Prepare yourself, dear reader: what follows is not a tale for the faint of heart, nor for accountants who misplace their coffee. 🌄

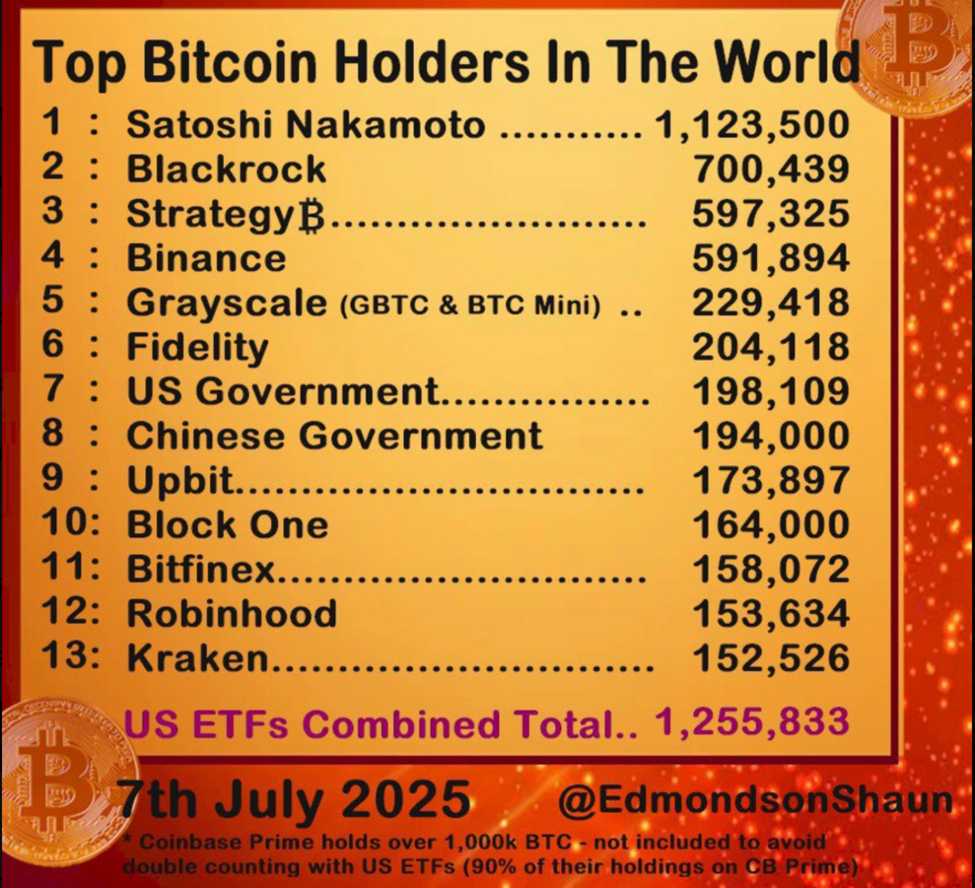

Somewhere in the gray morning, beneath the trembling leaves of Wall Street, the titans grind their teeth and shuffle digital coins like peasants shuffling rubles in the old days. Wordlessly, the invisible hand of BlackRock – that eternal clerk – sidles toward a prize so storied that even the mysterious Satoshi Nakamoto might be stirred from his cryptographic nap. Yes, with their diligent ETF IBIT, BlackRock is within a bare stroll of possessing more Bitcoin than the great Satoshi himself. Remarkably, not a single samovar was shattered in the process.

