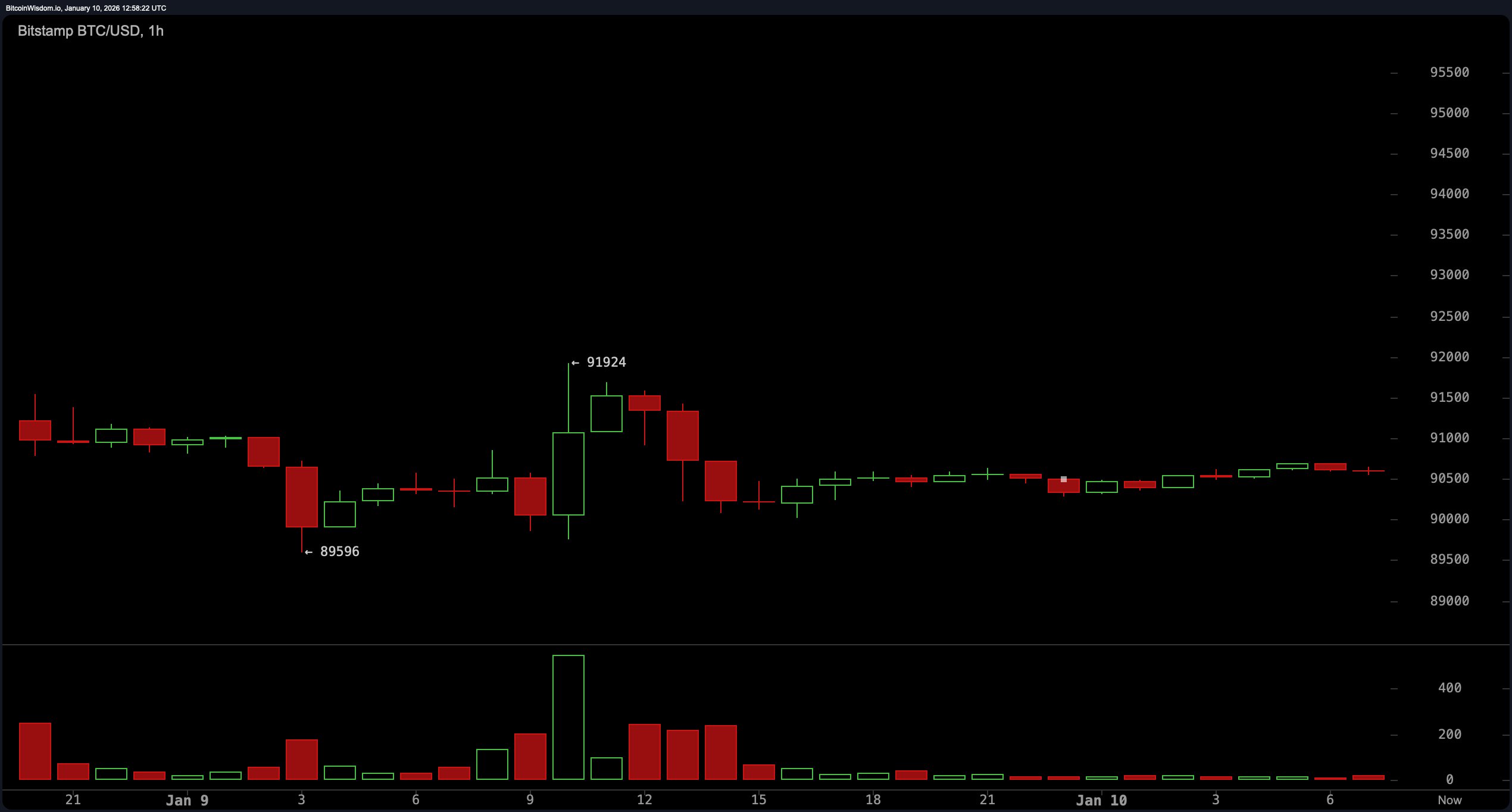

Ah, the great Bitcoin, once the fiery steed of the financial revolution, now trots along with the grace of a weary plow horse. With a 24-hour trading range between $89,596 and $91,924, and a current price of $90,617, it delivers not a roar, but a yawn so profound it could rival Tolstoy’s descriptions of Russian winters. Its $1.8 trillion market cap and $32.66 billion in trading volume suggest the world still cares-but cares like a distant relative at a family reunion, polite yet detached. Interest, alas, is not momentum, and momentum, my dear reader, is as absent as a moral compass in a novel by Dostoevsky.

