BitMine ($BMNR) startled the cosmos on an otherwise indolent Monday, scorching upward a vertiginous 700%—or, as the ancients might have called it, “to moon and back twice”—after anointing Fundstrat’s Tom Lee as Chairman. The maestro’s baton hardly touched the podium before the company declared intentions to rustle up $250 million for a madcap Ethereum treasury offensive. Forget Satoshi—are we witnessing the emergence of MicroStrategy’s doppelgänger, clutching ETH instead of BTC? 💸🎩

BitMine Dons Its Ethereum Tuxedo (with a Neon Tie, Naturally)

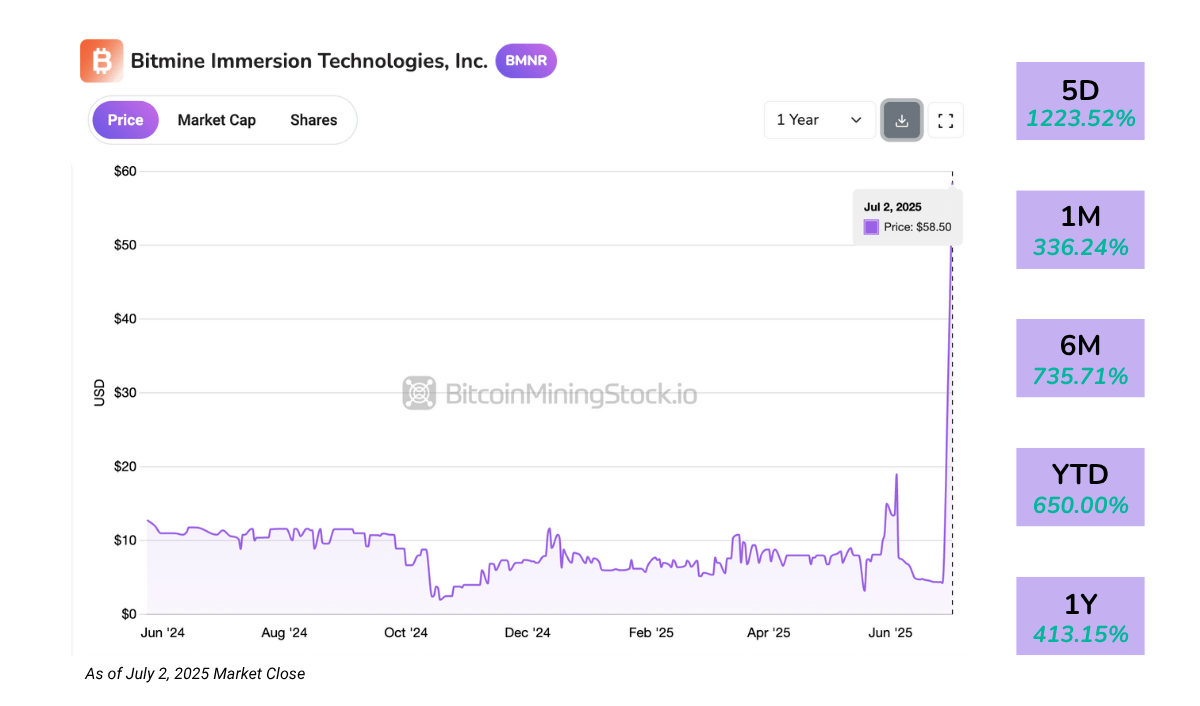

BitMine Immersion Technologies (NYSE American: BMNR) has lately become the Rorschach test of finance bros and crypto kittens alike—a stock that, as of Monday, pirouetted 700% in a single day. The trigger? The enlisting of Tom Lee, that zigzagging oracle of Wall Street, who now occupies the Chairman’s plush seat. What next—Jim Cramer as court jester?

BitMine has since announced a $250 million ethereal (pun intended) capital raise to turn its treasury into a temple of Ethereum, setting its sights on becoming the planet’s #1 public ETH hoarder. The sort of plan that compels one to check if management attended board meetings sober. 🤔

The landscape wiggles beneath their feet. Bit Digital (NASDAQ: BTBT) has tiptoed out of the sooty halls of Bitcoin mining, reinventing itself as a bonafide Ethereum maximalist. Unlike Bit Digital, BitMine can’t quite break up with Bitcoin—it’s more of a dysfunctional crypto love triangle now, with ETH invited to dinner.

BitMine’s metamorphosis comes mere nanoseconds after its NYSE American debut. The real question: Is this the start of something epochal, or just another episode in the perennial miniseries “Stocks Behaving Badly”?

