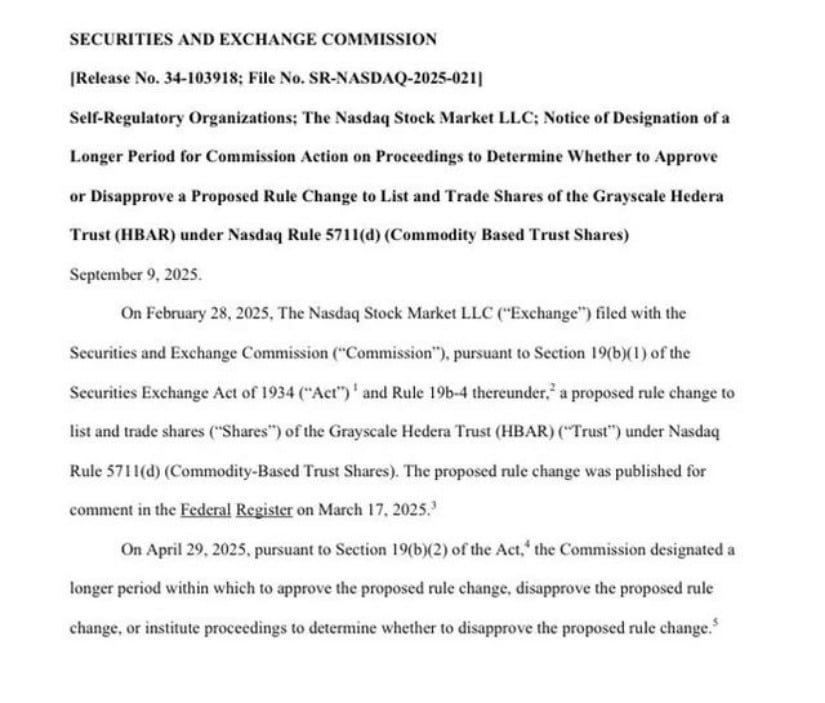

HBAR’s ETF Dreams: A Comedy of Hopes, Charts, and 150% Gains 🚀💸

In a dramatic twist worthy of a Parisian opera, the SEC now contemplates the Grayscale Hedera Trust ETF. 📜🎭 Rumor has it Paul Atkins, that architect of standards, might wave his wand by November 12! 🪄📅 But let us not forget: in this theater, hope is the lead actor, and reality? Merely a stagehand. 🎭💸