So, what’s the scoop?

- Brazil’s latest legislation is like a bouncer at the club, making sure that stablecoins are backed 1:1 with fiat. Bye-bye algorithmic models! Consumers, rejoice-unless you’re into risk-taking.

- This regulatory squeeze is pushing all those wild investments into good ol’ infrastructure projects. You know, the types of things that actually do stuff, rather than just looking pretty.

- Bitcoin Hyper ($HYPER) is on a roll, leveraging the Solana Virtual Machine (SVM) to help Bitcoin sprint instead of saunter, and it’s already raked in over $31 million in its presale. Talk about a money magnet!

- Whales are swimming around, showing their institutional interest in Layer 2 solutions with some serious on-chain shopping sprees right at the start of 2026. Big fish buying big toys!

Buckle up, folks! Brazil is tightening its crypto grip like a too-tight pair of skinny jeans. New legislation rolling through the Chamber of Deputies is specifically targeting those cheeky algorithmic stablecoins, insisting that they be backed 1:1 with actual money. Oh joy!

In simpler terms, Bill 4.308/2024 is basically telling algorithmic models-think Terra’s UST or Ethena’s USDe-to take a hike. No experimental shenanigans allowed!

And here’s the kicker: this bill mandates that issuers keep client funds locked away from their own cash flow. It’s like saying, “You can’t touch my lunch money!”-all thanks to the liquidity disasters we saw last bear market. But for the Brazilian Central Bank (BCB), it’s not just about holding hands and singing Kumbaya; they’re getting strategic. By booting out those mathematically stabilized assets, they’re making room for the flashy new ‘Drex’ (the digital real) and other compliant alternatives. Cheers to that!

Brazil is like the test lab for Latin American crypto trends, and this ban is sending a loud message. It’s all about pushing ‘experimental’ DeFi to the outskirts while diverting all that sweet capital into real, tangible stuff. Uncertainty? The market loathes it, and while bans may sound harsh, they usually pave the way for institutional love.

As the door slams shut on risky yield products, smart investors are pivoting to infrastructure layers that offer utility instead of just financial wizardry. Enter Layer 2 solutions like Bitcoin Hyper ($HYPER).

$HYPER is just a click away!

SVM Integration: Who Knew Bitcoin Could Speedwalk?

While regulators are busy worrying about stability, the market is all about speed. Bitcoin is still the gold standard for security (hence the regulatory crush), but let’s face it-it moves slower than a tortoise in a marathon.

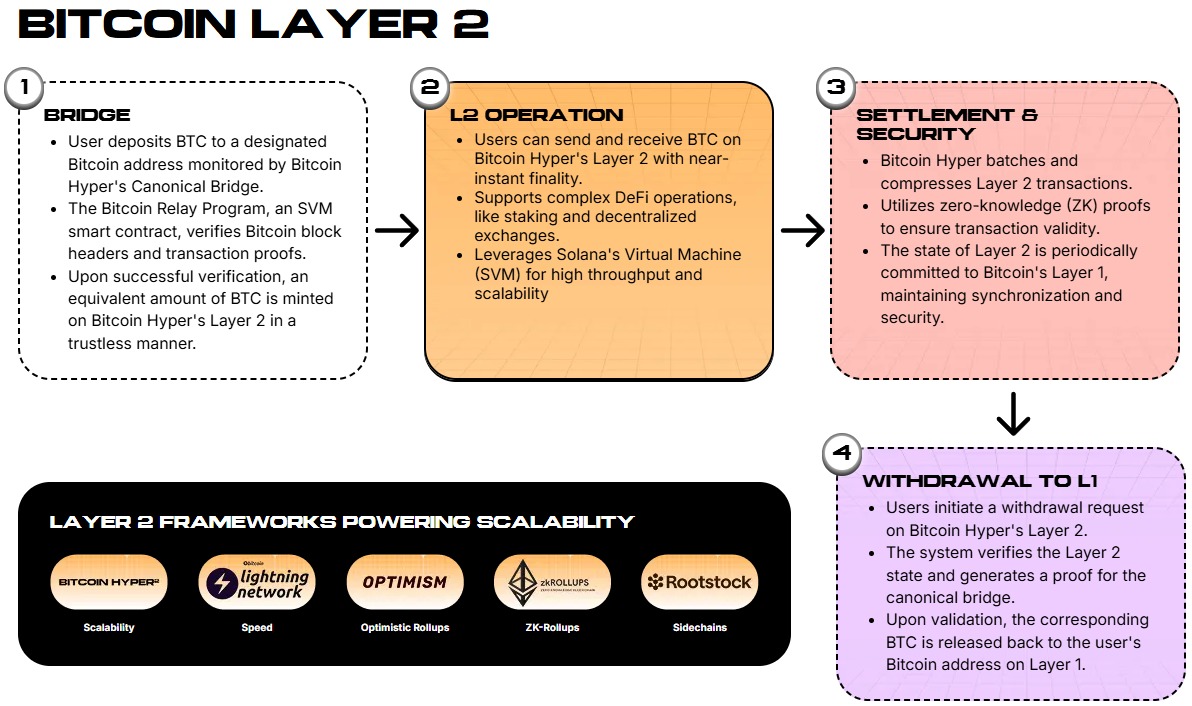

Enter Bitcoin Hyper ($HYPER), swooping in with the Solana Virtual Machine (SVM) as a Layer 2 solution. It’s like giving Bitcoin a caffeine boost, helping it finally keep up with the cool kids!

This whole setup is a major shake-up from the EVM-on-Bitcoin approach. Thanks to SVM, Bitcoin Hyper offers sub-second finality and low-latency performance-basically, it’s the Usain Bolt of crypto now. Developers, rejoice! You can write smart contracts in Rust without getting stuck in main chain traffic!

By separating consensus (Bitcoin L1) from execution (SVM L2), we’re creating a modular environment, allowing payments to scale without breaking a sweat. Brazil wants fully backed assets? Well, now we need a high-performance network to move those assets faster than ever. Bitcoin Hyper is paving the ‘fast lane’ for the world’s most secure collateral. How fancy!

Grab your $HYPER today and join the fun!

Smart Money Sees the Light as Presale Hits $31M

The market’s got a serious appetite for this ‘Bitcoin-security, Solana-speed’ combo, and the numbers are proof. The Bitcoin Hyper presale has already raked in over $31.2M, with a token price hovering around $0.0136751. Investors seem to be glancing past the regulatory ruckus and placing their bets on strong, long-term infrastructure plays. Smart cookies!

And guess what? This isn’t just retail action. Etherscan shows three whale wallets have splashed out a combined $1M in recent transactions. We’re talking about serious dough ($274K, $379.9K, $500K). Classic case of ‘when the going gets tough, the rich get going’!

The risk? Bridging two distinct architectures is like trying to merge water and oil. But the potential reward of unlocking Bitcoin’s gigantic $1T+ capital base for DeFi makes it worth the gamble. This could catapult $HYPER to the top of the food chain in 2026 and beyond!

Hit that buy button for $HYPER here!

Just a reminder: This content is for entertainment purposes only. Don’t go throwing your money around without doing your homework first. Crypto is wild-handle with care!

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- DeFi’s Wild Ride: From Yield Fever to Utility Sanity 🤠💰

- Whizz-Pang: The 75/25 Crypto ETF Circus Hits the S&P

- BTC’s $93k Gamble: A Bull Cycle’s Last Dance 🐆💸

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- Is XRP Being Silenced by Big Banks? The Shocking Truth Revealed!

2026-02-05 18:44