Bitcoin, that enigmatic creature of the digital realm, now prowls between $109,549 and $109,939 on Sept. 2, 2025, its market cap swelling to $2.18 trillion like a balloon on a string. Over the last 24 hours, it has danced between $107,542 and $110,641, a tango of indecision near support and resistance levels that might as well be written in invisible ink. 🤖💸

The Digital Gold

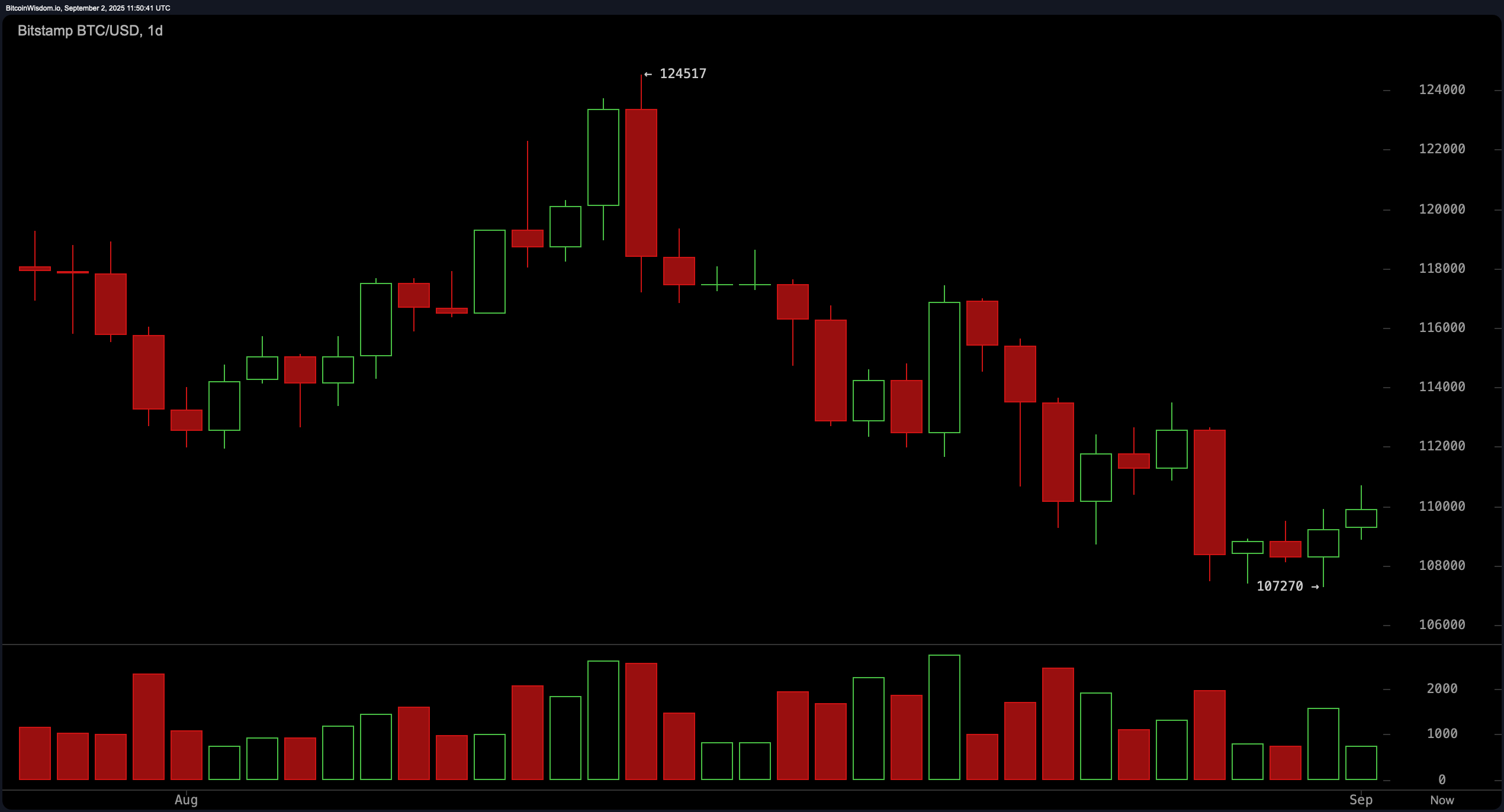

The daily chart of bitcoin tells a tale of hubris and humility, plummeting from $124,517 to $107,270 before birthing a green candle like a phoenix from the ashes. Yet, the volume spikes during its fall scream of sellers who still remember the scent of profit. Support clings to $107,000-$108,000 like a child to a security blanket, while resistance at $112,000-$114,000 stands as a fortress. Break it with volume, and the bulls might finally feel the wind beneath their wings-or perhaps just a gust of hot air. 🌪️

