XRP Soars 10%, Overtakes BNB to Claim 4th Spot in Crypto Rankings!

The recent, unexpected price increase has grabbed the attention of traders, particularly because XRP hadn’t shown much activity for several weeks.

The recent, unexpected price increase has grabbed the attention of traders, particularly because XRP hadn’t shown much activity for several weeks.

Historically, Bitcoin [BTC] has seen strong rallies after each halving, like a well-fed cat after a nap-until 2025, when it closed the year down 6%. 🐱

The idea, naturally, is to reduce circulating supply without having to rely on the whims of actual, you know, buyers. Which, let’s be honest, is a bit like trying to float a boat by removing water from the ocean. It does ease ‘sell-side pressure’, allegedly. And it’s supposed to stabilise the ecosystem. Because ecosystems really appreciate a bit of financial engineering. 🙄

In a missive dated January 1st, Claver, with the gravitas of a soothsayer adjusting his crystal ball, remarked: “Timelines always get extended,” a statement as profound as it is self-exculpatory. “I should know this by now,” he added, with a wink to his three years of toiling in the vineyards of partnerships and regulatory labyrinths. “The Domino Theory,” he intoned, “still stands, as immutable as the laws of physics. Real world events will play out, and XRP shall become the backbone of markets-a spine, if you will, for the financial leviathan of the future.”

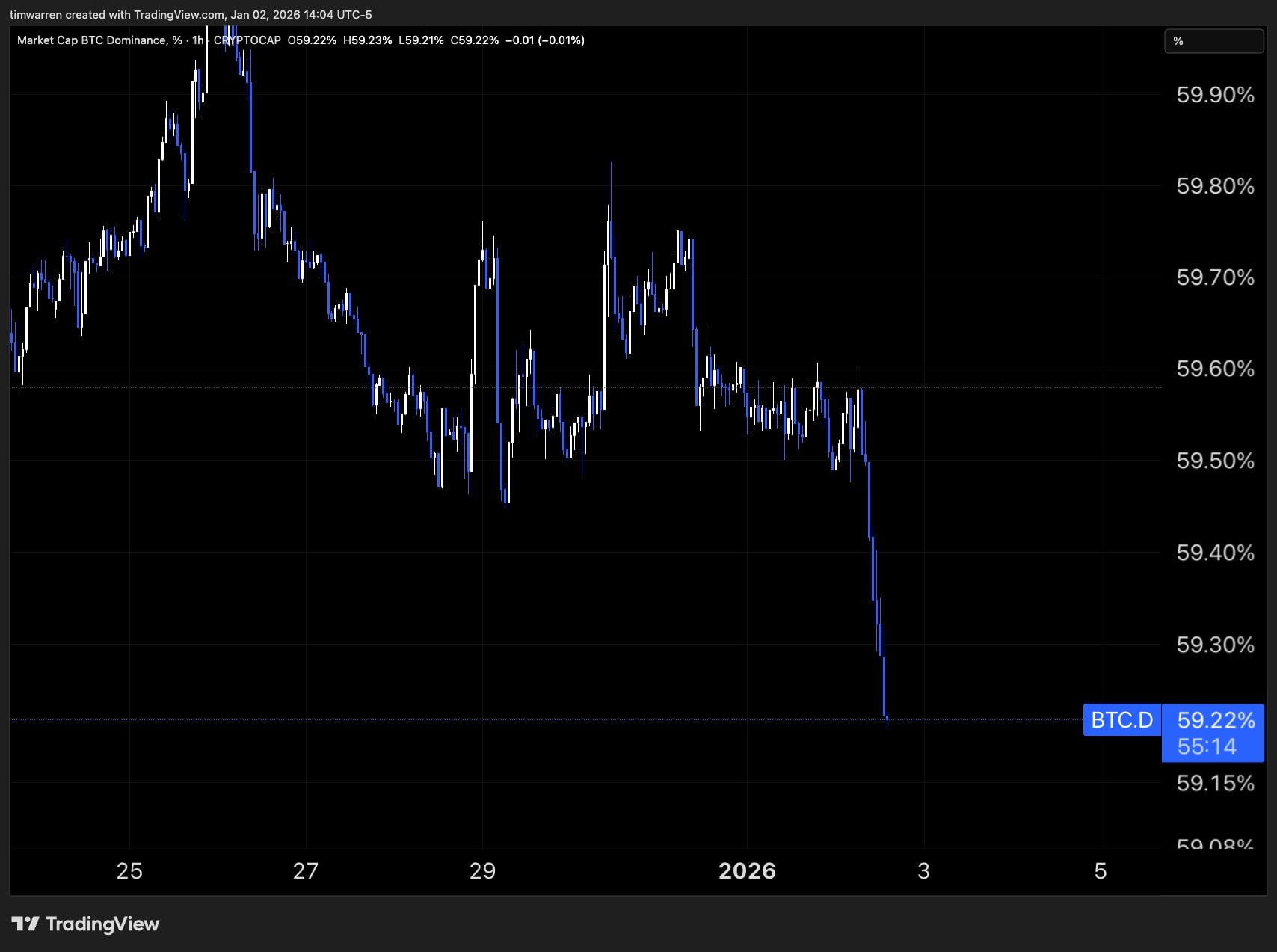

Major altcoins, including resurgent XRP (which apparently thinks it’s the main character) and a high-flying Dogecoin (the Shiba Inu of crypto), have posted outsized gains. One might say the market is throwing a party-and Bitcoin got left on read.

Our protagonist, known in the digital realm as @Cryptobilbuwoo0, has graced us with an analysis so extravagant it could make even the most seasoned fortune teller blush. He posits that XRP, currently lounging at a modest $1.83, might one day frolic in the verdant pastures of $300. Why, one might wonder, should we not all don our rose-tinted glasses and believe such wonders are possible?

Cantonese Cat’s yearly chart, a labyrinth of logarithmic scales, framed 2025 as a delicate truce with gravity. The 0.786 Fibonacci line, roughly $0.10879, had become a fortress, its walls reinforced by an inside candle that whispered of bullish continuation. “Ah,” the analyst mused, “price has respected the ancient geometry of despair-how very Victorian.” The chart’s next target, $0.73905, loomed like a gothic spire, promising catharsis if the 0.786 bastion held. One might almost call it poetic, if not for the palpable stench of volatility.

Jonathan Carter, a market technician with the energy of a caffeinated squirrel, has boldly predicted four price targets for BTC this year. Despite the market’s ongoing “I’m fine, you’re fine” vibe, he’s bullish. His 8-hour chart analysis? Let’s just say it’s more “Yoda wisdom” than “Wall Street whisper.”

Behold, the project has already amassed a treasure trove of over $2.5 million, a testament to the boundless optimism (or folly) of the modern investor. The token, in its final throes of affordability, lingers at a mere $0.0012161. But haste, dear soul, for the clock ticks ever onward! ⏳

Key Takeaways