Ah, the fickle dance of fortune! Bitcoin, once the darling of the digital proletariat, now stumbles like a drunkard on a cobblestone street, its price tumbling from the lofty heights of $90,000-$95,000 to a mere $68,400. The air is thick with the scent of panic, and the on-chain metrics whisper tales of woe-a structural weakness that would make even the most hardened speculator weep into their vodka.

- Bitcoin, once a titan, now crouches at $68,400, its knees buckling under the weight of its own hubris. The breakdown from the $90,000-$95,000 range is not just a fall-it’s a comedy of errors, a farce played out in the theater of the markets.

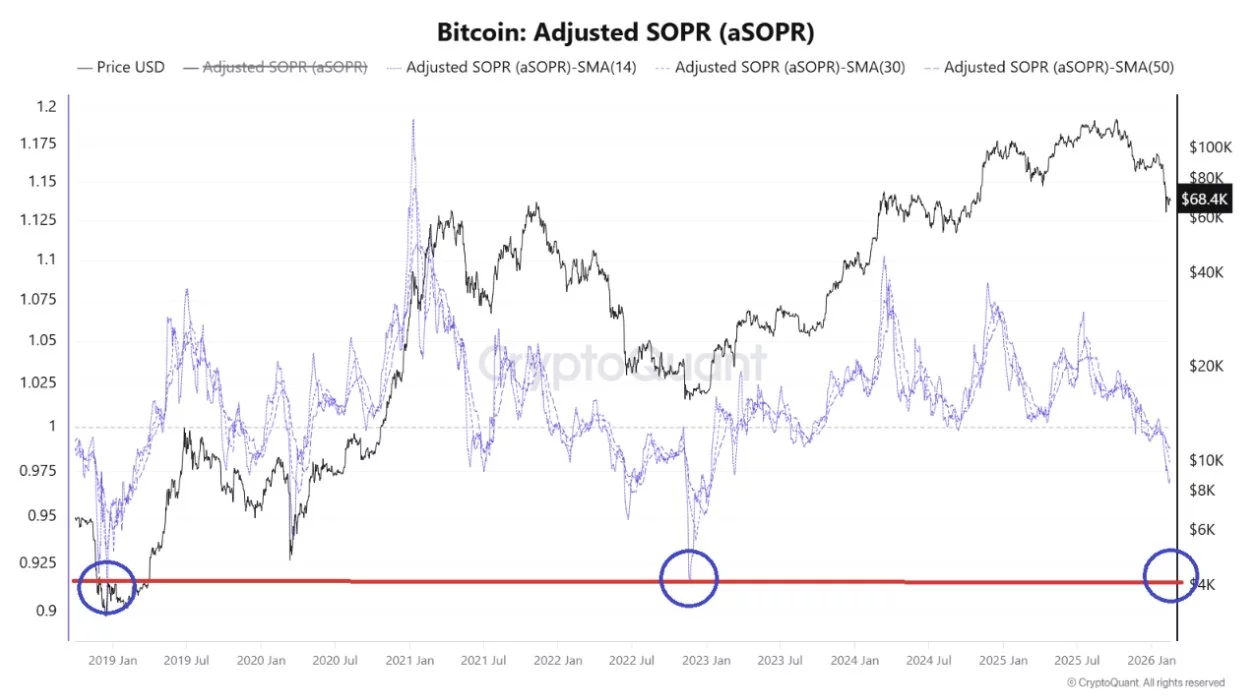

- CryptoQuant, that oracle of digital despair, reports the adjusted SOPR (aSOPR) sinking to 0.92-0.94. Ah, the bear market stress zone! Where coins are spent at a loss, and dreams go to die. In 2019 and 2023, this zone was a graveyard; now, it’s a stage for the tragicomedy of loss realization.

