Well, buckle up, folks, because Bitcoin is about to do its best impression of a caffeinated squirrel on a unicycle. With the biggest options expiry of the year looming like a storm cloud over a picnic, and the Fed meeting breathing down its neck, our favorite cryptocurrency is teetering on the edge of a $90,000 precipice. Spoiler alert: it’s either going to soar like a rocket or crash like a toddler on a tricycle. Either way, it’s going to be entertaining.

Key Takeaways (Because Who Has Time for Nuance?)

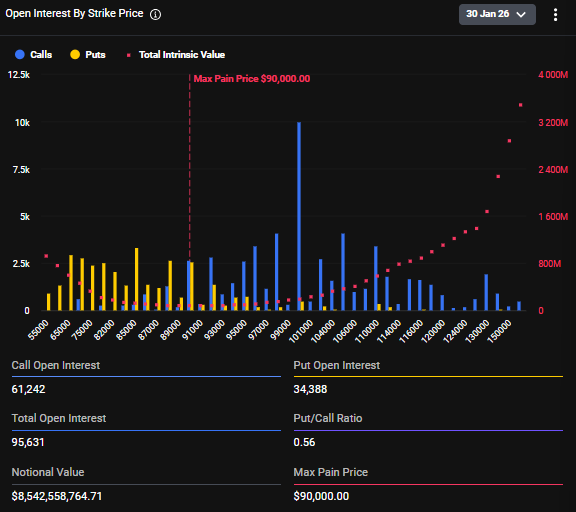

- $8.53 billion in Bitcoin options are expiring this week-more money than I’ve seen in my entire life.

- Call options are stacked at $100,000 like teenagers at a Black Friday sale, while puts are lurking at $85,000 like vultures.

- Max pain is at $90,000, which sounds like the title of a bad thriller but is actually where option sellers high-five each other.

- Short-term price action will be driven by hedging flows and dealer positioning, which is just a fancy way of saying “chaos.”

How Options Positioning Can Move Bitcoin’s Price (Or: Why You Should Care About This Nerdy Stuff)

Apparently, when options expire, market makers start hedging like it’s going out of style. If Bitcoin flirts with $100,000, dealers who sold calls might buy Bitcoin to cover their backsides, sending the price higher. Conversely, if it dips toward $85,000, they’ll hedge like it’s the apocalypse, dragging the price down. It’s like a financial game of Whac-A-Mole, but with more zeros.

Then there’s the “max pain” level at $90,000, which is where the most options expire worthless. It’s like the financial equivalent of a participation trophy-nobody wins, but everyone feels slightly disappointed. Historically, Bitcoin loves to hover around this level, because why make a decision when you can just sit on the fence?

Investors, of course, are using this information to position themselves for volatility, which is just a polite way of saying they’re panicking. Reduced leverage, tighter risk management, and directional trades are all the rage, because who doesn’t love a good rollercoaster?

Technical Structure: What the Chart Is Signaling (Or: How to Pretend You Know What You’re Talking About)

Bitcoin is currently chilling around $90,100, clinging to a support zone like a cat on a windowsill. The RSI is at 68, which means buyers are feeling frisky but might need a nap soon. The MACD is positive, but momentum is flattening, which is basically the financial version of “I’m fine, but I’m also tired.”

Volume is moderate, which means everyone’s waiting for something to happen. My money’s on the options expiry, but honestly, it could be anything-a tweet from Elon Musk, a sudden craving for pizza, who knows?

What Investors Are Watching After Expiry (Or: The Financial Version of ‘What Happens Next Will Shock You!’)

Once the dust settles, there are two likely scenarios. If Bitcoin holds above $90,000 and reclaims the $92,000-$94,000 zone, dealers might unwind their hedges, paving the way for a momentum push toward $100,000. On the other hand, if it dips below $88,000-$89,000, we could see a freefall to $85,000, where the puts are waiting like a pack of hungry wolves.

The smart money? Expect volatility, respect key levels, and wait for confirmation. Because, as we all know, the most decisive trends happen when you least expect them-like right after you’ve decided to take a nap.

Oh, and let’s not forget the Fed rate decision, which is like the elephant in the room but with a suit and tie. If Jerome Powell so much as sneezes, the markets will react like it’s the end of the world. So, you know, just another day in crypto.

Disclaimer: This article is for entertainment purposes only. If you’re taking financial advice from a sarcastic rewrite, you’ve got bigger problems than Bitcoin’s volatility. Always do your own research and consult a professional-preferably one who doesn’t write like me.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- XRP: A Most Disappointing Turn of Events! 📉

- Dogecoin’s Rise: A Thrilling Dance Between Support and Resistance!

- Bitcoin Breaks Trendline? 94% Rate Cut Odds! 🚀

- XRP’s Wild Ride: To the Moon or Just a Bit Bouncy? 🚀

- Gold-Backed Crypto Coins Land on Polygon – But Why? 🤔💰

- 🤑 Rich Dad, Poorer BTC: Kiyosaki Dumps Crypto for Scalpel & Billboards! 🏥🚀

- India’s Crypto Users Are Finally Diversifying (And It’s Hilarious)

- Crypto Leverage: Uh Oh ⚠️

2026-01-28 20:24