Bitcoin Chart Outlook 🧐📉

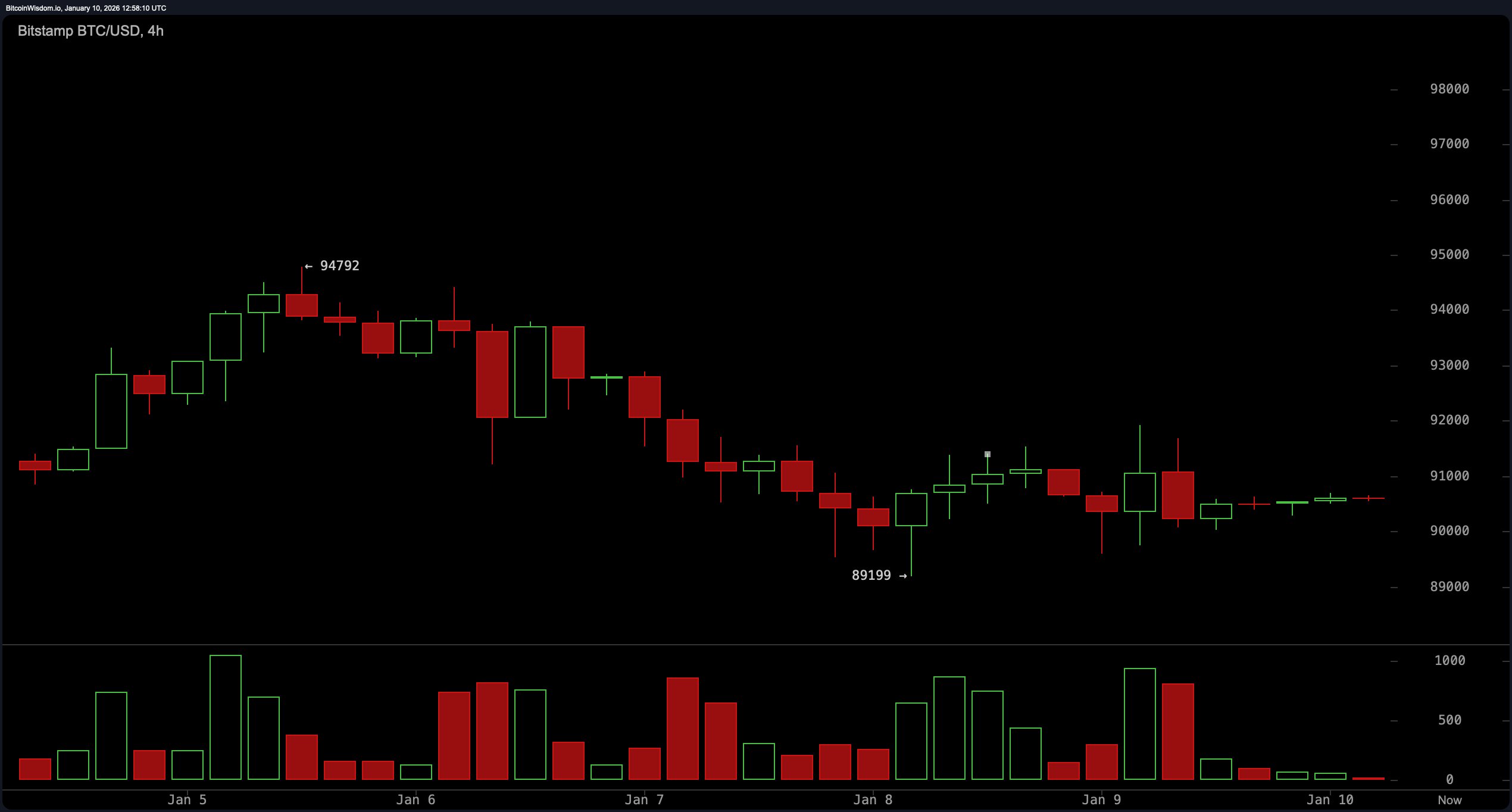

The daily chart, a tragic hero in this financial drama, reads like the final pages of a sprint turned marathon. Bitcoin, once charging from $84,398 to $94,792, now lies gasping for breath, its recent three-day pullback a testament to the fickleness of fortune. The price, trapped in a holding pattern around $91,000, resembles a nobleman pondering his next move in a game of chess-only to realize the board is missing pieces. Declining volume during this retreat, unusually high, is the harbinger of bearish doom, a textbook sign that even the candles are losing their wick.