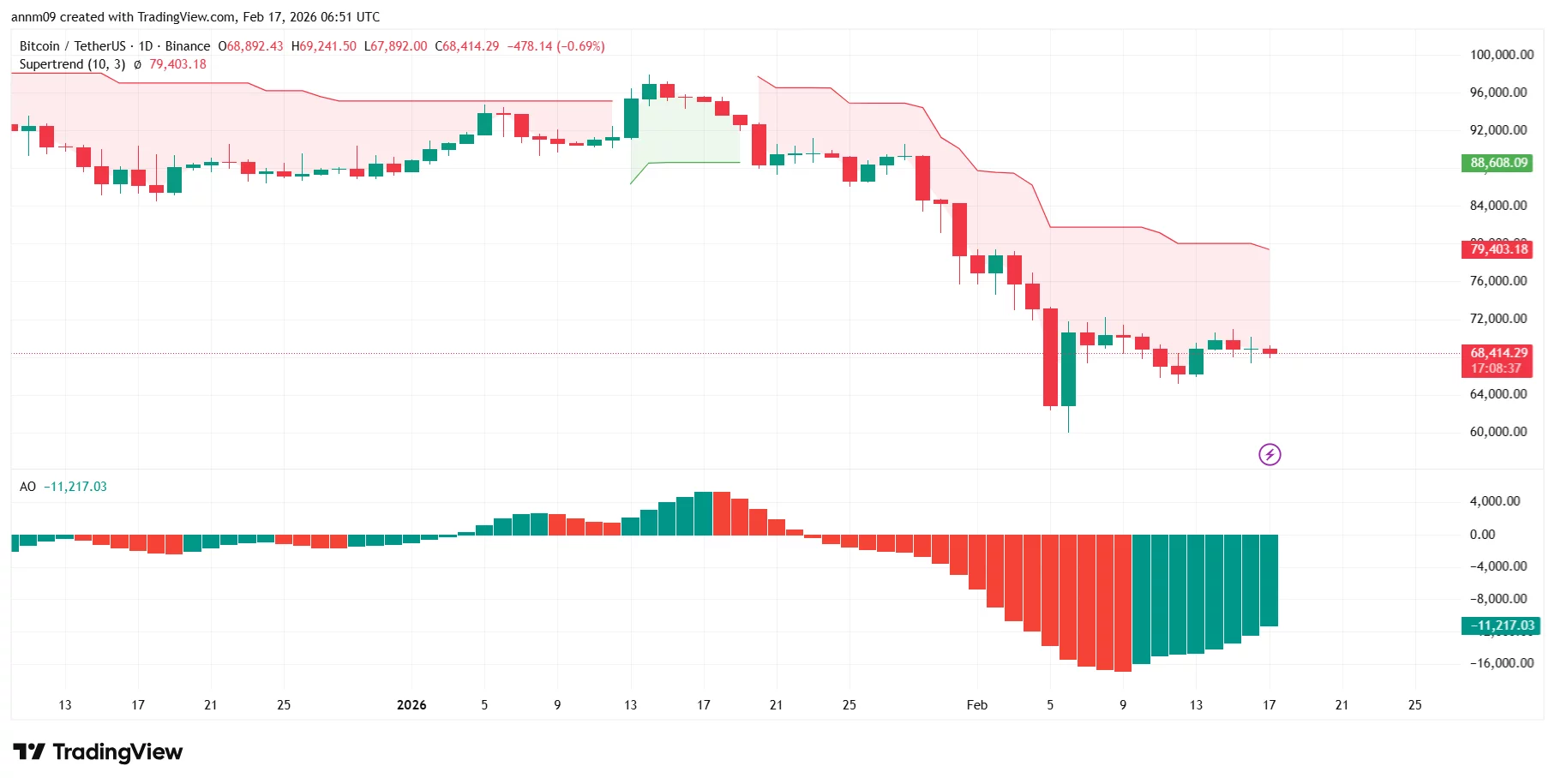

- Technical indicators, those cold-hearted harbingers of doom, point to resistance at $72,000 and $79,400. Support, meager and trembling, sits at $64,000 and the $60,000-$62,000 zone. Will it hold? Or will Bitcoin plunge further, like a clown falling off a unicycle?

At this hour, Bitcoin trades at $68,400, a far cry from its earlier glory. The breakdown from $90,000-$95,000 was not just a fall-it was a spectacle, a lesson in the cruelty of markets.

Bitcoin’s Descent into the Abyss: aSOPR Signals the Bears’ Banquet

The on-chain data from CryptoQuant paints a grim picture: the aSOPR metric has slithered into the 0.92-0.94 range, a zone of historical despair. Below 1.0, coins are spent at a loss-a sign of capitulation, of holders throwing in the towel. In past cycles, this range was the domain of deep corrective phases, of structural resets. Now, it’s a carnival of misery, a testament to the fickleness of fortune.

Unlike mid-cycle dips, where aSOPR rebounds like a rubber ball, the current move is a slow, painful descent. CryptoQuant notes that true bottoms form only after deeper compression, after the last tear has been shed, and the last seller has fled. Until then, the bears feast, and the bulls weep.

In 2019 and 2023, this zone was a crucible; now, it’s a stage for Bitcoin’s latest tragedy. Will it survive? Or will it join the ranks of the forgotten, a cautionary tale for future speculators?

The Charts Speak: A Tale of Woe and Resistance

The daily chart is a masterpiece of despair. The Supertrend indicator, once a beacon of hope, has flipped bearish, now looming at $79,400 like a specter. Price recently dipped into the low $60,000s before stabilizing, but the damage is done. Immediate support at $64,000 trembles, while the $60,000-$62,000 demand zone waits like a safety net-or perhaps a trap.

Momentum indicators remain negative, though the pace of decline slows. Unless Bitcoin can reclaim $72,000 and eventually $79,400, the broader structure favors continued weakness. Combined with the on-chain signals, the setup resembles not a correction, but a regime shift-a new era of bear dominance. So, grab your popcorn, comrades, and watch the drama unfold. For in the world of Bitcoin, as in life, the only certainty is uncertainty-and the occasional laugh at our own expense.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- 🚨 Bunni DEX Bites the Dust After $8.4M Oopsie! 🚨

- Vitalik Buterin Pushes Gas Futures Idea for Ethereum

- RENDER PREDICTION. RENDER cryptocurrency

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- Will Ethereum’s $5K Destiny Unravel as Whales Assert Themselves? 🐋💰

- Why Cardano’s Next Move Might Make You Say ‘Wow’ or ‘Oh No’

- Meme Coins: September’s Silent Revolution? 🤑

2026-02-17 11:28