Company Overview: Or, How to Mine Bitcoin and Still Sleep at Night

BitMine bills itself a “Bitcoin Network Company.” This presumably means anything remotely blockchain-y is fair game: self-mining, synthetic hash rate contracts, Mining-as-a-Service, crypto advisory, and—if you blink—delivering pizza with AI drones. 🍕🤖

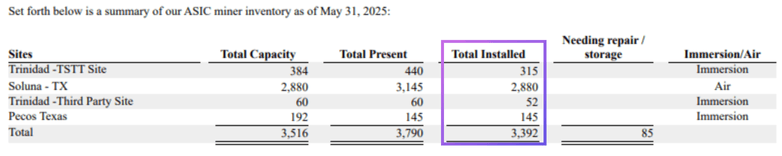

Based in the US, it operates a quintet of mining outposts (mostly Texas, Trinidad & Tobago), but with a fleet of 3,392 ASIC miners as of May 2025, it’s barely a minnow among the blockchain sharks—closer to a digital guppy, really.

Hash rate? Shrouded in mystery. By back-of-the-envelope math, using those Antminer S19/S21 trinkets, BitMine might manage 0.5–0.7 EH/s. Or, as they say in Texas, “bless your heart.”

They’re not just mining for themselves—BitMine rents out hash power to institutions too, via a $4 million deal signed this year. Synthetic mining, they say! (Translation: “You get the bitcoin, we keep the depreciation.”)

Lately, BitMine has pivoted to Bitcoin treasury consulting—a logical step if you enjoy explaining crypto accounting to CFOs until one of you weeps.

Led by CEO Jonathan Bates (ex-JP Morgan, unemotional), supported by CleanSpark’s former CFO and, now, Tom Lee. The cocktail napkin pitch: “Wall Street brains, dreams bigger than our hash rate!”

Financial Highlights: Excel Sheets that Scream (and Sigh)

Q2 FY2025 enters stage left. Revenues: $2.05 million (double last year’s numbers, cue polite applause). The main hero? Leases, which make up more than half the revenue pie. Even delivered gross margin of ~36.2%—a rare moment of fiscal sanity.

Self-mining returns? $813k revenue versus $785k in brute costs—yes, that paltry margin means the mere thought of plugging in another rig might bankrupt the company. In fact, BitMine’s self-mining gross margin (3.4%) is so wafer-thin you could use it as tracing paper.

Mining one Bitcoin reportedly costs $25,182.59 (energy alone) or $75,336.43 (full horror show). The power rate—$0.0180/kWh. Not for the faint of heart, or wallet.

Equipment sales: humming along at $129k with a 36.2% margin. Consulting—tiny as a mouse but with a lion’s margin (78.6%!). BitMine, you might just make a living lecturing the naive, if all else fails.

Hosting revenue was absent this quarter. Missing: presumed reclassified, like an embarrassing tattoo covered by a blazer.

Balance Sheet & Liquidity: The Wallet, Naked and Afraid

Total assets: $8.26 million (a 75% YoY leap), spurred by a 195% leap in cash. Crypto holdings at $173k—a rounding error for any self-respecting degen. Liabilities, on the other hand, are shy creatures: just $396k. Liquidity ratios hover near 4x, enough to impress that one guy in your group chat who really, really likes spreadsheets.

But stockholders’ equity fell almost 30% the past year, as the accumulated deficit—a phrase everyone hates—continued its creeping growth. Paid-in capital is up, suggesting outside investors still enjoy the party. Retained earnings? Not so much—nobody likes to hang around after the lights come up.

BitMine’s glitzy valuation (as of May 31, 2025):

- Market Cap: ~$397 million—enough to buy, perhaps, a small city in the Midwest.

- Enterprise Value: ~$384.5 million

- EV / Revenue (TTM): ~80.6x (Wall Street, please avert your gaze.)

- P/S: ~83.2x—an excellent number if you’re a magician, less so for mortals.

- Crypto Holdings / Market Cap: 0.04%. Even your dog’s meme coin portfolio is meatier.

P.S. Our heroic calculations do not yet account for BitMine’s new stacks of BTC, its wannabe-MicroStrategy ETH war chest, or the dizzy heights its stock hurled itself toward. Stay tuned, amateur sleuths.

