\n

In the frostbitten realm of blockchain, where frostbitten digits clutch at thin air, the enigmatic report from Glassnode whispers of calamity. Should the beast named Bitcoin falter beyond the elusive $108,500 mark, it may dance with a deeper correction, as fickle as a snowflake’s descent.

\n\n

The Supply Quantiles Cost Basis model, that spectral compass of hodlers’ fate, maps Bitcoin’s soul to the 0.85 quantile-a line drawn in entropy. Here, 15% of BTC supply dangles like a pendulum, flirting with the abyss. The 0.95 quantile, once a golden threshold, now weeps as BTC tumbles into the red, reduced to a mere $108,600.

\n\n

\n

BTC’s recent dalliance with the market’s capricious moods sees it languish near the 0.85 line, a ghost of $97,500’s dinner party beckoning. History, that fickle oracle, whispers that failure here births a winter more severe than GOST-certified vodka.

\n\n

BTC once knelt before the 0.75 quantile in mid-2024. Now, it stares at $97,500 with the dread of a Siberian hare facing a snowstorm. Can it cling to the 0.85 line? Or shall it surrender to the 0.75? The answer: a costly poker hand between hope and despair.

\n\n

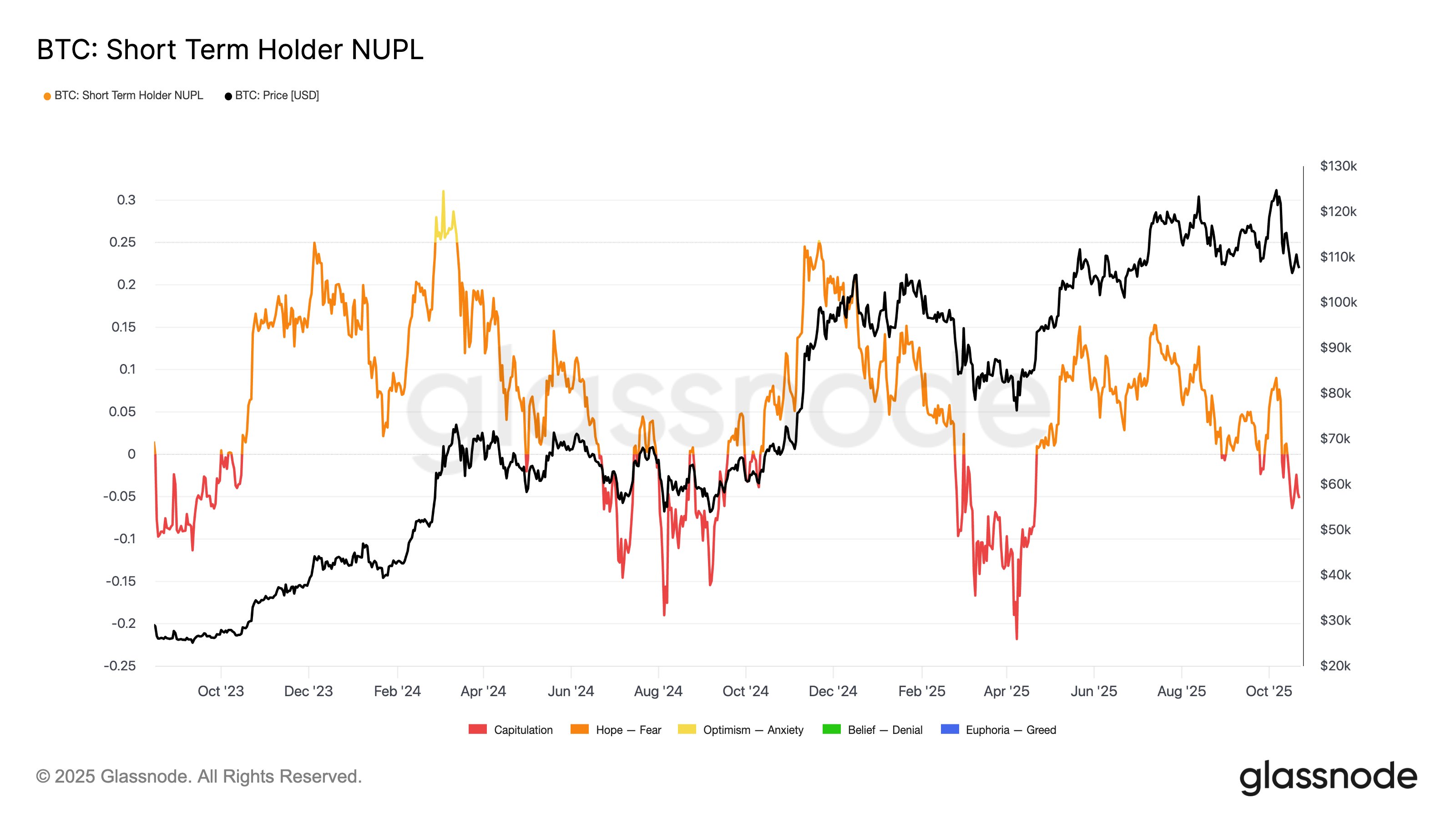

Beyond quantiles, the short-term holders’ average cost basis ($113,100) crumbles like a macaroon in a snowfall. These “weekend chefs,” who bought chips within 155 days, now simmer in heated soup pots. Glassnode sighs: “This prelude to capitulation is as fresh as a 1940s potato ration.”

\n\n

\n

BTC’s price? A meek $109,100, quivering like a chandelier in a draft. One might argue it’s less a cryptocurrency and more a cyber-smoke signal, calling for the crypto fleet for reinforcements.

\n\n

\n

In the frostbitten realm of blockchain, where frostbitten digits clutch at thin air, the enigmatic report from Glassnode whispers of calamity. Should the beast named Bitcoin falter beyond the elusive $108,500 mark, it may dance with a deeper correction, as fickle as a snowflake’s descent.

