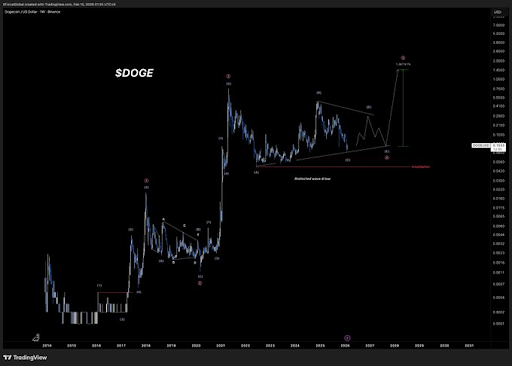

Dogecoin to $1? Perhaps, But Only After the Next Ice Age

In a missive dispatched via the modern-day town crier, X, XForce declares that Dogecoin retains the potential for a tenfold leap in the coming years, a feat as likely as a muzhik finding a golden samovar in his cabbage patch. He elaborates, with the precision of a clockmaker, that this vision hinges upon a singular bullish trajectory, wherein Wave 4 of DOGE’s chart may form a triangle-a geometric marvel that, if realized, could propel the coin to $1.3 by the year 2028. Mark well, dear reader, for this aligns with the predictions of other market seers, such as Benjamin Cowen, who foresee the zenith of the next bull run in this very epoch. Yet, let us not forget the peril: should DOGE falter below $0.05, this grand design shall crumble like a poorly baked pirozhki.