XRP’s Secret Tango with Lady SEC: A Desired Romance 🌹💰

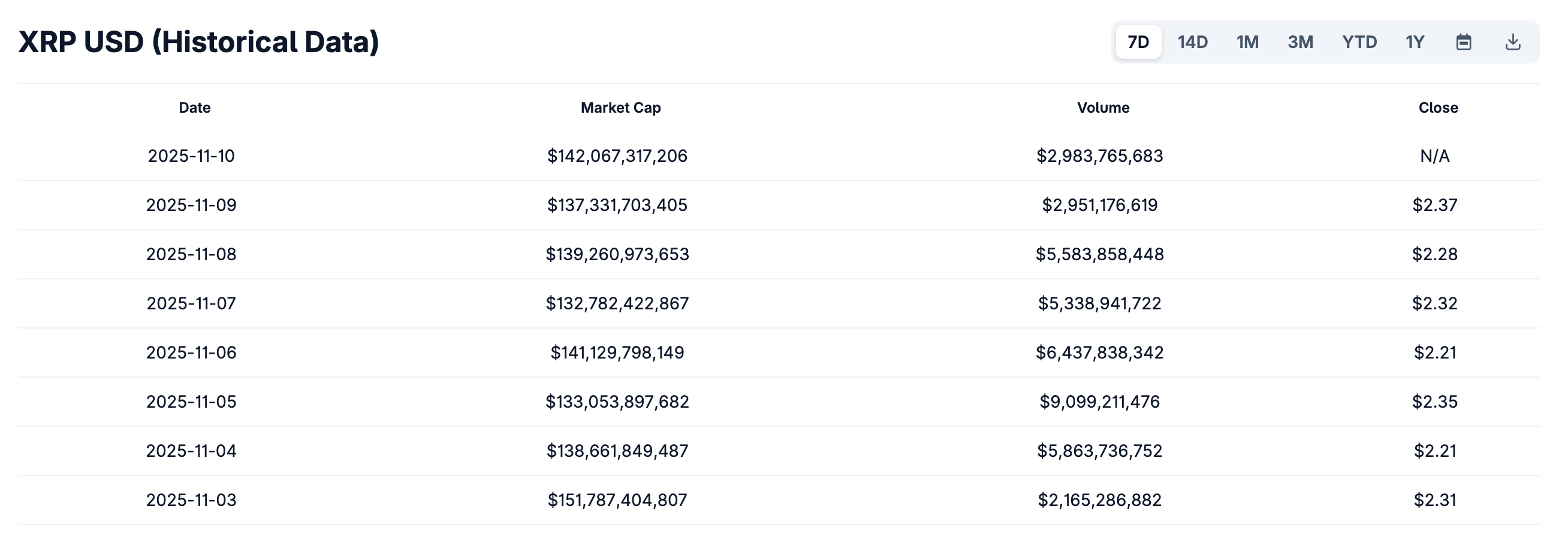

Amid the looming curtain call on the government’s little hiatus, one can only fawn over the possibility that the SEC, in its infinite wisdom, might expedite its deliberations, elevating XRP’s price to a dizzying $2.46. Ah, the sweet scent of fiscal anticipation!