China’s Crypto Ban: Still Kicking, Still Killing Vibes 😒

The People’s Bank of China (PBOC) doubled down on this after a November 28 meeting, because nothing says “we’re serious” like a bureaucratic huddle. 🤷♂️

The People’s Bank of China (PBOC) doubled down on this after a November 28 meeting, because nothing says “we’re serious” like a bureaucratic huddle. 🤷♂️

Several crypto assets made a run for the moon this week, with Compound (COMP) leading the pack, making a jaw-dropping 129.90% leap to $65.57 per coin. Clearly, someone let the rocket fuel out.

To figure out why predictions about Bitcoin are often wrong, one expert created a model that didn’t try to forecast Bitcoin’s price. Instead, it analyzed what Bitcoin’s behavior suggests about broader trends in the world.

Now, here’s the kicker: we’ve got some experimental Quantum computers floating around right now. They’re in that awkward teen phase of their life, not quite ready to destroy everything, but showing alarming potential. No, we don’t have the perfect Quantum supercomputer yet. But when one does pop out from the tech incubator, well, prepare your wallets-multi-trillion-dollar fortunes could be at stake. And if it arrives before we’ve got any defense? Things will get very complicated in a hurry. But hey, who’s counting? It’s only the entire future of digital security.

What maketh this moment most peculiar? Not merely the scale of the giveaway, but the manner in which it hath transmuted the very essence of FUNToken. Engagement, once a flickering ember, now blazes with fervor. Activity, like a maniacal pendulum, swings with renewed vigor. And the community, that fickle creature, hath begun to whisper the old question: What transpireth when the fundamentals, like a repentant sinner, seek to atone while the market, ever capricious, returns to its familiar lair of accumulation?

Ethereum’s at a point where a tiny nudge can turn this thing into a full-blown roller coaster. Buckle up.

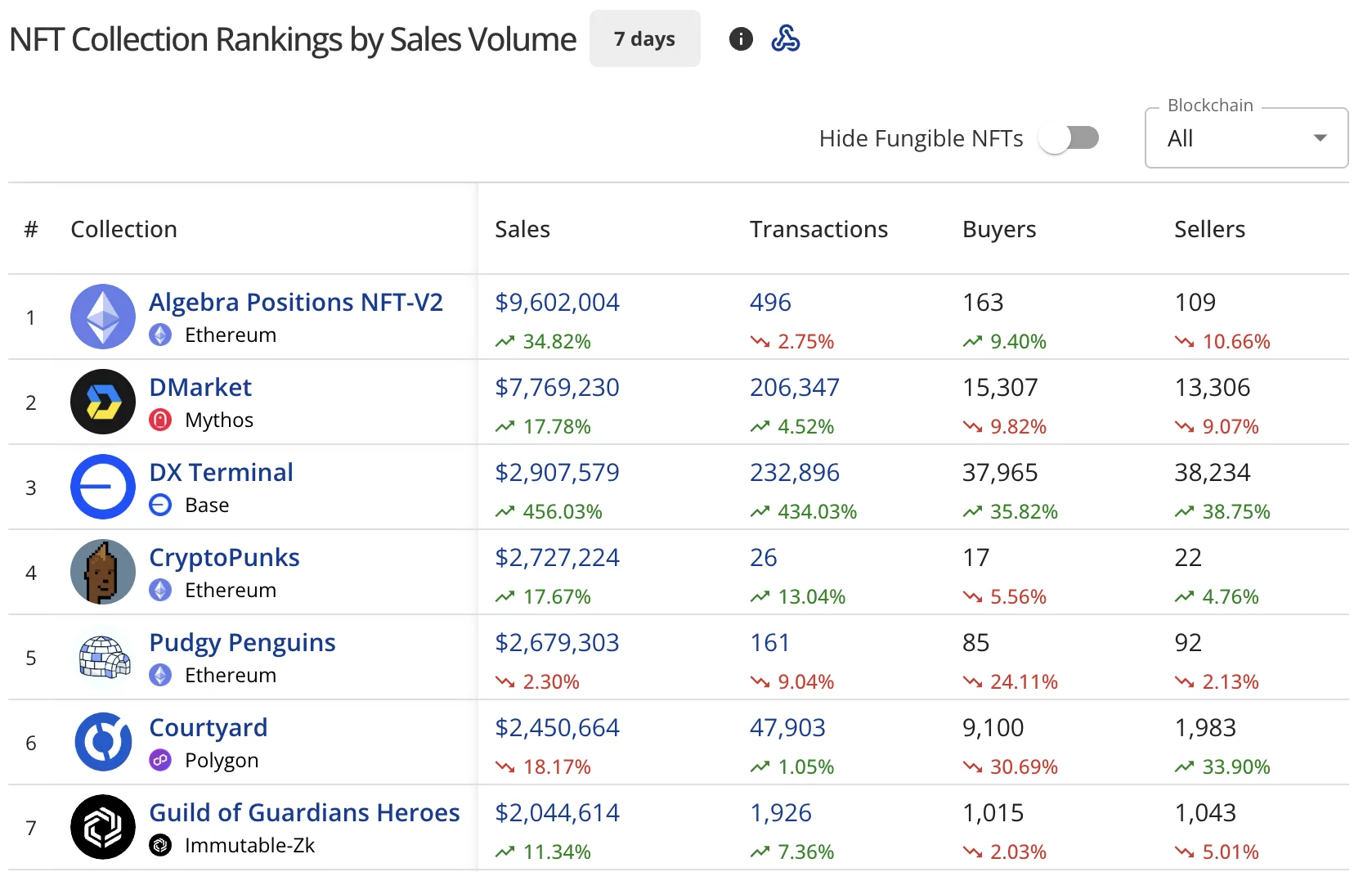

Market participation, that most thrilling of spectacles, saw NFT buyers swell by 25.34% to 397,409, while sellers increased by 15.56% to 349,725. One can only wonder if the market’s newfound vigor is due to genuine enthusiasm or a particularly persuasive meme. 🐍

The real surprise? Not the show of shiny new funds sprouting left and right, but that these precious funds have yet to shed a single tear of outflow since anointing the stage with their first trade. Yes, sir, the liquidity fairy is apparently napping. 🦄

Apparently, XRP had a “cool-off period” in 2017 (read: everyone forgot it existed) before skyrocketing like a caffeinated squirrel. Now, ChartNerd insists the same snooze-fest is happening again, because nothing says “bullish” like three months of crickets. 🦗

This here volatility, it’s enough to make a man’s wallet wobble. Folks are sayin’ it’s a sign of weakness, like a mule stubbornly refusin’ to budge. But hold onto your hats, ’cause Wall Street’s bigwigs are dancin’ to a different fiddle.