- Bitcoin‘s ascension to $109K is fueled by institutional investors, not on-chain activity – a curious case indeed 🤔.

- Miners are holding tight, derivatives are surging, and long-term holders are showing restraint – no panic in sight 😎.

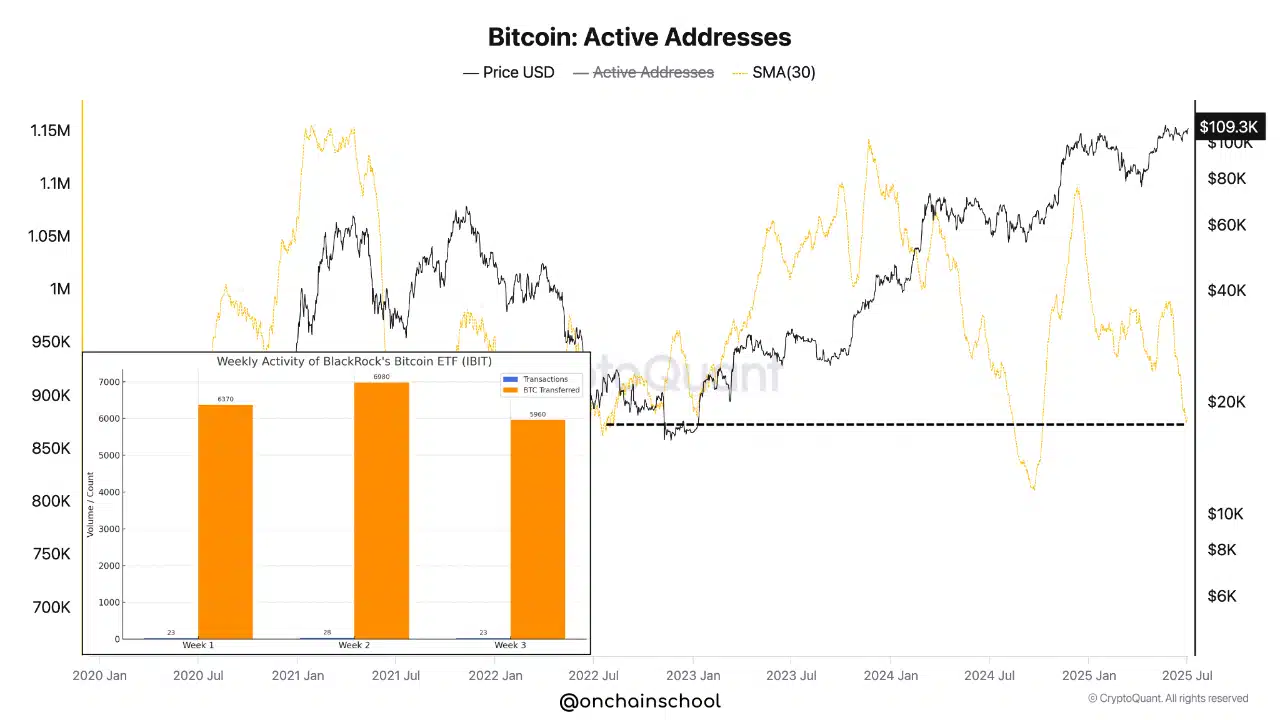

The demand for Bitcoin from institutional investors continues to grow at a rapid pace, yet on-chain activity remains eerily subdued, creating a striking divergence between price action and network signals 📊.

At the time of writing, BTC was trading at $109,919 after gaining 2.04% in the last 24 hours, but active addresses remain stuck around 850,000 – a level last seen when BTC hovered near $16,000 in 2022 📉.

This gap reflects the growing influence of ETFs and corporate treasuries, where large capital flows occur off-chain, making traditional metrics less reflective of actual demand 📈.

Therefore, Bitcoin’s rally may be unfolding under a new, quieter market structure – one that is driven by the whims of institutional investors rather than the fervor of retail traders 🤫.

