Oh, finally-a signal that’s not just a mirage in the desert of crypto chaos. 🌵💸 Macro liquidity expectations are finally improving, and institutional inflows into Bitcoin ETFs are as steady as a toddler on a sugar rush. 🍬📉

Bitcoin Price Steadies as RSI Divergence Confirms Buyer Strength 🚀

Bitcoin is currently trading near $101,724, up 0.46% over the past 24 hours, according to Brave New Coin data. The cryptocurrency remains well below its all-time high of $126,198, but on-chain and momentum indicators suggest renewed accumulation. 🧠📈

Market analyst Mister Crypto (@misterrcrypto) highlighted a hidden bullish divergence between Bitcoin’s price and its Relative Strength Index (RSI)-a formation that typically indicates weakening bearish pressure and potential trend continuation. “Hidden bullish divergence on Bitcoin’s RSI hints at underlying buying strength, even as prices retest local lows,” he said on X. 🤔💸

Bitcoin Liquidity Sweep Could Precede Upside Move 🌪️

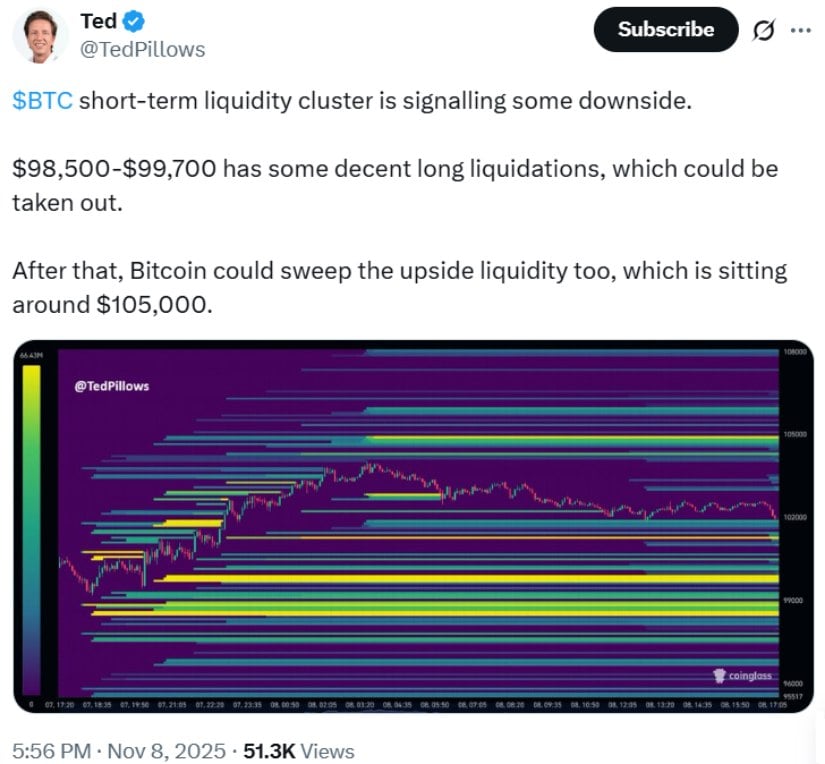

Despite the bullish setup, short-term volatility remains in play as traders assess Bitcoin’s liquidation heatmap for potential liquidity sweeps. Analyst Ted (@TedPillows) noted that long liquidations between $98,500 and $99,700 could attract short-term downside before a relief bounce. “After that, Bitcoin could sweep the upside liquidity too, which is sitting around $105,000,” he explained. 🧙♂️🔮

Data from Coinglass and Bybit support this thesis, showing that such liquidity-driven flushes often resolve higher, particularly in trending bull markets. Historical analyses suggest these liquidity sweeps lead to upside continuations about 70% of the time. With weekend trading volume thinning, analysts expect short-term volatility to persist, though ETF inflows from BlackRock, Fidelity, and Grayscale continue to provide structural support for Bitcoin’s medium-term trend. 🏗️📈

Bitcoin Resistance at $111,600 Could Trigger Next Major Upside Move 💥

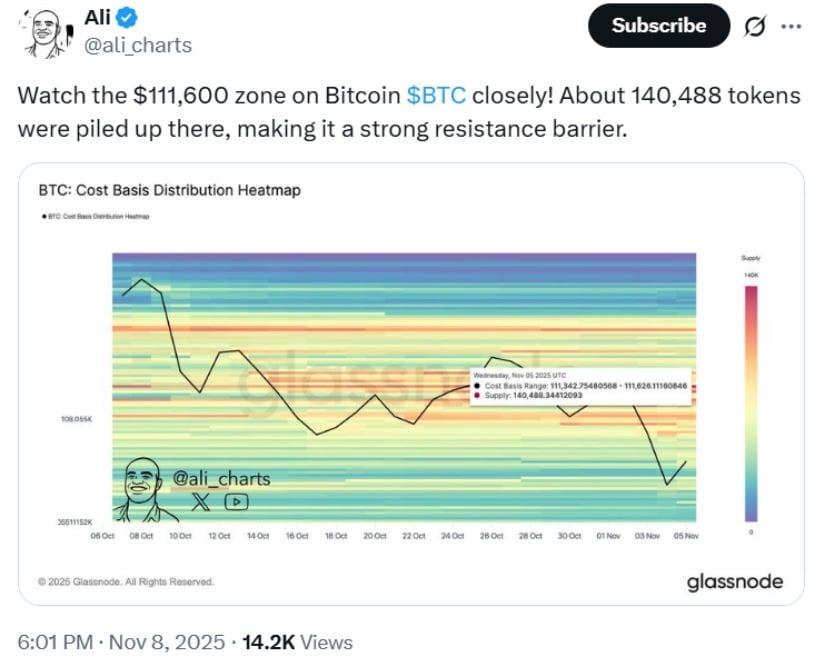

On-chain data indicates that $111,600 remains a key resistance level to watch. According to Ali (@ali_charts), approximately 140,488 BTC were accumulated between $111,342 and $111,626, forming a dense cost basis zone where holders may look to exit at breakeven. “Watch the $111,600 zone on Bitcoin closely-it’s a strong resistance barrier but could flip to support if broken decisively,” Ali said. 🧠💸

Analyst Shanaka Perera referred to this area as a “memory wall,” a zone that has historically flipped from resistance to support during strong uptrends. Glassnode data shows that in about 65% of prior bull markets, breaking through similar accumulation clusters triggered accelerated price rallies. If Bitcoin closes above $111,600 on strong volume, traders expect momentum to strengthen toward the $110K-$115K range. 📈🔥

Final Thoughts 🧠

Bitcoin’s current setup highlights a mix of technical optimism and short-term caution. The hidden bullish divergence on the RSI, combined with strong on-chain accumulation and steady institutional ETF inflows, suggests that BTC could be preparing for a rebound toward the $110K zone. Traders are watching key liquidity levels closely, as short-term sweeps below $99K may trigger temporary volatility before a sustained recovery. 🌀📉

Macro tailwinds, including anticipated rate cuts, improving liquidity, and continued inflows into Bitcoin ETFs from providers like BlackRock, Fidelity, and Grayscale, further support a constructive outlook. While risks remain, Bitcoin’s market structure, combined with historical patterns, points to the potential for renewed bullish momentum. If BTC holds current supports and breaks resistance at $111,600, the next leg toward higher price targets could be underway-marking another pivotal moment in its ongoing bull cycle. 🚀💸

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Cronos Rises as Crypto Markets Crumble! 💸📉

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- DOGE PREDICTION. DOGE cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- USD CNY PREDICTION

2025-11-08 23:33