That candle, caught between hesitation and exhaustion, is the very embodiment of indecision. Traders, those modern-day peasants seeking riches, must now await a strong close above $92,000-ideally with volume as their trusty squire-before dreaming of another assault on the $94,000 to $95,000 resistance ceiling. Until then, they are but spectators in a theater of the absurd.

Zoom into the 4-hour chart, and the optimism, once as vibrant as a spring morning in Moscow, begins to peel away like old wallpaper. Bitcoin drifts sideways in the $90,000 to $91,000 pocket, its price structure hinting at a bear flag-a consolidation, not a celebration. Volume on green candles, as underwhelming as a lukewarm borscht, signals that buyer enthusiasm is either lost or terribly misjudged. A decisive breakdown below $90,000 could open the gates to a re-test of the $88,500 to $89,000 support zone, especially if volume decides to join the bearish choir.

The 1-hour chart, a microcosm of this financial farce, tells the tale of a market stuck in a revolving door. Bitcoin, rangebound between $90,500 and $91,500, makes intraday attempts at breakout only to be swiftly rejected, like a suitor at a ball who cannot find a dance partner. Volume, as lifeless as a forgotten manuscript, and volatility, on an extended smoke break, create an environment fit only for the nimblest of scalpers. Micro-opportunities lurk, but conviction is as scarce as a happy ending in a Tolstoy novel.

Oscillator readings, those modern oracles, echo this ambivalence. The RSI at 52, Stochastic at 50, and CCI at 45 all flash neutral, like a shrug in mathematical form. The ADX, at 24, confirms a lack of trend strength, while the Awesome Oscillator meanders near 1,941 with no clear direction. The momentum indicator at 3,101 and the MACD at 509 lean bullish, but without confirmation, they are but whispers in the wind.

As for moving averages (MAs), it’s a tug-of-war worthy of a Tolstoy epic. Short- and mid-term EMAs and SMAs split between upward and downward trends: the 10-day averages flash red, while the 20-day and 30-day lean green. Longer-term indicators, however, are decisively bearish-the 100-day and 200-day averages are deep in red territory, suggesting the macro trend is cooling off despite near-term stabilization. It’s a sideways shuffle, and until Bitcoin clears $92,000 or cracks below $90,000, the charts demand patience, not predictions.

Bull Verdict: 🐂🚀

If Bitcoin can reclaim $92,000 with conviction and volume, short-term momentum might return, setting the stage for a retest of the $94,000 to $95,000 range. Support from mid-term moving averages and bullish signals from the momentum indicator and MACD offer some tailwinds-assuming the bulls can stay awake and not succumb to existential dread.

Bear Verdict: 🐻❄️

With price action stuck beneath key resistance and a potential bear flag brewing on the 4-hour chart, Bitcoin risks slipping below the $90,000 mark. Weak volume on upticks and bearish pressure from long-term moving averages suggest the recent uptrend is cooling off-and a descent toward $88,500 may be back on the menu, served cold.

FAQ ❓

- What is Bitcoin’s current price?

As of 8:45 a.m. Eastern time, Saturday, Jan. 10, 2026, Bitcoin is priced at $90,617. 💰 - Is Bitcoin in an uptrend or downtrend?

Bitcoin is currently consolidating after a recent uptrend, showing signs of short-term indecision. 🧘♂️ - What is Bitcoin’s trading range today?

The 24-hour price band is between $89,596 and $91,924. 📏 - What are key Bitcoin support and resistance levels?

Support sits near $90,000, while resistance stands around $92,000 to $95,000. 🛡️⚔️

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Larry David on Pakistan & Kyrgyzstan’s Crypto Love Affair 🤦♂️

- TAO PREDICTION. TAO cryptocurrency

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- XRP Staking: A Tale of Tension and Tokens 🚀

2026-01-10 17:00