The Supply Quantiles Cost Basis model, that spectral compass of hodlers’ fate, maps Bitcoin’s soul to the 0.85 quantile-a line drawn in entropy. Here, 15% of BTC supply dangles like a pendulum, flirting with the abyss. The 0.95 quantile, once a golden threshold, now weeps as BTC tumbles into the red, reduced to a mere $108,600.

BTC’s recent dalliance with the market’s capricious moods sees it languish near the 0.85 line, a ghost of $97,500’s dinner party beckoning. History, that fickle oracle, whispers that failure here births a winter more severe than GOST-certified vodka.

BTC once knelt before the 0.75 quantile in mid-2024. Now, it stares at $97,500 with the dread of a Siberian hare facing a snowstorm. Can it cling to the 0.85 line? Or shall it surrender to the 0.75? The answer: a costly poker hand between hope and despair.

Beyond quantiles, the short-term holders’ average cost basis ($113,100) crumbles like a macaroon in a snowfall. These “weekend chefs,” who bought chips within 155 days, now simmer in heated soup pots. Glassnode sighs: “This prelude to capitulation is as fresh as a 1940s potato ration.”

BTC’s price? A meek $109,100, quivering like a chandelier in a draft. One might argue it’s less a cryptocurrency and more a cyber-smoke signal, calling for the crypto fleet for reinforcements.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Tether’s U.S. Debut: Trump’s GENIUS Act & a Stablecoin Saga 🤖💸

- WalletConnect Dives into Stablecoin Mayhem with dtcpay in Asia! 🎉

- XRP Staking: A Tale of Tension and Tokens 🚀

- Bitcoin Signals Recession…” but then contrast with the data. Also, mention the potential upside. Let me check character count. “Bitcoin Signals Recession, But Data Says Otherwise – Bullish Opportunity Ahead?” That’s 78 characters. Maybe shorten “Bullish

2025-10-24 05:22