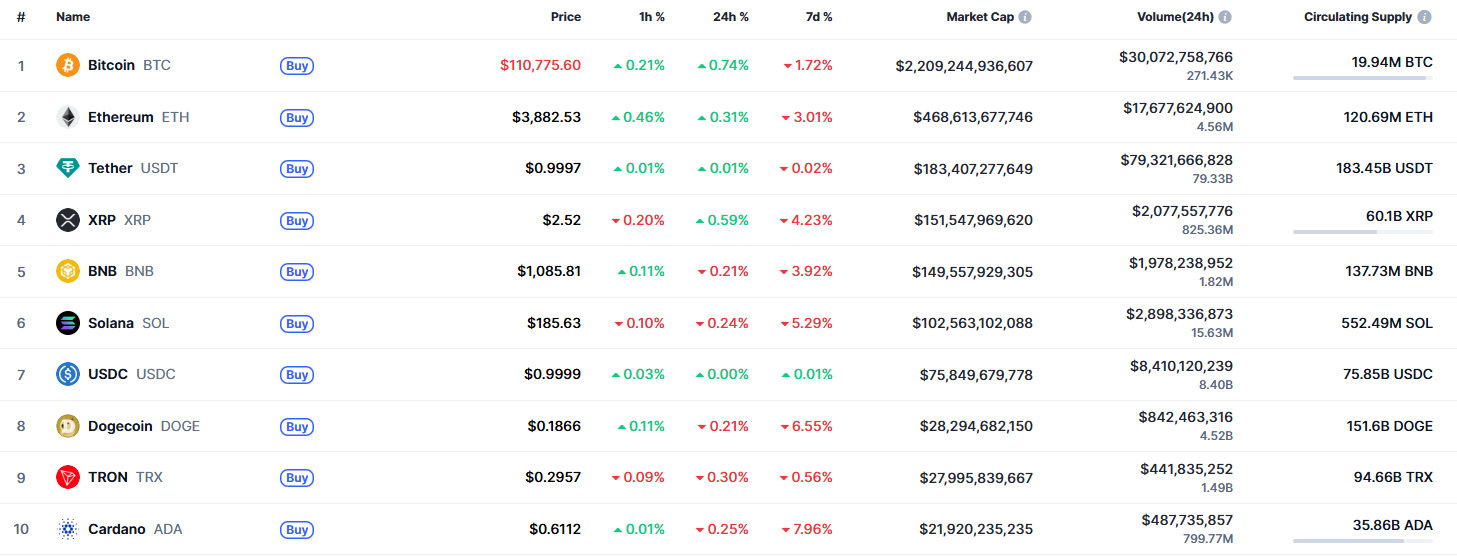

Our beloved DOGE seems to have lost a peppercorn of its weight, settling down 0.21% since yesterday. Over the last week, it’s lost more ground than a mischievous weasel in a henhouse, about 6.55%, by the numbers wizards bandy about.