Ah, Bitcoin (BTC), that fickle muse of the modern age, has been on a downward spiral since its august heights of $123,731 on August 14. In the weeks that followed, it shed nearly 10% of its value, like a nobleman losing his fortune at the roulette table. 🃏

Now, with the leading coin trading beneath $110,000, and considering its historical penchant for September melancholy, the outlook appears as dreary as a Russian winter. ☠️

September: The Month When Bitcoin’s Heart Turns Cold ❄️

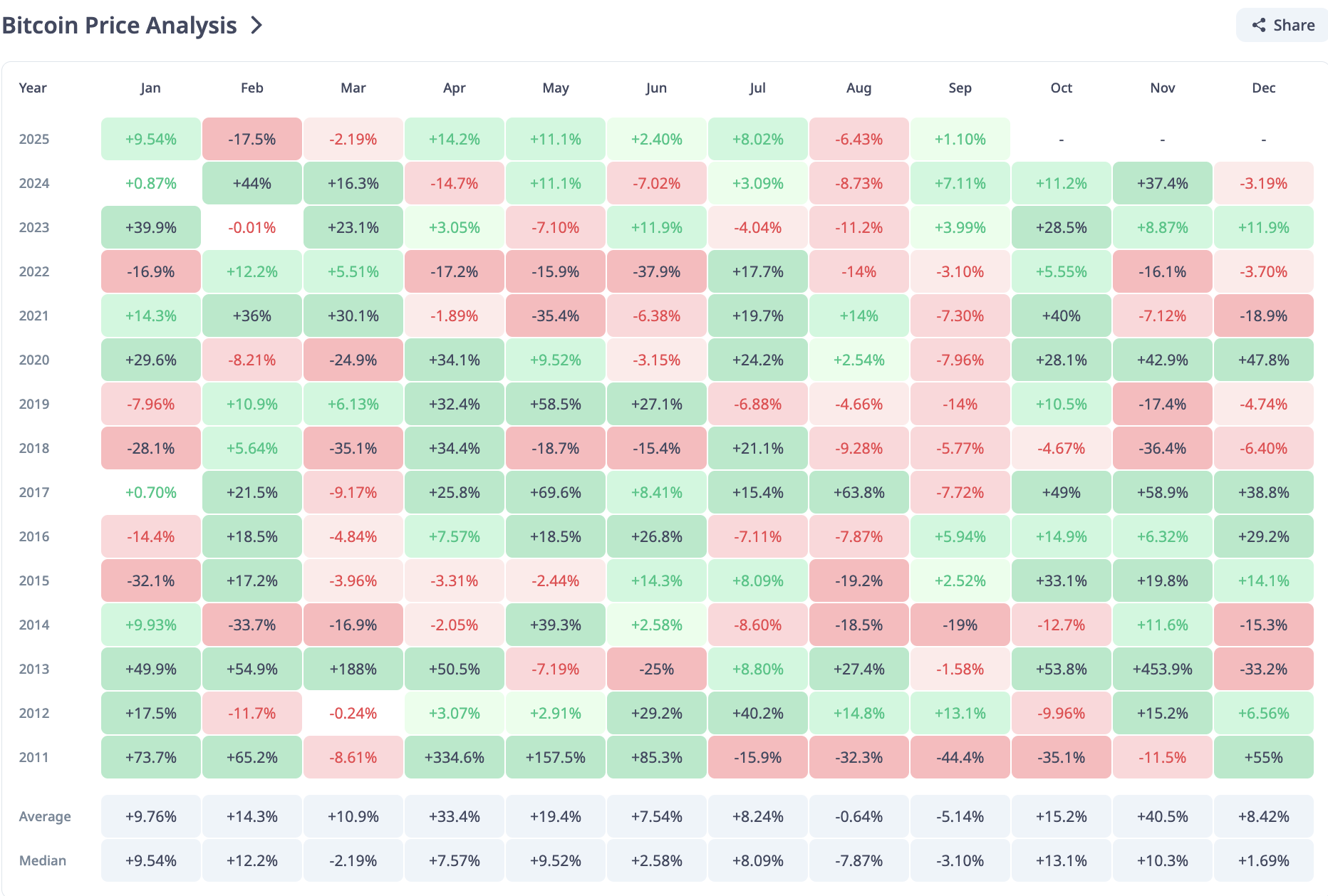

Historically, September has been Bitcoin’s least favorite month, a time of negative returns and heightened volatility. Data, that dry chronicler of fate, shows that over the years, the coin has logged multiple red closes in September-an 8% drop in 2020, a 7.3% decline in 2021, and a 3.10% dip in 2022. One might say September is to Bitcoin what nihilism is to Bazarov. 🌪️

