Bitwise Asset Management, with the solemnity of a Russian poet waxing lyrical about the first snow, has unveiled its “10 Crypto Predictions for 2026.” Prepare yourselves, dear readers, for a bullish odyssey fueled by ETFs, institutional gold-diggers, and regulatory hand-holding. The bulls, those eternal optimists, shall triumph over the bears, who are merely taking a well-earned siesta.

Bitwise Forecasts 10 Predictions as Bitcoin Decouples From Stocks and Follows Crypto-Specific Catalysts

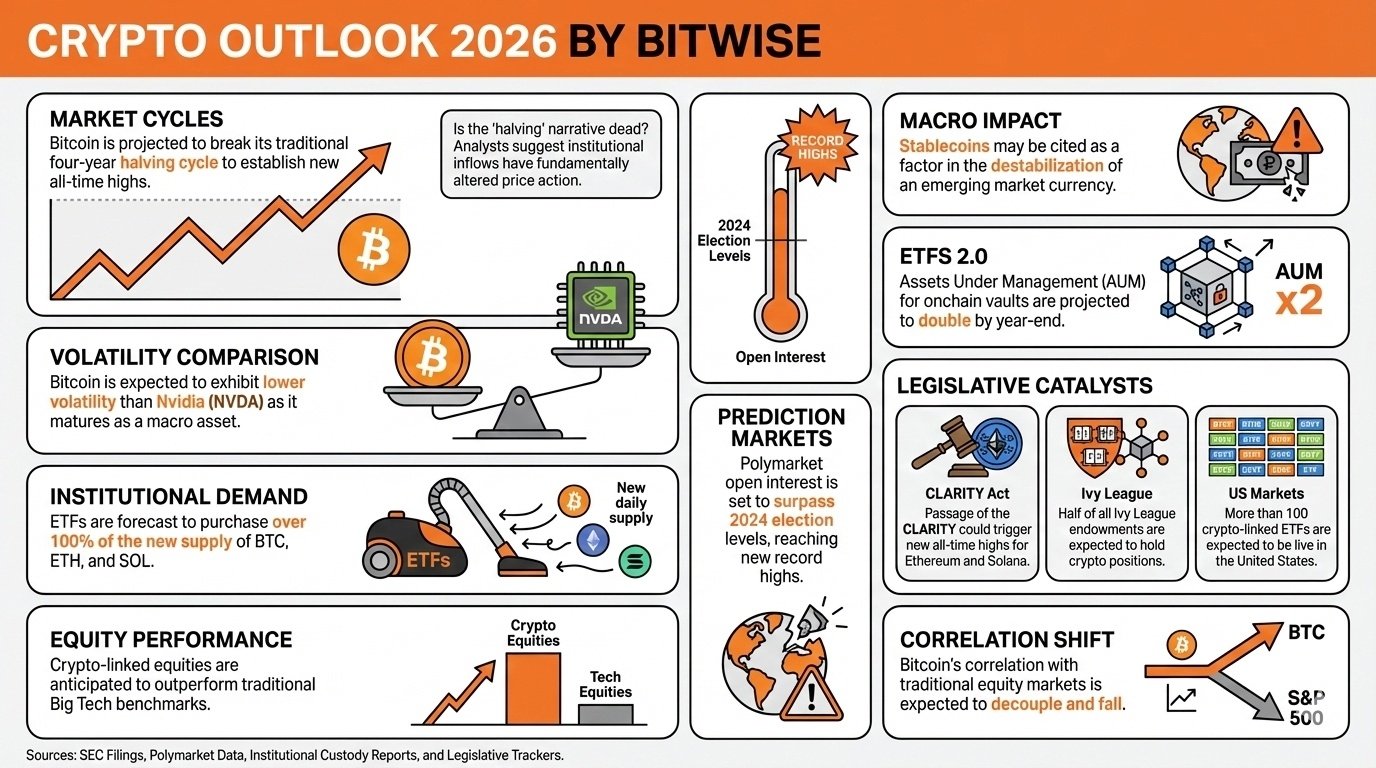

Bitwise Asset Management, that paragon of U.S. asset management, has published its “10 Crypto Predictions for 2026” report on Dec. 15, a document so bullish it makes a Siberian winter seem warm. Chief Investment Officer Matt Hougan and Head of Research Ryan Rasmussen, with the gravitas of Tolstoy dissecting peasant life, declare:

We think the bulls will win out in 2026. The prevailing positive trends, from institutional adoption to regulatory progress, appear too strong and too far-reaching to be subdued for long.

The first prediction, as dramatic as a Dostoevsky monologue, proclaims: “Bitcoin will break the four-year cycle and set new all-time highs,” as if Bitcoin has finally grown up and traded its wild teen years for a tailored suit. The second prediction states that bitcoin will be less volatile than Nvidia, a claim that makes one clutch their pearls. The third prediction projects ETFs gobbling up 100%+ of new bitcoin supply, alongside ethereum and solana, creating a supply-demand imbalance so profound it could make a economist weep. The report adds:

One of the primary reasons we’re bullish on crypto in the long term is that we think demand from institutional investors will outpace new supply for years to come.

The remaining seven predictions, with the theatrical flair of a Chekhov play, expand on Bitcoin’s future. Prediction four: crypto equities will outperform tech equities, as if stocks had taken a backseat to a new cast of characters. Prediction five: Polymarket open interest will hit stratospheric heights, surpassing even the 2024 election frenzy. Prediction six: Stablecoins will be blamed for destabilizing an emerging-market currency, a twist so absurd it could star in a satire. Prediction seven: Onchain vaults, “ETFs 2.0,” will double assets under management, because nothing says innovation like adding “2.0” to everything. Prediction eight: Ethereum and solana will reach new highs if the CLARITY Act passes, a regulatory dream so sweet it could make a bear blush. Prediction nine: Half of Ivy League endowments will invest in crypto, because nothing says “prestige” like allocating funds to a digital ledger. Prediction ten: Over 100 crypto-linked ETFs will launch in the U.S., because why not? A bonus prediction: Bitcoin’s correlation with stocks will fall, as if it’s finally learning to walk on its own two feet.

FAQ 🧭

- Why is Bitwise bullish on bitcoin heading into 2026?

Bitwise believes Bitcoin, once a tempestuous youth, now matures into a staid patriarch, buoyed by institutional adoration and regulatory hand-holding. The four-year cycle, that old nemesis, has been vanquished by ETFs and a collective shrug at volatility. 🤷♂️ - How do ETFs impact bitcoin’s supply-demand outlook?

ETFs, those modern-day saviors, will consume more than 100% of new BTC supply, creating a supply-demand imbalance so severe it could make a economist weep. 🧮 - What regulatory developments matter most for crypto investors?

The CLARITY Act, that beacon of hope, could unlock a treasure trove of products and boost crypto equities. Regulatory clarity, it seems, is the new black. 👗 - What signals growing institutional acceptance of crypto?

Half of Ivy League endowments and 100+ crypto ETFs launching? That’s not just acceptance-it’s a full-blown love affair. 💍

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- BNB: To $1,000 or Total Chaos? 🤯

- Circle’s Amazing €300M Milestone with EURC! 🌍💸

- XRP Price Tale: The River That Rises

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- Larry David on Pakistan & Kyrgyzstan’s Crypto Love Affair 🤦♂️

- How Trump Turned Bitcoin into a Shooting Star & Made Shorts Cry 😜🚀

2025-12-25 04:04