Forlorn Progress: BlackRock Is 62% Away From Outshining Satoshi’s Cold Wallet 🧐

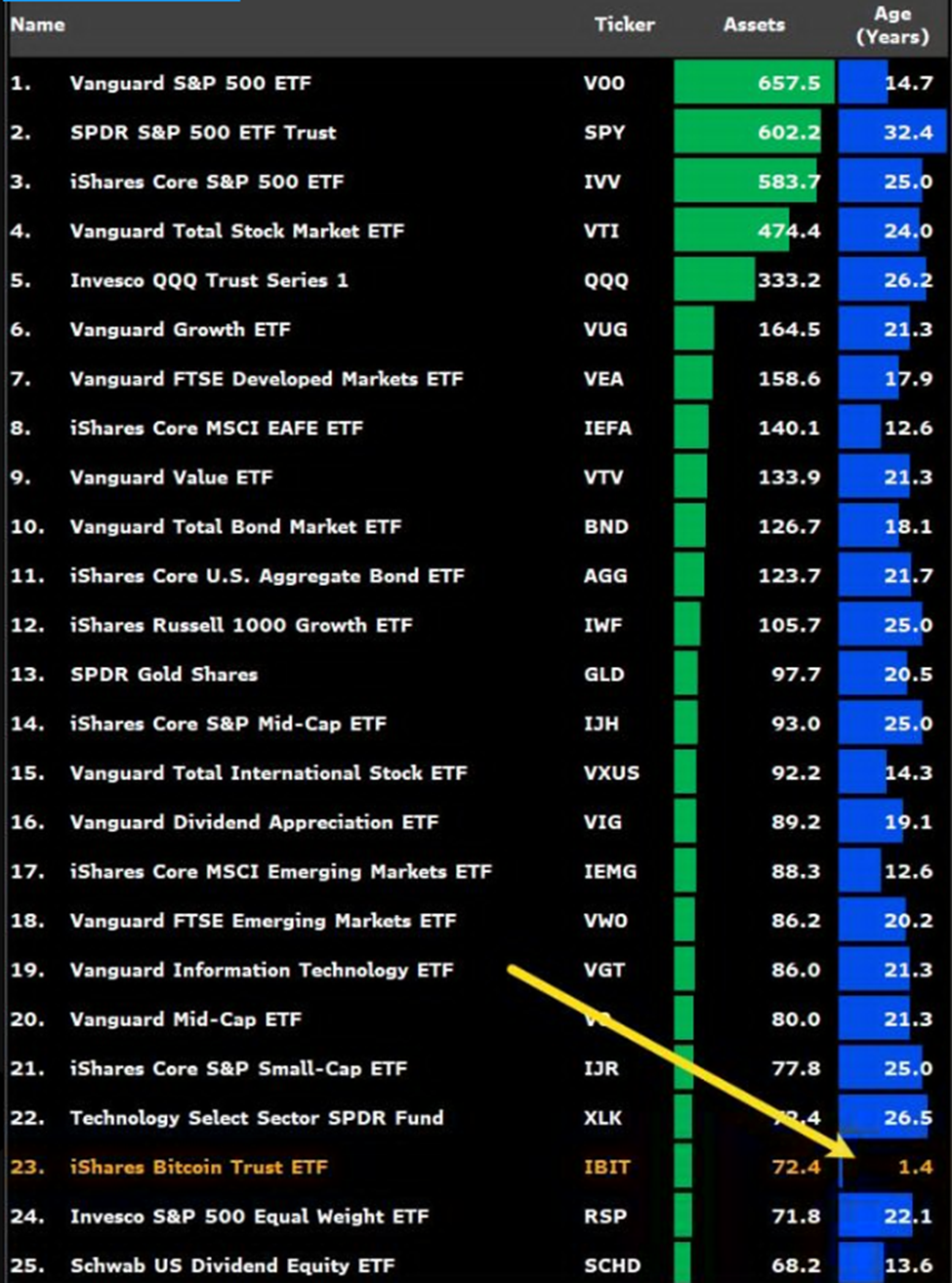

IBIT – BlackRock’s spot Bitcoin ETF – has now reached 700,000 BTC. Try saying that without spilling your tea. Analyst and self-appointed town crier, Eric Balchunas, seems rather pleased to announce BlackRock could soon one-up Satoshi as the chief Bitcoin hoarder among mere mortals.

“BlackRock holds 700,000 BTC now, and is 62% of the way there to passing Satoshi as world’s largest single holder of bitcoin,” writes Balchunas, presumably while polishing his monocle.

Satoshi’s stash, untouched and as solitary as an uncle in the attic, stands at an estimated 1.1 million BTC. Meanwhile, IBIT devours around 40,000 BTC per month – one could call that “enthusiastic nibbling.” If nothing changes (highly probable in the unpredictable world of finance), BlackRock will surpass Satoshi by May 2026, at which point IBIT will finally be old enough to have an existential crisis.

For those keeping track: yes, 1.4 years since launch and IBIT is rubbing elbows with the top 25 ETFs globally. Oh, to be so precocious at that age! 🍼

Balchunas, chronicler of ETF oddities, points out that IBIT is already BlackRock’s third-most profitable ETF—and just $9 billion shy of securing the coveted number one spot. Somewhere, a fund manager clutches their lapels and whispers, “But what about IWF?”