Though it recorded marginal gains of 4% and 7% in September 2023 and 2024, respectively, this month could see the downtrend return, given the combination of waning institutional demand and a market sentiment as bearish as a wounded bear. 🐻

ETFs Flee, and Sentiment Sours: Bitcoin’s Double Whammy 🍋

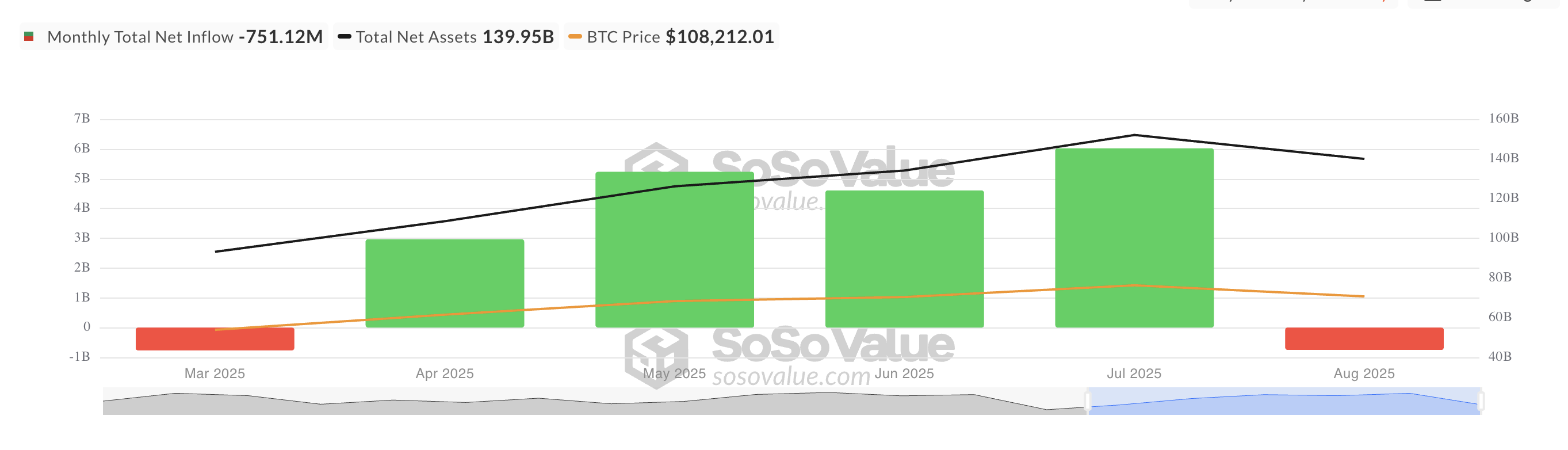

August, that cruel month, was marked by a decline in capital inflows into BTC-backed exchange-traded funds (ETFs). According to SosoValue, outflows totaled $751.12 million, ending a four-month streak of steady inflows that had propped up BTC’s rise like a crutch for a lame horse. 🏇

This is no small matter, for since the approval of spot BTC ETFs, the asset’s ascent has been as dependent on institutional inflows as a nobleman on his serfs. The more capital poured in, the stronger BTC’s momentum. Now, with inflows reversing and institutional interest flagging, the coin faces additional downward pressure, like a fallen aristocrat pleading for alms. 🧑🌾

Without the consistent backing of large-scale ETF demand, the market may struggle to maintain its bullish momentum, leaving the asset as vulnerable as a debutante at her first ball. If retail buyers fail to fill the gap, sharper corrections loom like a storm on the horizon. 🌩️

