On this rather ordinary Sept. 9, 2025, bitcoin is gallivanting around $112,569, boasting a market cap of $2.24 trillion and a 24-hour trading volume of $39.50 billion. One might say it’s a genteel frolic between $111,200 and $113,226, with investors twitching like debutantes at a dance, cautiously optimistic yet horrified at the slightest misstep.

Bitcoin

The 1-hour chart for bitcoin exhibits the sort of whimsical behavior only a digital asset can muster. After peaking at $113,279, it recoils, showing faint bearish pressure that resembles a cat swatting a mouse-slightly menacing but ultimately ineffective. Micro support clings near $110,624, while eager buyers attempt to ascend higher, perhaps imagining a chandelier of gold at $114,000. Intraday resistance is visible between $113,200 and $113,500, a veritable glass ceiling if ever there was one.

Turning to the 4-hour chart, bitcoin seems determined to uphold a higher low and higher high structure, as if insisting on climbing a metaphorical stairway while occasionally tripping over its own ledger. A local bottom at $109,343 has rebounded to $113,402, spurred on by bullish candles that puff out their chest with dramatic volume. A bullish engulfing candle near $111,500 presents a charming opportunity for re-entry-think of it as a polite invitation to the ball. Pullbacks between $111,500 and $112,000 are ideal, with stops tucked discreetly below $110,000.

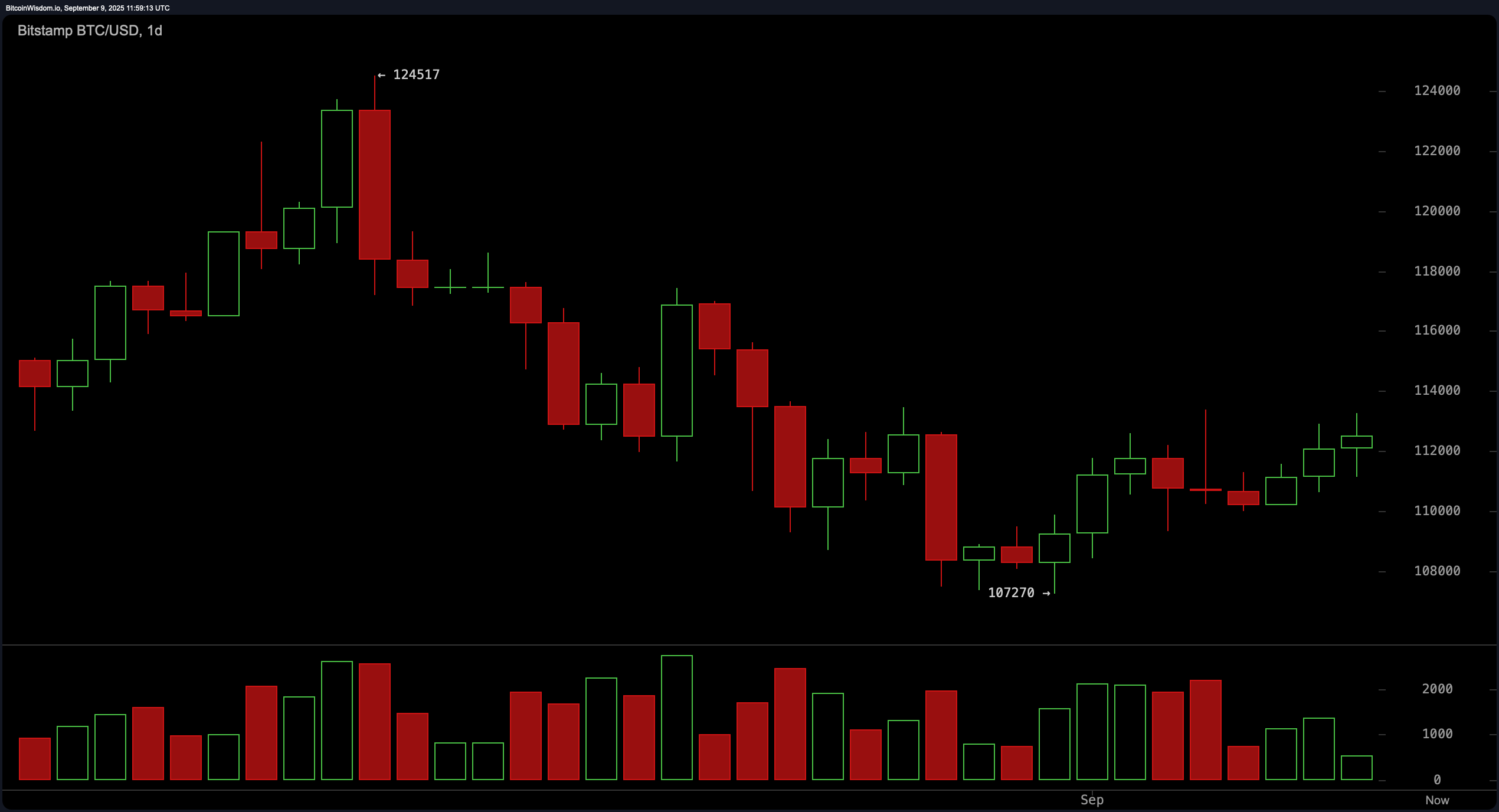

On the daily chart, bitcoin recovers from a tumble reminiscent of a disgraced aristocrat, falling from $124,517 to $107,270 before attempting to regain some dignity. The price forms a bullish staircase, ascending with carefully measured pomp. While the daring entries near $110,000 have passed like last season’s hats, patience suggests waiting for a daily close above $113,500. Key resistances wink at $114,000-$115,000, with the mighty $120,000-$124,000 looming like a distant palace.

Technical indicators, ever the party-poopers, suggest cautious optimism. The RSI at 50.5, Stochastic at 74.9, CCI at 43.3, ADX at 14.9, and Awesome oscillator at −2,511.1 collectively whisper, “Perhaps… maybe…” Yet momentum at 3,777.0 and MACD at −961.4 add a sly nod toward upward potential. 🍸

Moving averages offer their own genteel gossip. Short-term EMAs and SMAs flirt with bullishness between $110,799.4 and $111,941.4, while the 30-day SMA sulks at $113,518.7. Long-term support rests comfortably below current levels, suggesting a strong constitution amidst volatile theatrics. Resistance awaits at the 50-day EMA and SMA, peering down from $112,950.7 and $114,831.5 like overbearing aunts.

Bull Verdict:

If bitcoin elegantly vaults above $113,500 with proper volume, the uptrend may pirouette with gusto. Higher lows across charts and robust momentum hint at further ascents to $114,000-$124,000, as if reaching for a chandelier of unclaimed fortunes.

Bear Verdict:

Should bitcoin stumble below $113,000 and fail to hold, the rally may collapse like an ill-constructed soufflé. A descent below $111,000 could expose it to renewed pressure, with potential retreats toward $109,000 and the venerable $107,000 support-poor creature, caught between hope and panic. 😬

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Steinbeck’s Take on Dogecoin’s Wild Ride 🐶🚀

- ETH PREDICTION. ETH cryptocurrency

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

2025-09-09 16:14