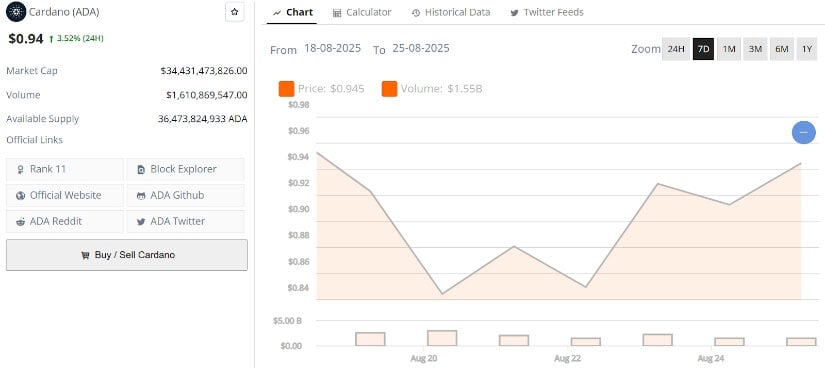

It seems that the good old Cardano (ADA) has found itself in quite a pickle, what with the Grayscale Cardano Spot ETF whispers swirling about like a summer breeze. This has, of course, caught the eye of those well-heeled institutions, who now find themselves rather intrigued. With a market cap that could make a duke blush (over $34 billion), and daily trading volumes that wouldn’t be out of place at a bustling bazaar, the stage is set for a grand breakout as we saunter into Q4 2025. Or so the pundits would have us believe.

Cardano Price Setup: A Tale of Two Lines

Our dear ADA is currently prancing about within the confines of a symmetrical triangle, a formation so classic it might as well be wearing a monocle. Support is holding firm near $0.88, while resistance is being ever so politely contested just shy of $0.95. Analyst William, a chap with more charts than a pirate’s treasure map, notes that such a pattern often signals that the price is preparing for a grander move. Buyers, bless their souls, continue to step in at higher levels, while sellers valiantly defend the same lofty ceiling. On the 4H chart, ADA has managed to stay above its 50-period EMA, indicating that short-term momentum is decidedly bullish. Quite the setup, wouldn’t you say? 📈

The key level to watch is the $0.95 to $0.97 zone. Should ADA muster the courage to break and close above it with a hearty volume, the next upside targets could be as high as $1.15 and $1.25. With the price tightening and the RSI in neutral territory, the breakout point is drawing nigh, and the bulls are positively giddy. 🐂

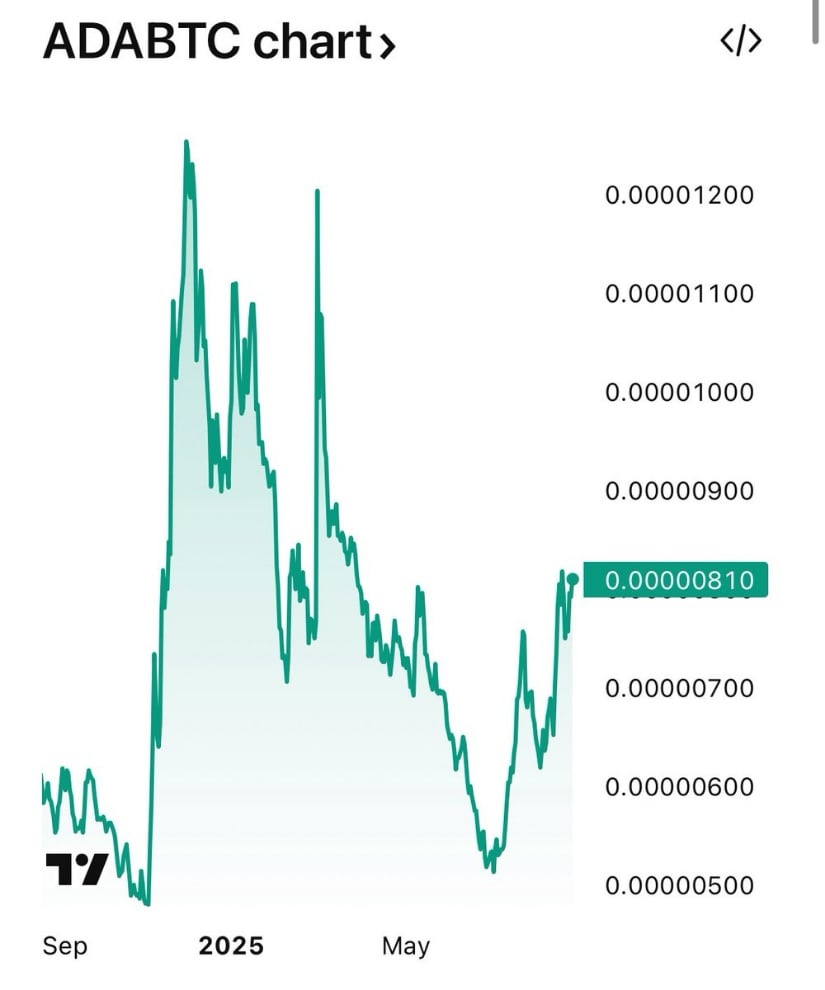

ADA/BTC Chart: A Glint of Hope

When it comes to Cardano’s performance against Bitcoin, things are looking decidedly more cheerful. ADA/BTC has rebounded from the 0.00000700 support area and is now eyeing the 0.00000810 level with a glint in its eye. TapTools, a source of wisdom in these matters, suggests that this chart is showing early signs of a breakout. 🌟

This recovery structure hints that relative strength may be shifting in ADA’s favor, especially if Bitcoin’s dominance continues to wane. From a technical standpoint, the next level to watch is around 0.00000850 to 0.00000900, where ADA has faced resistance before. A close above this range would confirm a breakout and could pave the way to 0.00001000. Quite the journey, wouldn’t you agree? 🚀

Market Outlook: A Bullish Ballet in Q4 2025?

