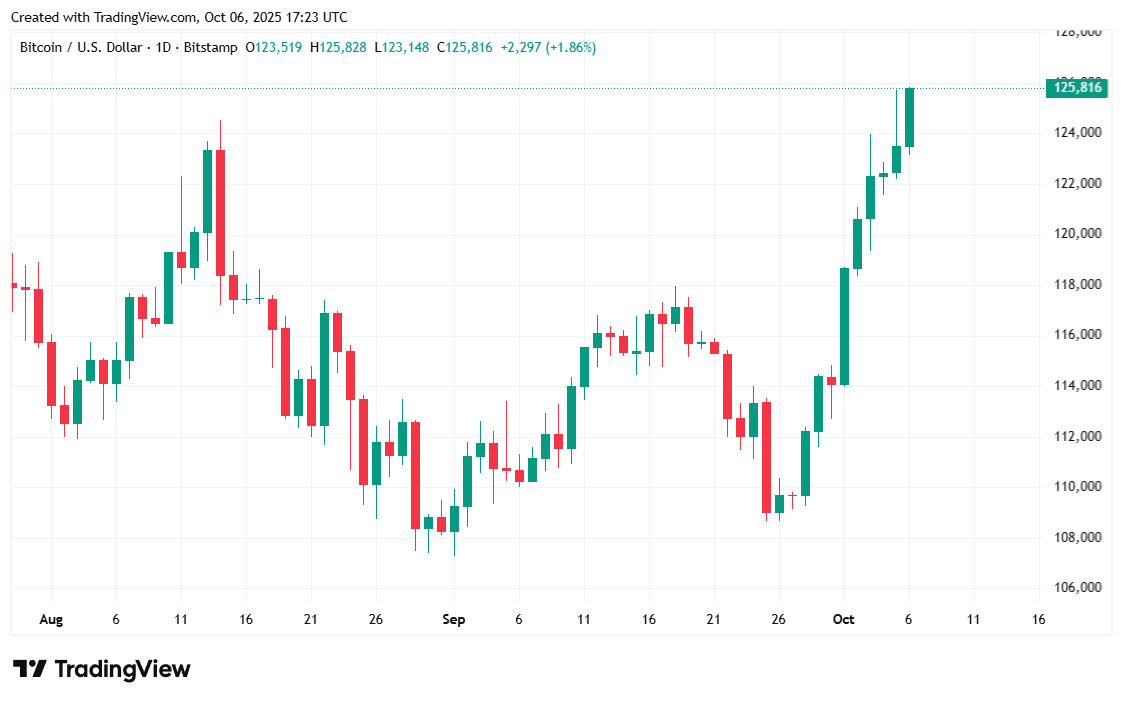

Bitcoin‘s latest record-breaking moment? Oh, just a casual stroll past $125K early Sunday morning. It then decided to set a new $125.8K record on Monday afternoon. No biggie, right?

Is Bitcoin’s Rally Sustainable? Data That Actually Makes Sense Suggests It Is

According to Coinmarketcap, Bitcoin (BTC) quietly broke its previous record of $124,457.12 and then just kept going. On Monday afternoon, it touched a new high of $125,559.21. And guess what? No one seems to be throwing a massive party about it, which might just be a good sign of strength in the market, says Glassnode, that ever-so-wise crypto analytics firm.

But wait, there’s more: ETFs holding Bitcoin now have a combined value of $164.5 billion, representing roughly 6.74% of Bitcoin’s total market cap. Sosovalue.com even showed net inflows exceeding $60 billion into Bitcoin ETFs last Friday. Daily retail demand? Nearly $1 billion. Who says no one is paying attention?

