Binance Panic! WhatsApp Scams & North Korean Pranks 🤯

The High Priest of this volatile temple, one Richard Teng-CEO by title, prophet by accident-recently issued a Pontifical Edict via Twitter (or X, or whatever Satan’s latest app is called):

The High Priest of this volatile temple, one Richard Teng-CEO by title, prophet by accident-recently issued a Pontifical Edict via Twitter (or X, or whatever Satan’s latest app is called):

Richard Teng, the ever-dashing CEO of Binance, took to the oh-so-trendy social platform X (formerly Twitter, but who’s counting?) this week to confirm what we’ve all suspected: digital assets have well and truly joined the ranks of the mainstream. Apparently, it’s now all about “clear regulatory frameworks” – because nothing says ‘modern finance’ like a bureaucracy!

The surge in Stock-to-Flow and declining NVT ratio reinforces long-term bullish momentum. A most promising sign, indeed! 📈

Short-term traders are clutching their pearls, hoping for a rebound, while long-term holders should probably check if their parachute is packed. Technical indicators? They’re throwing red flags like it’s a yard sale for panic. 🚩🚩

Bitcoin is currently trading near $101,724, up 0.46% over the past 24 hours, according to Brave New Coin data. The cryptocurrency remains well below its all-time high of $126,198, but on-chain and momentum indicators suggest renewed accumulation. 🧠📈

The ETF outflows trickle like a reluctant lover’s tears, whispering of timid hearts and trembling hands. 🎭💔

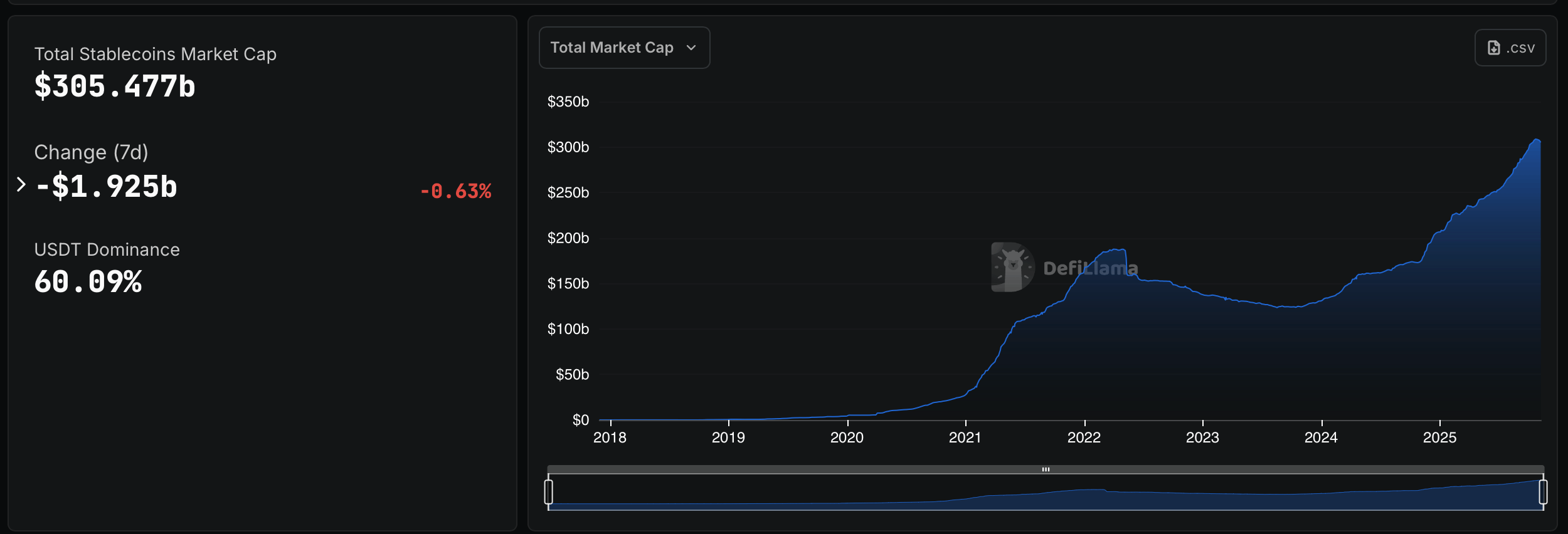

The stablecoin arena roared with chaos this week, as Stream Finance’s XUSD and Stable Labs’ USDX fled their dollar pegs with the urgency of a man chased by a bear. A spectacle of triumphs and faceplants-these tokens nailed the latter with the precision of a drunk archer. 🎯💩

Reports, those harbingers of doom, proclaim that the hashprice-the daily bread of the miner-has fallen from its lofty perch of $62 per PH/s in July to a measly $42 today. A dip, you say? Nay, it is a precipice, a chasm into which the smaller operators are cast, their margins as thin as the air at the summit of Mount Everest. Power bills? Maintenance? Ha! They might as well ask for the moon. 🌙💸

Brace yourselves: Filecoin (FIL) just crossed the $4 mark. That’s a whopping 585% increase from its lowest point this year. 🚀 This surge is enough to make anyone believe in crypto miracles. The market cap? A solid $2.4 billion, positioning Filecoin as the second-best performer this week, right after the Internet Computer (ICP). Not bad, huh? 😎

The daily chart looked like a rollercoaster designed by a sadist-Bitcoin had been sliding downhill since mid-October, when it peaked at $126,272 (cue the tiny violins). Now, it was stuck between $98,900 and $104,000, like a stubborn mule refusing to budge. Lower highs? Lower lows? Bears were having a picnic while bulls sharpened their horns.