ADA has been gradually regaining its composure, currently trading near $0.94 with a solid market support forming above the $0.90 zone. The structure suggests that buyers are defending higher lows, while resistance remains concentrated at $0.97 to $1.00. Oscillating indicators are sitting in a healthy mid-range, allowing for momentum to expand without overextending. With a market cap above $34 billion and daily trading volume crossing $1.6 billion, liquidity continues to provide a sturdy foundation for a potential breakout.

As we head into Q4 2025, ADA’s ability to reclaim the $1 mark will be the decisive factor. Market watchers, a rather nosy bunch, suggest that a confirmed close above $1.05 could unlock upside targets at $1.20 and $1.35, aligning with historical accumulation-to-expansion cycles. A true test of ADA’s mettle, indeed! 💪

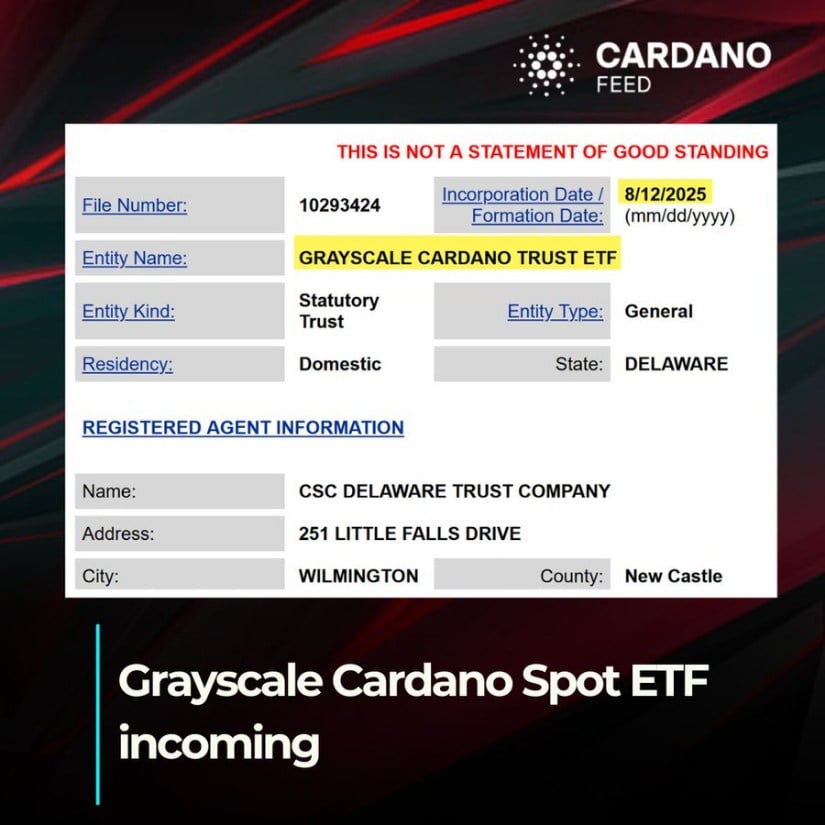

Grayscale Spot ETF: The Elephant in the Room

Cardano’s momentum is receiving a rather timely boost from the news of a Grayscale Cardano Spot ETF filing. This development, if it comes to fruition, could mark a significant shift in institutional engagement with ADA. While the ETF is still awaiting approval, the mere possibility adds a layer of credibility to Cardano as an investable asset class, offering exposure through regulated channels. 🏦

If confirmed, the ETF could serve as a fundamental catalyst for ADA price action in Q4 2025 and beyond. Historically, ETF-related headlines have provided a spark for price momentum across crypto markets, and ADA could see similar effects as it approaches key resistance around the $1 mark. A thrilling prospect, wouldn’t you say? 🔥

Final Thoughts: The $1 Barrier and Beyond

Cardano’s price is shaping up for a decisive moment, with the symmetrical triangle pattern tightening and momentum leaning toward a breakout. If buyers can summon the fortitude to reclaim the $1 mark with strong volume, ADA could quickly shift sentiment from cautious to bullish, opening the door to the $1.20 to $1.35 range. The added spotlight from Grayscale’s Spot ETF filing only reinforces the notion that institutional demand may play a pivotal role in ADA’s next move.

However, let’s not forget to keep an eye on the $0.88 to $0.90 support zone, as losing this level could delay the breakout narrative. For now, the balance between steady technicals, improving fundamentals, and growing institutional interest makes ADA Cardano one of the more intriguing altcoins to watch as we march into Q4 2025. A veritable rollercoaster ride, if ever there was one! 🎢

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Winklevoss Twins Back $M Bitcoin Listing

- Hong Kong’s Stablecoin Shenanigans: The Big Circus Begins! 🎪🚀

- Asia’s Financial Rampage: Stablecoins and the Race for Supremacy

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

- Why Is Everyone Suddenly So Bullish About Stellar? 🚀 You Won’t Believe These 5 Price Targets!

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

2025-08-25 12:03