Behold, the mighty BTC, having taken a brief dip to the lowly $60,000, now dares to flirt with the tantalizing figure of $69,500. A spectacle of fluctuation, one might say, akin to a man attempting to balance a teeter-totter while wearing a top hat. The question looms: is this a noble relief rally, or merely a dead cat bounce, that most elusive of market phenomena? One can almost hear the collective sigh of the investing public, who have long since abandoned hope of understanding such matters.

Crowd Psychology Turns Deeply Bearish After Sharp Selloff

When the markets fall with the grace of a lead balloon, the crowd, ever the dramatic, begins to chant for further descent. “Lower! Below!” they cry, as if the price were a wayward child. Yet, one must wonder-does this not often occur when the market is on the cusp of a turnaround, rather than a continuation? It is as if the investors have mistaken a gentle slope for a cliff, and are now fervently preparing for a plunge they did not request.

Meanwhile, the social volume, that fickle creature, has grown more pessimistic than a man who discovers his umbrella is missing. This, despite the price’s feeble attempt to rise. One might surmise that the market is a masquerade ball, where everyone is pretending to be something they are not, and the only certainty is that the dance will end in confusion.

Dead Cat Bounce or Short-Term Relief Rally?

One cannot help but ponder: is this rebound a mere mechanical short covering, or a response to the exhaustion of sentiment? The market, that most capricious of creatures, rarely moves in straight lines. It prefers to zigzag, much like a drunkard attempting to navigate a minefield. And yet, here we are, watching with bated breath as it teeters on the edge of a precipice, hoping for a miracle.

From a technical standpoint, BTC hovers just above the weekly 200-EMA, that sacred line drawn by the hands of analysts. To cross it is to invite chaos, yet to remain above it is to court the possibility of a grander ascent. One can almost hear the murmurs of the long-term participants, who, like ancient sages, await the moment when the stars align-or, in this case, the price chart.

Whale Exchange Activity Adds Caution to the Setup

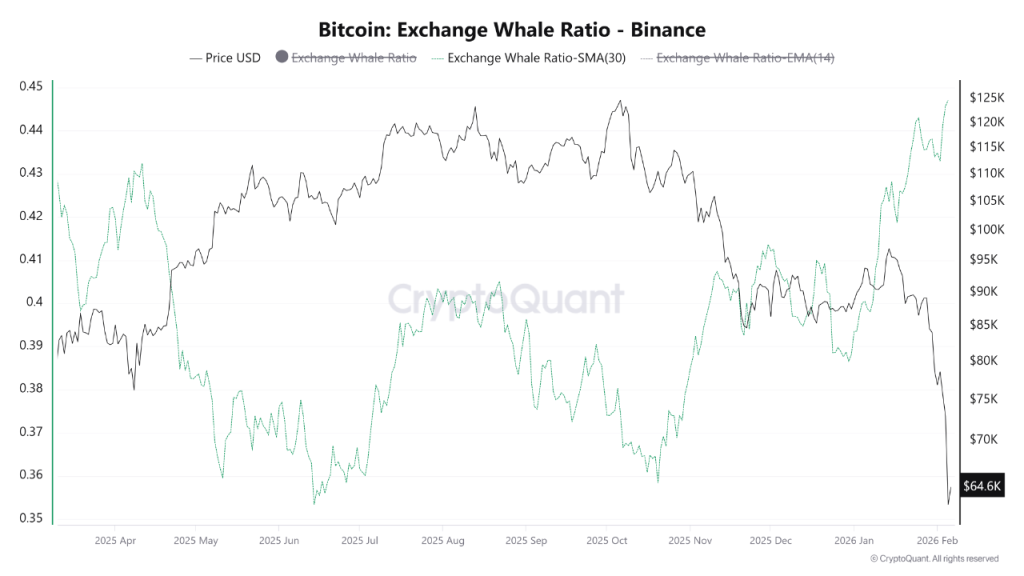

Meanwhile, the on-chain behavior introduces a note of caution, as if the whales have gathered to whisper secrets in the dark. The Exchange Whale Ratio, that most enigmatic of metrics, has reached its zenith since March 2025. This suggests that the large holders are, in their infinite wisdom, pouring funds into exchanges with the enthusiasm of a man who has just discovered a treasure map.

Historically, such a spike coincides with distribution or hedging, not accumulation. It is as if the whales are preparing for a storm, and the rest of us are left to wonder if we shall be swept away or merely drenched. Until this metric cools, the downside risk remains as persistent as a gloomy forecast.

Contradictory Signals Keep BTC Price Range-Bound

Still, the divergence between retail fear and whale pressure creates a tableau of confusion. While the smaller participants, ever the dramatists, cry for a rebound, the whales, with their inscrutable motives, limit the upside. It is a dance of contradictions, where every step forward is met with a backward stumble, and the audience is left to guess the choreography.

From a broader perspective, the BTC markets appear to be undergoing a reset, much like a man who has just realized he has misplaced his keys. If the price stabilizes above key moving averages, the narrative may shift toward consolidation-or, as the more optimistic might call it, a temporary reprieve. Conversely, renewed weakness could lead us toward the $53,000 region, where prior demand has historically emerged, like a ghost from the past.

In this context, BTC remains a prisoner of its own contradictions, caught between sentiment exhaustion and structural selling. The coming weeks, one suspects, will be a veritable feast of confusion, where every headline is a cliffhanger, and every chart a mystery to be solved.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- XRP’s Wild Ride: To the Moon or Just a Bit Bouncy? 🚀

- Harvard’s Shocking $117M Bitcoin Bet: Is This the Future of Investing? 🤯💰

- ASIC Grants Crypto Firms a Breathing Space… With a Deadline! 💸

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- XRP: A Most Disappointing Turn of Events! 📉

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- DeFi’s Wild Ride: From Yield Fever to Utility Sanity 🤠💰

- Bankman-Fried\’s Wild Excuse

2026-02-06 19:56