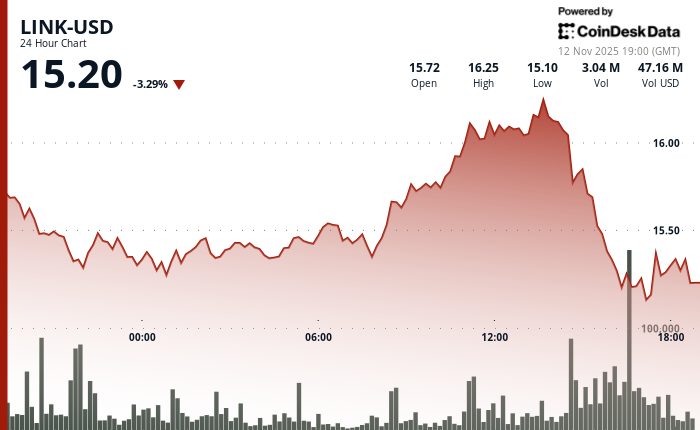

AI’s $1.4T Gamble: Bitcoin Sinks Like a Stone 🚀💸

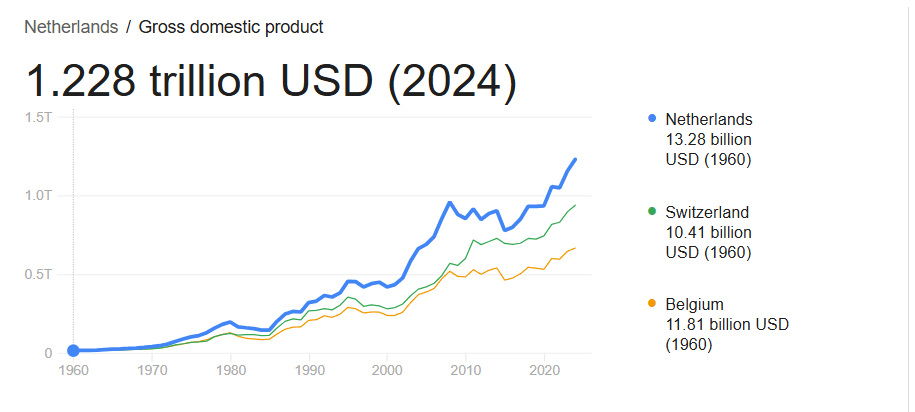

“We are looking at commitments of about $1.4 trillion over the next 8 years,” OpenAI CEO Sam Altman said last week. That figure is almost $200 billion larger than the gross domestic product (GDP) of the Netherlands, a modest European nation that once fancied itself a world power. 🇳🇱