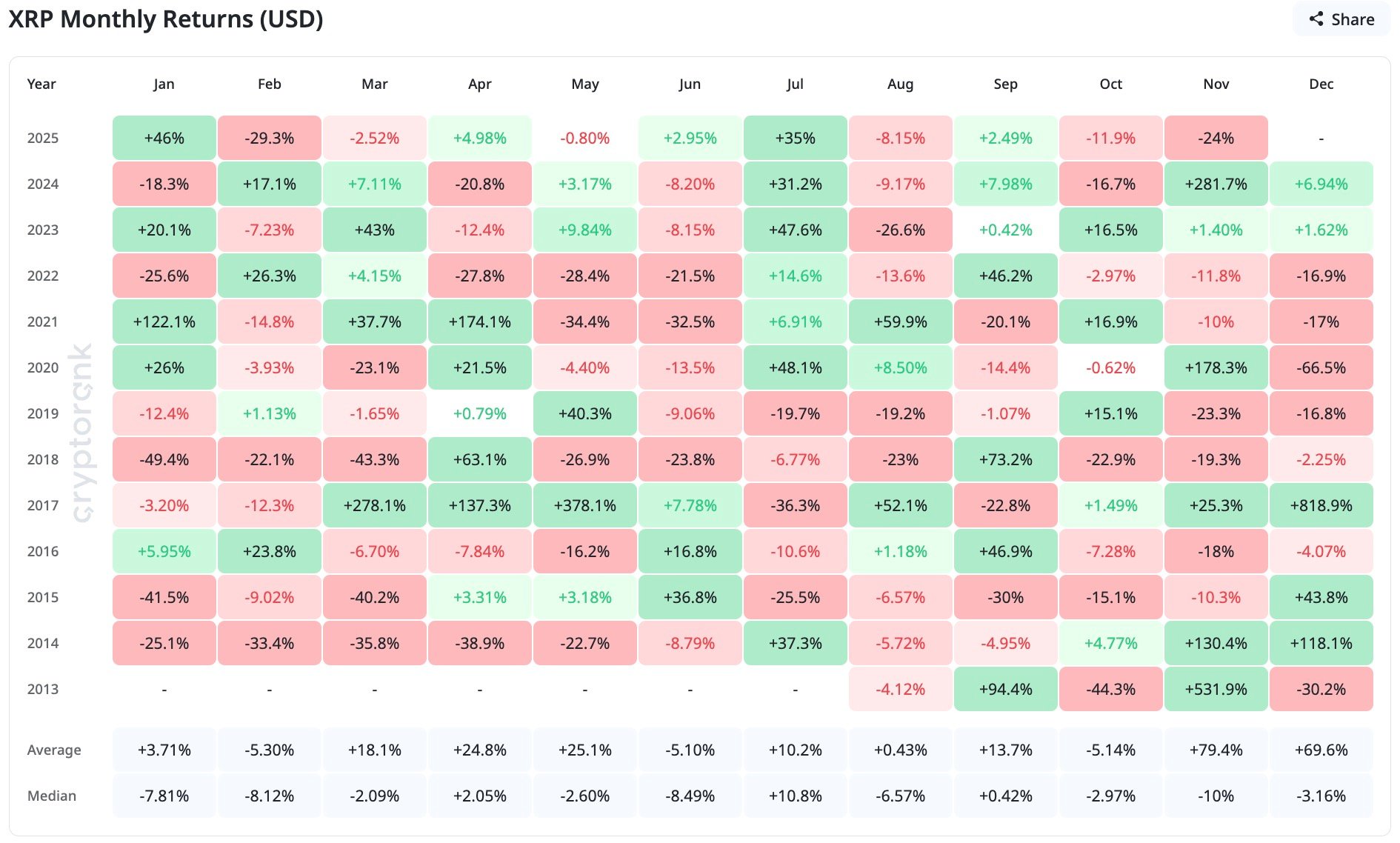

XRP’s Wild Ride: From $2 to Despair (But Decembers Save Us All 🎄)

But today’s star is XRP, which ditched its $2 throne like it was a broken chair. Down to $1.85, it’s now the crypto equivalent of that friend who promised to pay you back in 2016. Glassnode’s data? A daily $75M loss since April 2025-wait, 2025? Did I miss a time-travel memo? 🕰️