Darling, it seems the Federal Reserve has decided to throw a spanner in the works, leaving Bitcoin in a bit of a tizzy. With the Fed’s internal squabbles reaching a crescendo, 2026 may well be the year of the lone interest rate cut-if we’re lucky! 🍸✨

Bitcoin Takes a Tumble: Fed’s Hawkish Tantrum for 2026

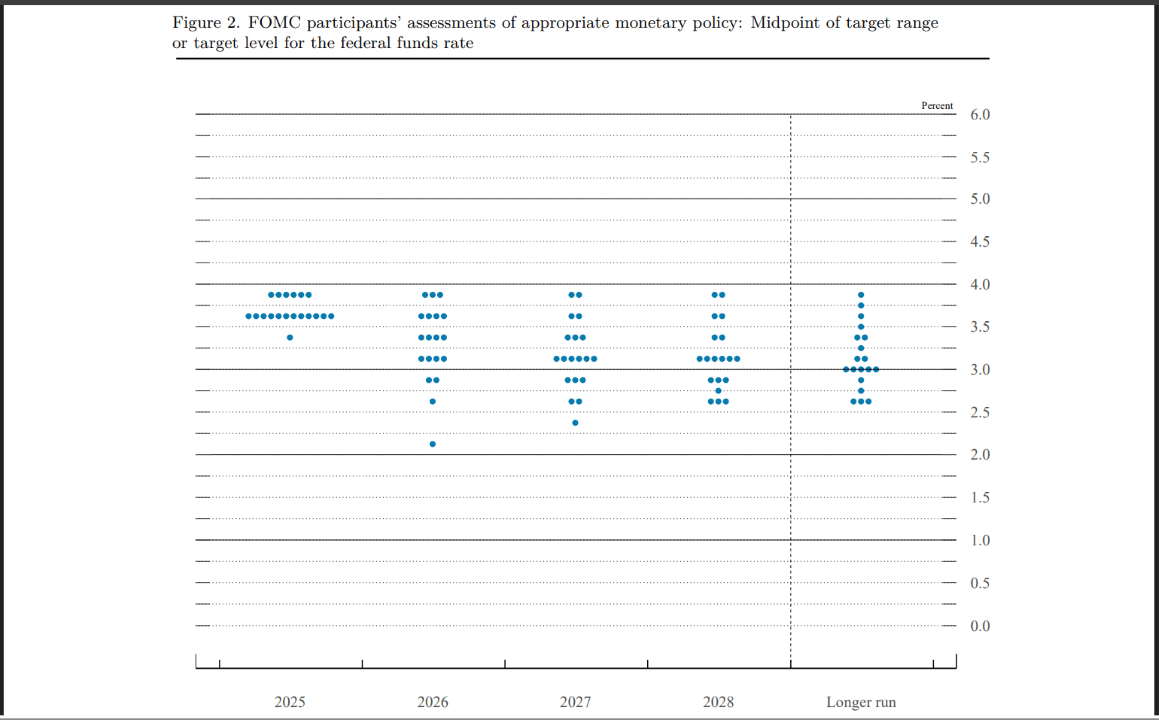

For the first time in six years, three members of the Federal Open Market Committee (FOMC) decided to throw their toys out of the pram, dissenting against Wednesday’s interest rate reduction. The result? A chart dubbed “the dot plot”-a delightful little doodle-reveals that 2026 may only see a single rate cut. This, my dear, has sent Bitcoin spiraling below $90K, faster than a Coward cocktail at a society party. 🥂💔

The Fed, ever the drama queen, held rates steady for most of the year, despite Trump’s administration clamoring for cuts. Eventually, softer employment figures forced their hand, leading to three cuts in 2025. But oh, the theatrics! Austan Goolsbee and Jeffrey Schmid, the Fed presidents for Chicago and Kansas City, respectively, voted to hold rates. Meanwhile, Trump’s recent appointee, Stephen Miran, wanted a 50-basis-point reduction. Darlings, it’s like a bad episode of Downton Abbey but with more economic jargon. 🏰📉

“You just have people who have strong views,” Fed Chairman Jerome Powell quipped at Wednesday’s press conference. “Nine out of twelve supported it, so fairly broad support. But it’s not like the normal situation where everyone agrees on the direction and what to do.” Oh, Jerry, darling, if only you knew how much we adore a good drama! 🎭💅

Powell’s “strong views” have also made their way into the dot plot, a quarterly chart showing interest rate projections by the FOMC members and Federal Reserve Bank presidents. The median interest rate range? 3.25-3.50%, darling. Powell confirmed it: 3.4%. This means a single 25-basis-point cut in 2026, which is hardly music to the ears of risk-on assets like Bitcoin. The current range? 3.50-3.75%. 🤑📉