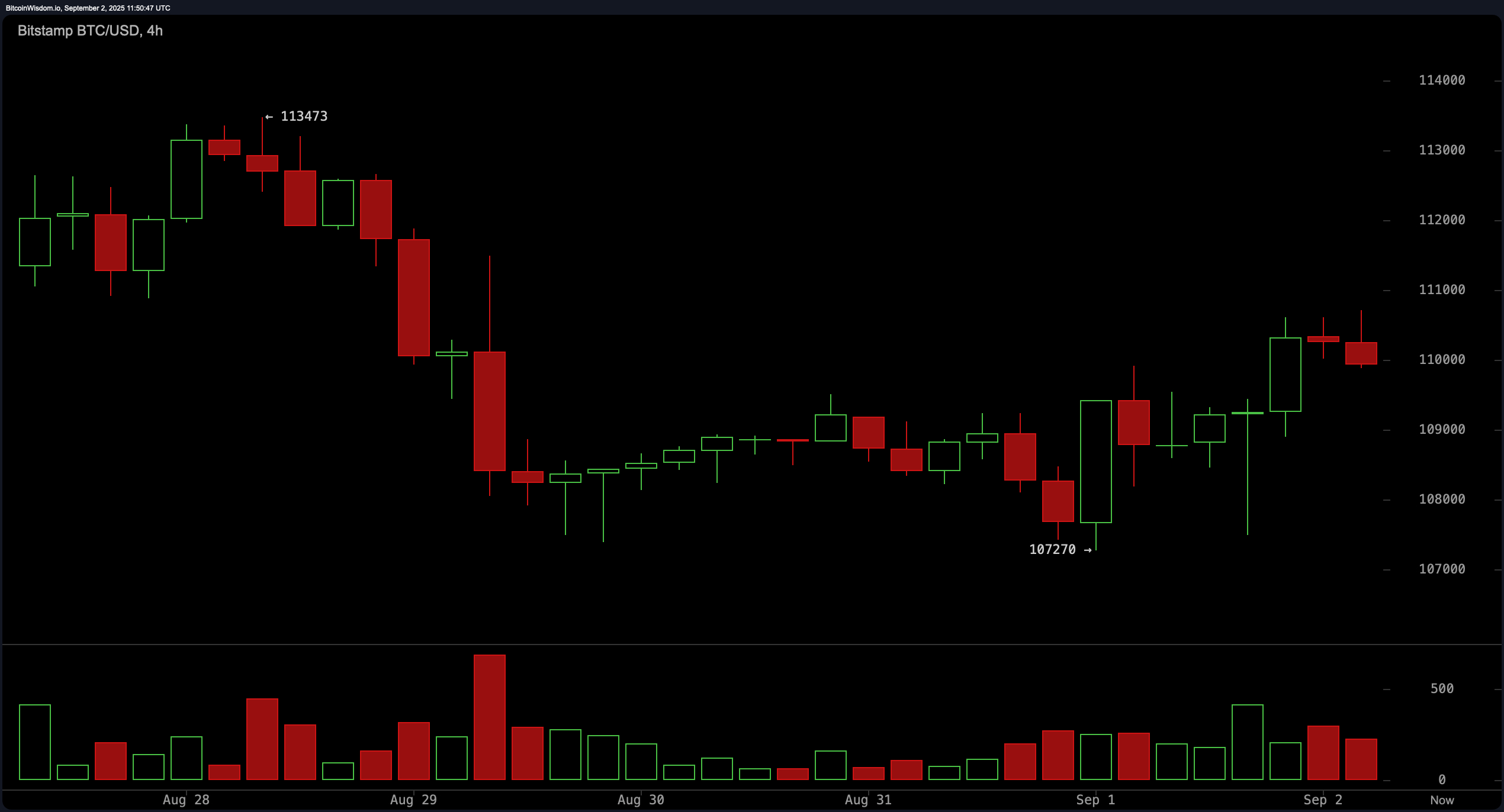

The 4-hour chart, however, whispers of a double-bottom at $107,270, a classic play where bitcoin climbs higher lows like a drunkard ascending stairs. Resistance at $110,700 looms, and if bitcoin re-tests $108,500-$109,000 with a bullish candle, it might just be the green light for longs-or a trap set by the market’s favorite jester. Break above $111,000 with vigor, and the bulls could ride into the sunset; fail, and the bears will cackle like hyenas over a carcass. 🐺

The 1-hour chart paints a picture of consolidation, bitcoin rallying from $107,270 to $111,000 before retreating into a fog of indecision. Volume here is as thin as a moth’s wings, traders likely sipping tea and waiting for a catalyst that may never come. Break above $110,700-$111,000, and the short-term bulls might leap for joy-or trip over their own feet. Drop below $108,000 with rising volume, and the bears will feast. 🍵💣

Oscillators waltz in neutral territory: RSI at 42, Stochastic at 18, CCI at −79. The ADX at 20 suggests the market is as decisive as a sleepwalker. Momentum leans slightly bullish (−5,426), but MACD at −1,930 hisses like a teakettle. Short-term dynamics? A cocktail of mixed signals served in a glass of confusion. 🥄

Moving averages, those stoic elders of the market, chant bearish mantras across all timeframes. Yet the 200-day EMA ($104,180) and SMA ($101,390) cling to bullish dreams like ivy on a crumbling wall. Until bitcoin cracks the $112,000-$114,000 ceiling, traders should tie their shoelaces tight and brace for turbulence. 🚀

Bull Verdict:

If bitcoin stamps its foot above $109,000 and shatters $111,000 with volume as loud as a thunderclap, the bulls might just reclaim the narrative. A breakout above $112,000-$114,000 could spark a rally to the stars-or a trip to the moon, depending on your caffeine intake. 🚀🌕

Bear Verdict:

Should bitcoin falter below $109,000 and crumble past $108,000 with volume like a waterfall, the bears will howl their victory hymn. Sustained rejection at resistance and bearish MAs could drag bitcoin back to $107,000 or lower, a reminder that even digital gold can rust. 🐆📉

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- XRP’s Big Week: SEC Drama, BlackRock Rumors & A Possible $6 Party 🚀

- BlackRock & Stablecoins: A Most Convenient Arrangement 🧐

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

2025-09-02 16:30