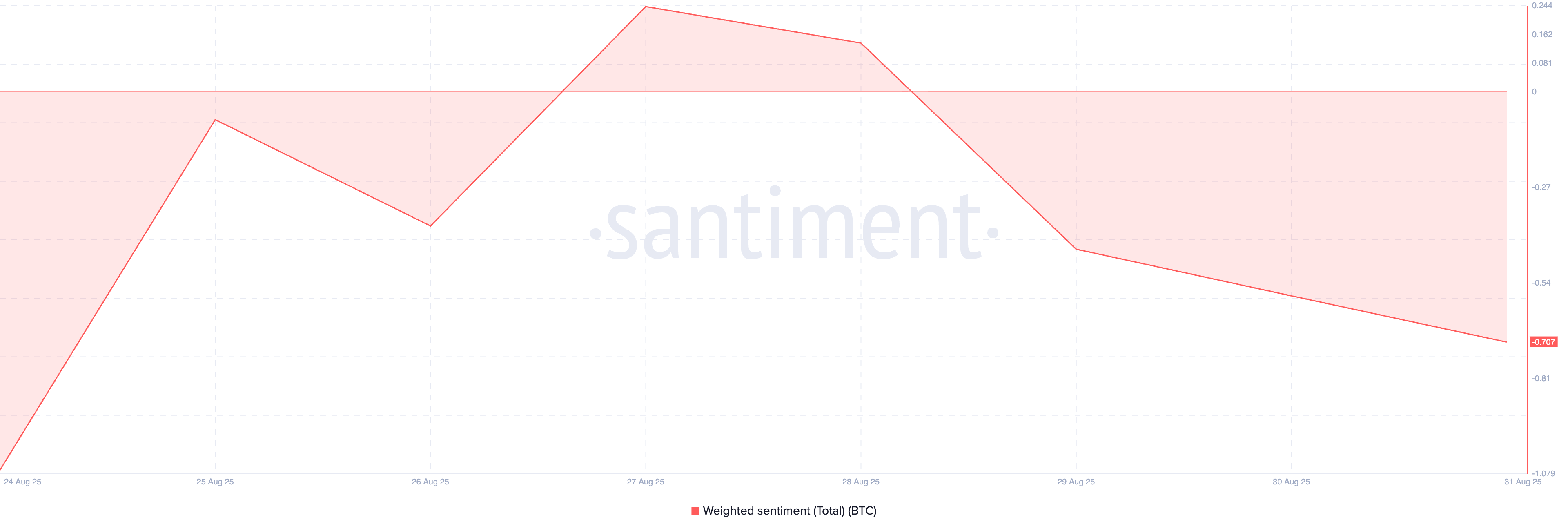

Furthermore, Bitcoin’s negative weighted sentiment confirms the likelihood of a further price dip. According to Santiment, this metric stands at -0.707, as bearish as a Tolstoy novel. 📉

Weighted sentiment, that barometer of collective mood, measures an asset’s bias by combining social media mentions with their tone. A positive sentiment signals rising confidence, while a negative one reflects skepticism, like a society lady spreading gossip at a soirée. 💬

When sentiment turns negative, investors grow wary, trading less and leaving the asset to its own devices, like a forgotten character in a Turgenev novel. 🕊️

Bitcoin Bears Circle $103,000: Will the Bulls Hold Their Ground? 🐂🆚🐻

With institutional investors and spot traders growing cautious, reduced optimism could translate into weaker demand and lower trading volumes. If buying continues to falter, the coin’s price might slip toward $107,557. Should the bulls fail to defend this support, a deeper decline to $103,931 could ensue, like a tragic hero’s final act. 🎭

On the other hand, if demand soars, BTC could rebound and climb above $111,961, like a phoenix rising from the ashes-though in this case, the ashes are of shattered hopes and dashed dreams. 🦅

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- Dildos & Dunks?! 🏀😂

- BNB: To $1,000 or Total Chaos? 🤯

- XRP Price Tale: The River That Rises

- XRP’s Big Week: SEC Drama, BlackRock Rumors & A Possible $6 Party 🚀

- BlackRock & Stablecoins: A Most Convenient Arrangement 🧐

2025-09-02 05:51