Ethereum Treasury: Chasing MicroStrategy’s Shadow (on Roller Skates)

//static.news.bitcoin.com/wp-content/uploads/2025/07/screen-shot-2025-07-03-at-2-01-48-pm.png”/>

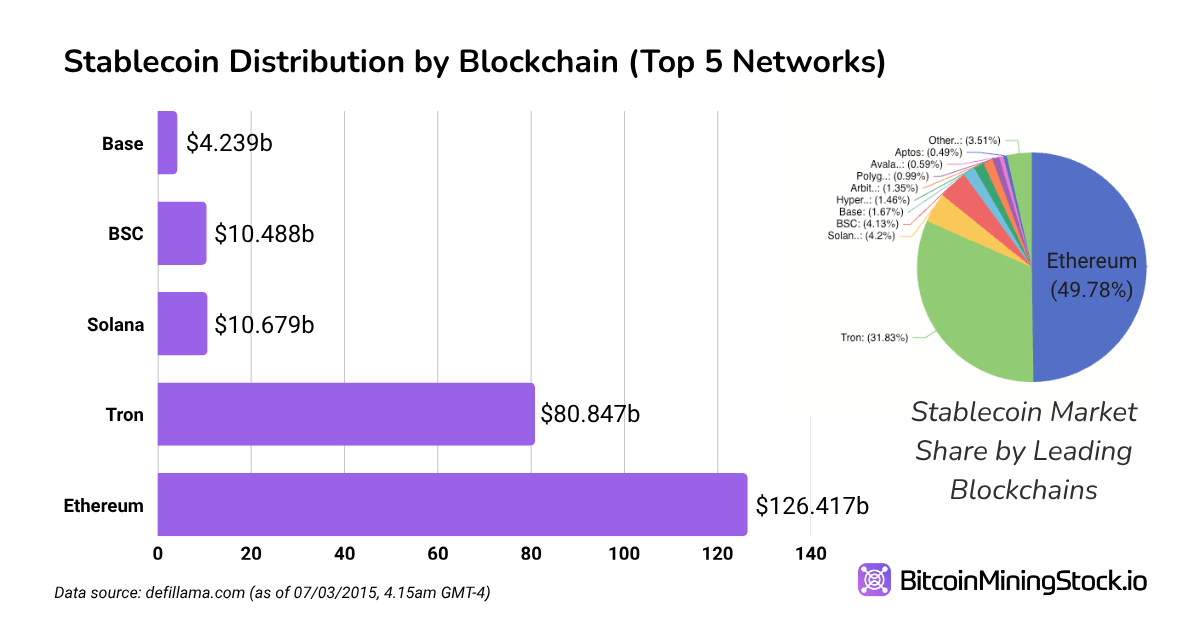

The U.S. Treasury—always the life of the party—says stablecoins could grow from $250 billion today to $2 trillion. If true, Ethereum will become the Nasdaq of digital assets, at least until the next congressional hearing. Infrastructure! Rails! “The pipes beneath civilization!”… as all great marketers whisper in the dark.

BitMine is openly trying to run the same playbook as MicroStrategy, only with ETH. They’ll build up an ETH hoard, and—here’s the twist—track ETH per share. Buy the equity, get a whiff of ETH. (No refunds if you sneeze.)

Other companies chasing this pipe dream: SharpLink Gaming and DeFi Development Corp. Of course, anything that isn’t BTC brings regulatory headaches—something the lawyers will explain, for a fee, at your next quarterly loss.

Punchline: Is BitMine Actually Just a PowerPoint Deck?

Let’s be direct. No one’s buying BitMine for its clattering racks of miners. They’re buying a wisp of hope—a story that maybe, one day, this modest minnow will transform into Ethereum’s MicroStrategy. Less than 4,000 ASICs scattered across five sites is hardly thrilling. Yet at $50 per share, BitMine trades above household names like MARA, IREN, or CLSK, all while bringing in a measly $6 million in trailing revenue. If that isn’t a setup for a classic retrace, I’ll eat my hardware wallet.

BitMine aspires not to be just another sooty, clattering miner. It wants to become a capital markets platform for Bitcoin and Ethereum—think Goldman Sachs but with more emojis and fewer dress codes. Its $250 million private round is bankrolled by the likes of MOZAYYX, Founders Fund, Pantera, FalconX, Republic Digital, Kraken, Galaxy Digital, DCG, and other acronyms you’re supposed to be impressed by.

The Ethereum “treasury as reserve asset” thesis rides the wake of Circle’s IPO and has a certain spritely optimism. Should ETH wind up as the corporate treasury darling, BitMine could become the levered phenom of the sector. If not—well, we’ll always have Monday’s price chart.

The Ethereum play, however, is still a Rube Goldberg contraption. Execution is a question mark the size of Musk’s ego. But if BitMine pulls it off, there’s a decent chance the company outgrows its current reincarnation as a glorified press release.

BitMine is aiming for MicroStrategy glory with Ethereum—glittering rewards, and all the peril of trying to skate on a volatile, digital lake. The risk, naturally, is included for free. 🛼💥

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- XRP Staking: A Tale of Tension and Tokens 🚀

- XRP Price Tale: The River That Rises

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- BNB: To $1,000 or Total Chaos? 🤯

2025-07-05 21:29