As Bitcoin (BTC) sits around a sluggish $113,000, Ethereum (ETH) is flexing its muscles, leaving Bitcoin looking like the slow kid in a race. Investors, ever the opportunists, are starting to think: “Maybe it’s time to swap that old, tired BTC for some of that fresh ETH juice.”

Bitcoin is Stagnant – Can ETH Save You From The Slump?

According to the wise folks at XWIN Research Japan, Bitcoin’s on-chain data is giving off some serious “something’s wrong here” vibes. Meanwhile, Ethereum is out here like an athlete in peak form, running ahead of the pack. Even as the broader crypto market loses steam, ETH is standing strong. It’s the underdog who just might win the race.

Bitcoin’s exchange reserves are sitting at a nice, fat 2.53 million BTC. But here’s the catch: they aren’t shrinking. Normally, falling reserves mean less BTC for sale and less sell pressure. But guess what? They’re holding steady, which means a whole bunch of Bitcoin is still just chilling, ready to be dumped onto the market at any moment.

And just to rub salt in the wound, Bitcoin’s price has dropped from $123,000 to $113,000. Talk about a red flag! Could a correction be on the horizon? Looks like it. Meanwhile, Ethereum’s got its own groove going on.

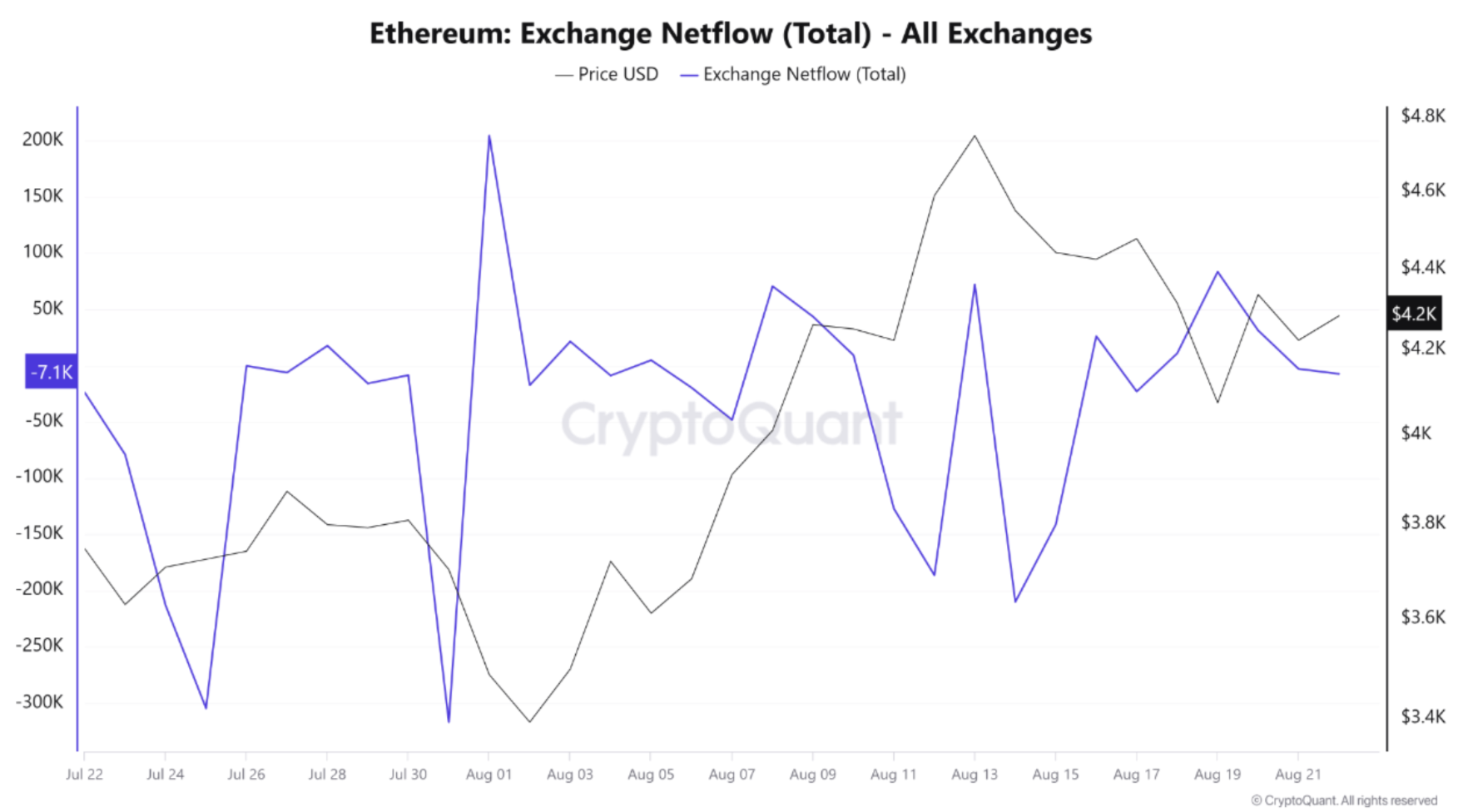

ETH, on the other hand, is all about those big net outflows. Huge chunks of ETH are moving off exchanges, most recently over 300,000 ETH at the end of July and again in mid-August. So what does that mean? Well, when coins leave exchanges, it usually means people are holding tight, staking, or sending them to cold storage. Either way, it signals less supply available for sale, which makes ETH’s price look like it could go up. 😎

As XWIN Research Japan puts it: “Outflows reflect coins moving into cold storage, staking, or institutional custody. ETH’s price staying between $4,150 and $4,400 is a sign that a supply shock could be on the way.”

So, while BTC is sitting on its hands with plenty of sell-side liquidity, ETH’s declining exchange balances are sending the opposite signal: institutional investors are getting hungry. Is capital shifting from BTC to ETH? It’s starting to look that way.

Bitcoin and Ethereum: A Battle of the Ages (Well, Almost)

Beyond just exchange reserves, the broader trends also favor Ethereum. One crypto analyst, Xanrox, dropped the bomb that Bitcoin could crash all the way down to $60,000-yes, you heard that right, a potential 50% drop. Ouch.

Meanwhile, Ethereum whales are like “Bitcoin who?” as they load up on ETH like there’s no tomorrow. Yesterday, one whale dropped $300 million on ETH in one fell swoop. And honestly, who can blame them? ETH’s looking solid with a potential price recovery to $4,788, while Bitcoin’s wobbling at $112,283, down a measly 0.7% in the last 24 hours.

Read More

- Brent Oil Forecast

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- DOGE PREDICTION. DOGE cryptocurrency

- Cronos Rises as Crypto Markets Crumble! 💸📉

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Crypto Crystal Ball: What Experts Are Really Predicting for Bitcoin & Friends! 📈✨

2025-08-23 01:18