The Corporate Adoption Conundrum 🤝

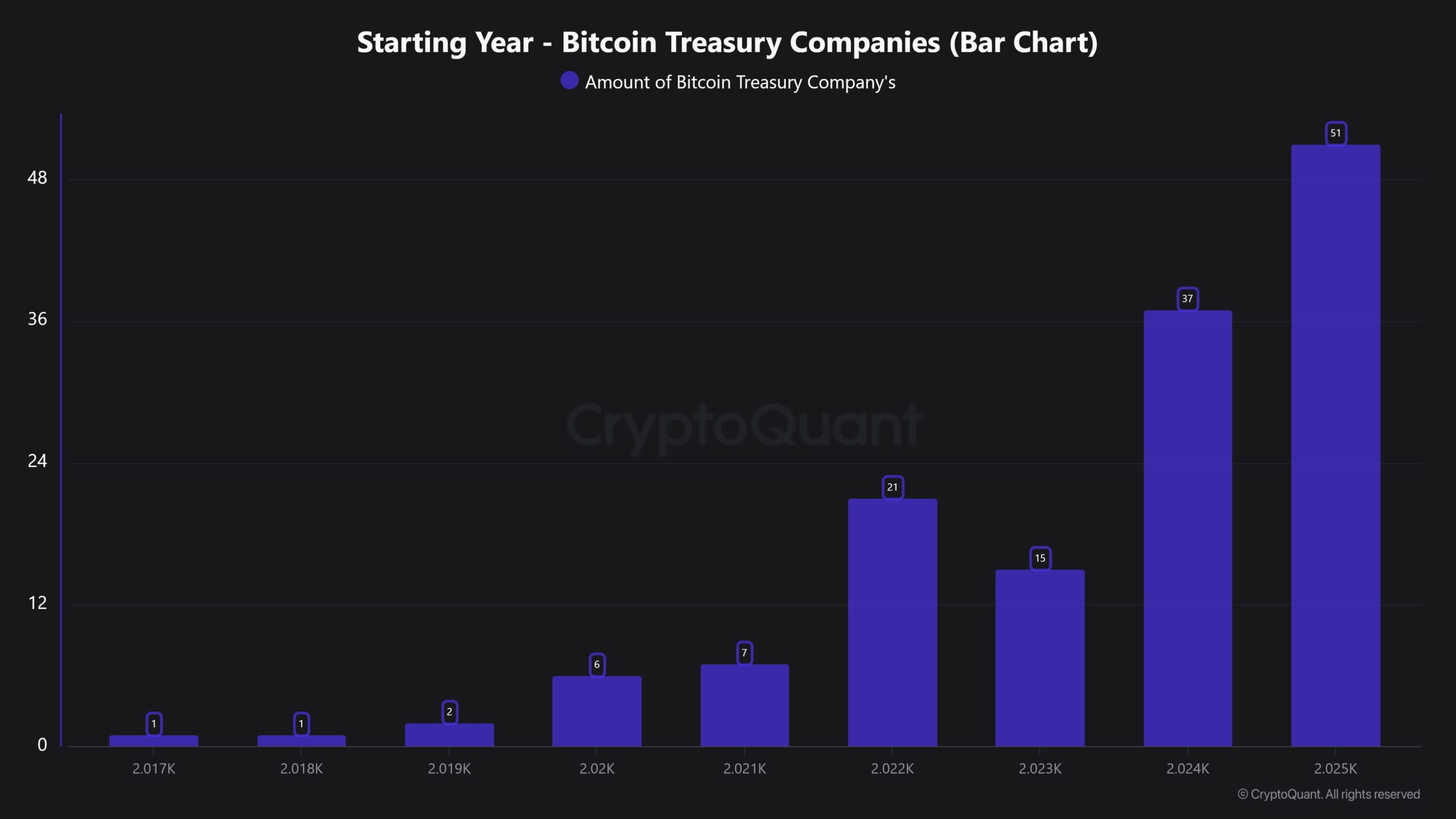

The surge in companies adding Bitcoin to their treasuries reveals growing institutional conviction – 51 firms have integrated BTC into their balance sheets as of 2025, nearly doubling from two years ago 📈.

This consistent year-over-year increase demonstrates strong strategic positioning by corporations, who are now accumulating Bitcoin for long-term exposure rather than short-term gains 🕰️.

While retail traders rely on price swings, institutions appear to be playing the long game, evolving Bitcoin from a speculative asset to a macro hedge and reinforcing its store-of-value narrative 💰.

Miners’ Reluctance to Sell 🔒

Despite a 68.51% daily rise in the Miners’ Position Index (MPI), the metric remained negative, signaling that overall miner outflows are still below the yearly average 📊.

Historically, negative MPI levels suggest miner confidence in future price appreciation – if miners anticipated a correction, more coins would likely be sent to exchanges 📉.

However, this reluctance to sell, even amid rising activity, suggests miners are holding firm, adding subtle but critical support to the ongoing price action 💪.

Long-Term Holders’ Measured Approach 📊

The Net Realized Profit and Loss (NRPL) rose 7.43%, signaling moderate profit realization – however, this activity seems measured rather than aggressive 📈.

Instead of a full-blown exit, holders appear to be trimming gains as Bitcoin approaches psychologically significant levels, indicating discipline in the market 📊.

This behavior reflects a maturing ecosystem where profit-taking is no longer synonymous with bearish pivots – recent sell-offs seem more tactical than fear-driven 😎.

Coin Days Destroyed – A Tale of Repositioning 🔄

Coin Days Destroyed (CDD) also climbed 3.04%, showing a slight uptick in activity from long-held coins – however, this movement does not indicate panic 📊.

Long-term holders may be reallocating or taking selective profits without exiting the market entirely, reflecting a broadly optimistic sentiment 🌟.

As long as CDD remains moderate, confidence among seasoned investors continues to anchor the bullish trend, supporting the notion of long-term market sustainability 📈.

Derivatives – The Next Wave 🌟

At the time of writing, BTC’s derivatives activity surged notably, with trading volume up 22.34% to $94.2 billion and Open Interest rising by 6.71% to reach $76.76 billion 📊.

Notably, options volume spiked 58.01%, pointing to increasing speculative momentum – this growing leverage participation could amplify both volatility and price discovery 📈.

However, such enthusiasm also reflects a stronger conviction among market participants, suggesting traders are positioning for further upside rather than preparing for a reversal 🚀.

Conclusively, BTC’s rise near $110K comes with muted on-chain signals but growing institutional adoption, restrained miner selling, and rising derivatives’ momentum – a potent cocktail indeed 🍹.

This evolving market structure suggests BTC’s price may now respond more to off-chain capital flows than to traditional network metrics, potentially marking a new era of quieter but more powerful rallies 🚀.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- 🚨 Bunni DEX Bites the Dust After $8.4M Oopsie! 🚨

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

- Meme Coins: September’s Silent Revolution? 🤑

- NYC Election Drama: Million-Dollar Bets, Big Losers & Market Shenanigans! 😂💸

- Dogecoin’s Dashing Cup-and-Handle: Is $0.25 the New $10? You Won’t Believe It!

2025-07-03 22:32