A Quick Glance, Darling

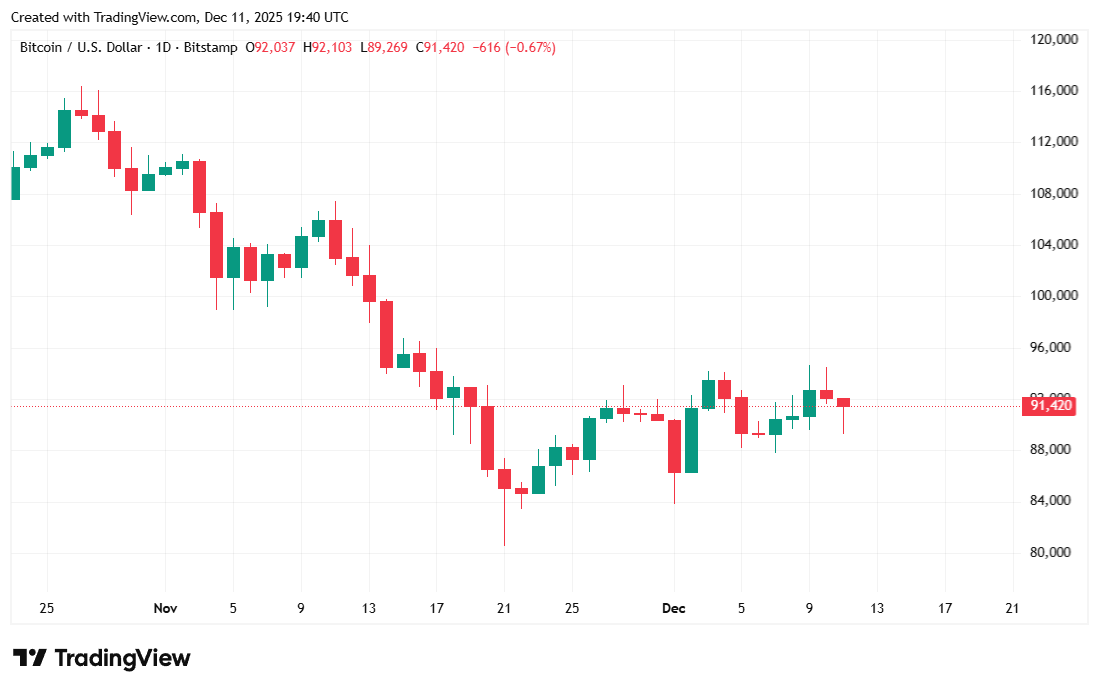

Bitcoin was priced at $91,346.75 at the time of reporting, down 1.82% over 24 hours and lower by 0.43% for the week, according to Coinmarketcap. It traded as low as $89,335.30 on Thursday and climbed as high as $94,477.16. Quite the rollercoaster, wouldn’t you say? 🎢💸

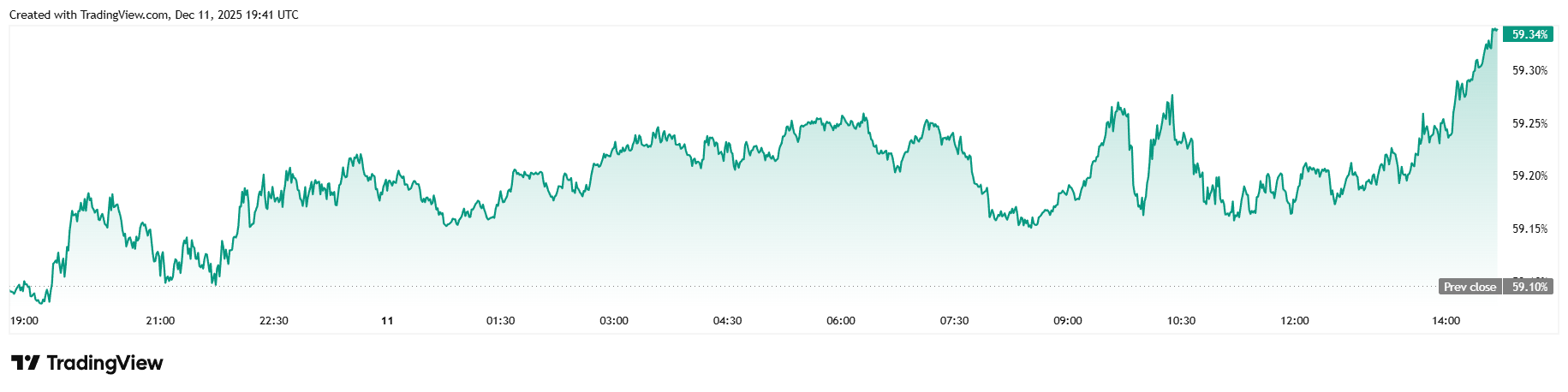

Daily trading volume rose 13.56% to $65.64 billion. Market capitalization fell to $1.82 trillion, but Bitcoin dominance increased by 0.45% to 59.34%. Oh, the drama! 🌟📈

Total Bitcoin futures open interest remained flat, inching upward by 0.20% to $59.74 billion. Thursday’s liquidations nearly doubled, reaching $180.23 million. Long investors suffered $131.81 million in losses, while overzealous short sellers lost $48.42 million. Oh, the folly of it all! 🤦♂️💸

FAQ ⚡

- Why did Bitcoin fall after the Fed’s decision?

Traders were spooked by the Fed’s projections of only one rate cut in 2026. How dreadfully unkind! 😱📉 - What changed inside the Federal Reserve?

Three FOMC members dissented, highlighting growing internal division. Drama, darling, drama! 🎭💥 - How does the 2026 dot plot affect crypto?

A hawkish outlook suggests tighter financial conditions, weighing on risk assets like BTC. Oh, the humanity! 😢📊 - What interest rate does the Fed now expect for 2026?

The median projection is 3.4%, implying barely any easing from today’s 3.50-3.75% range. How utterly tedious! 😴📉

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- CNY JPY PREDICTION

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- Mark Twain’s Take: South Korean Crypto Exchange Looks for a Sugar Daddy

- TRX PREDICTION. TRX cryptocurrency

- BNB: To $1,000 or Total Chaos? 🤯

- Trump’s Crypto Carnival: $800M in Gold-Plated Gibberish 🤑🤡

2025-12-12 00:29