$IBIT is now the 3rd highest revenue-generating ETF for BlackRock out of 1,197 funds, and is only $9b away from being #1. Just another insane stat for a 1.5yr old (literally an infant) ETF. Here’s Top 10 list for BLK (aside, how about the forgettable $IWF at top spot, who knew?)

— Eric Balchunas (@EricBalchunas) July 3, 2025

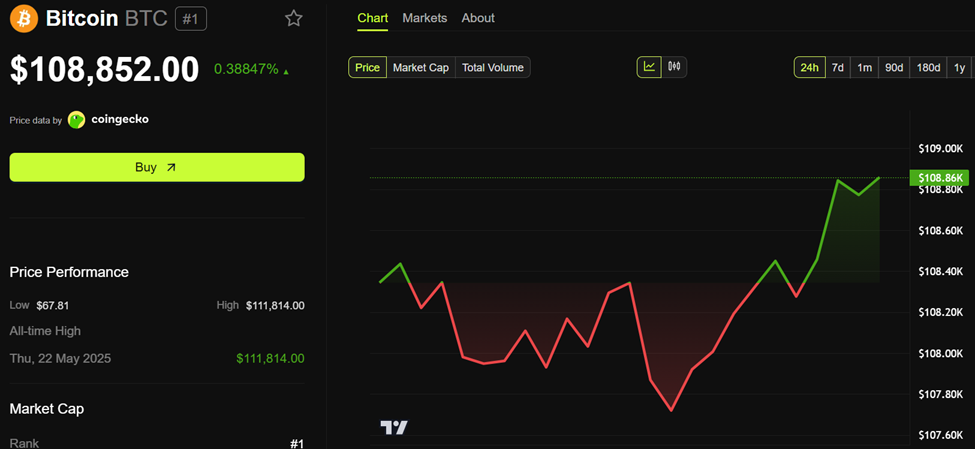

According to BeInCrypto (whose reporters probably tremble at the sight of a blockchain), IBIT has already overtaken BlackRock’s $624 billion S&P 500 fund in fee revenues. All this with Bitcoin trading at over $108,000, which frankly sounds made up, like prices for cabbage in 1918.

Other ETF providers have, collectively, already outdone Satoshi, but IBIT approaches that prize unaided, like a dog after someone else’s sausage. Such a feat would reinforce BlackRock’s iron grip – though to some purists, it may resemble an elderly aunt who insists on playing Chopin, but only knows one hand.

A chorus of anxious voices now arises, lamenting the irony: what began as a decentralised dream now sports a necktie and answers politely in quarterly earnings calls.

There once was a dream that was Bitcoin… this is not it.

ETFs

MSTR

Blackrock

Governments

“Institutional grade” custodians

— Hodlorado (@hodlorado) December 2, 2024

There are those who claim institutional control soothes Bitcoin’s notorious volatility: stability, they say, is like soup with too little salt—safe, but dull. Analyst IncomeSharks puts it more bluntly, presumably shaking his fist at the ticker tape:

“I still wish Bitcoin never got an ETF. It moves slower than most stocks and has lost its appeal to trade. We replaced exciting volatility with boring stability, just what the suits and institutions wanted,” analyst IncomeSharks announced, perhaps before hurling his abacus out the window.

So it is. Bitcoin’s largest wallet holders now dwell not in shadowy chatrooms, but behind the fortress-like desks of Wall Street. One wonders if Satoshi, wherever he may be (perhaps feeding pigeons in an urban park), laughs or sighs.

Meanwhile, in the subplot nobody asked for, Bitwise CIO Matt Hougan piped up, predicting up to $10 billion may soon flow into Ethereum ETFs in the second half of the year. The old world, it seems, is not going anywhere – but it is definitely buying more coins. 🪙

Chart of the Day

Byte-Sized Alpha

Chekhovian brevity: left for life’s mysteries to fill in.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 6 | Pre-Market Overview |

| Strategy (MSTR) | $395.67 | $400.04 (+1.10%) |

| Coinbase Global (COIN) | $357.10 | $361.30 (+1.18%) |

| Galaxy Digital Holdings (GLXY) | $19.69 | $20.20 (+1.58%) |

| MARA Holdings (MARA) | $16.75 | $16.99 (+1.43%) |

| Riot Platforms (RIOT) | $11.55 | $11.72 (+1.47%) |

| Core Scientific (CORZ) | $14.83 | $14.90 (+0.47%) |

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- BlackRock & Stablecoins: A Most Convenient Arrangement 🧐

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

2025-07-08 17:12