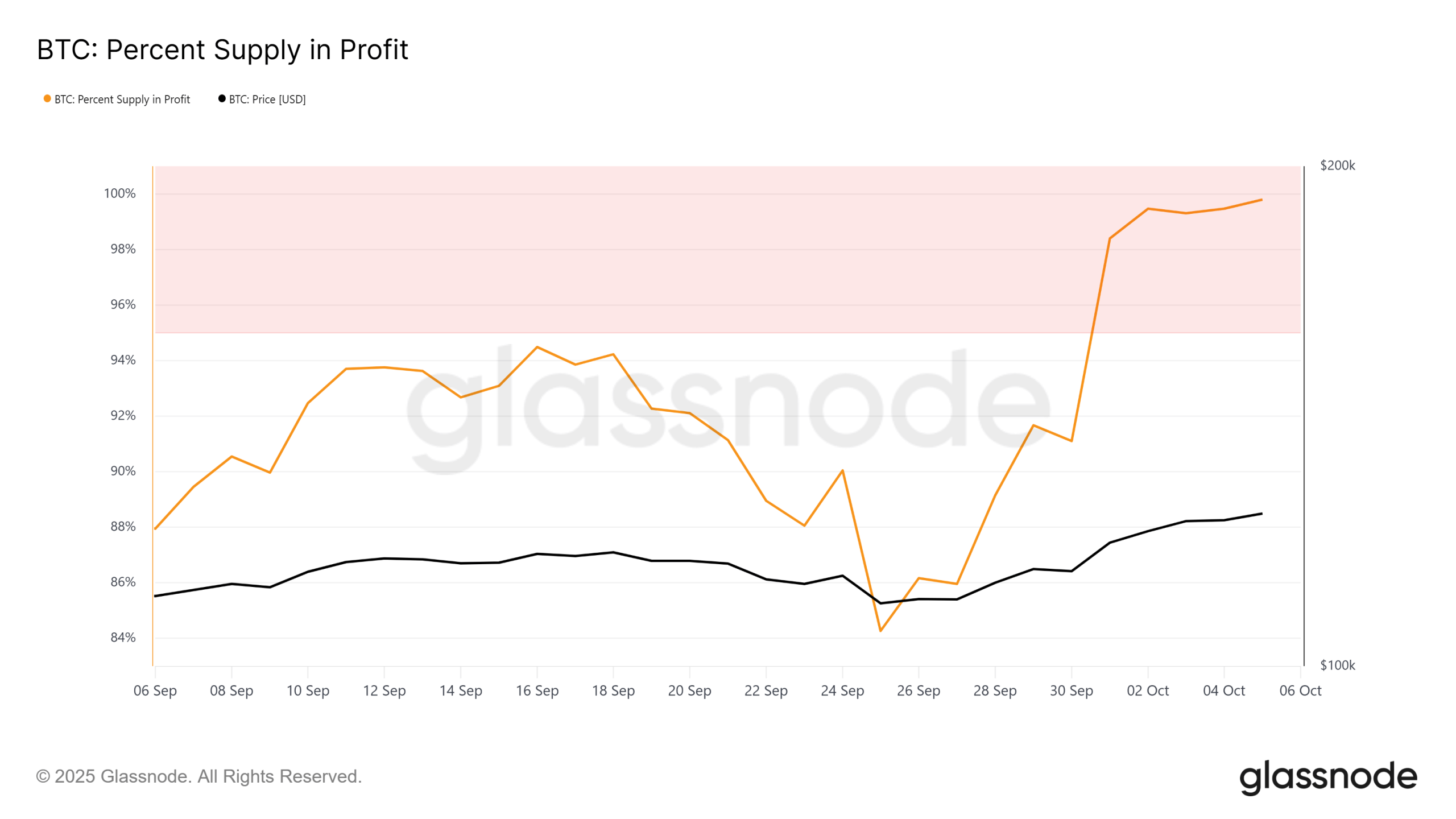

On-chain activity is buzzing like a caffeinated bee, with active addresses up by 11%. Oh, and did we mention that nearly every Bitcoin holder is currently swimming in profits? Yeah, it’s a good time to be in Bitcoin, assuming you didn’t panic-sell in 2018. Futures contracts are nearing a whopping $100 billion, so in other words, Bitcoin’s rally isn’t driven by unchecked greed-it’s backed by solid fundamentals. For now, at least.

According to Glassnode, “Bitcoin’s new all-time high is supported by synchronized growth in spot, derivatives, and on-chain markets.” Translation: improving liquidity, strong ETF inflows, and rising on-chain profitability mean this rally is based on structural capital inflows-not just another bout of speculative nonsense. Phew.

Here’s What the Market’s Saying About Bitcoin

Bitcoin was trading at $125,282.56 at the time of writing, up 1.83% in the last 24 hours and 9.87% over the last week, according to Coinmarketcap. It briefly surged past $126K on Monday afternoon, but then decided to take a breather. Classic Bitcoin.

Now, here’s the real kicker: daily trading volume dipped 7.22% to $64.35 billion. A 7% drop, really? Apparently, people were too busy staring at Bitcoin’s new all-time high to trade. But despite this, Bitcoin’s market cap climbed 1.72% to $2.49 trillion. In the altcoin world, however, it looks like the real party is just getting started.

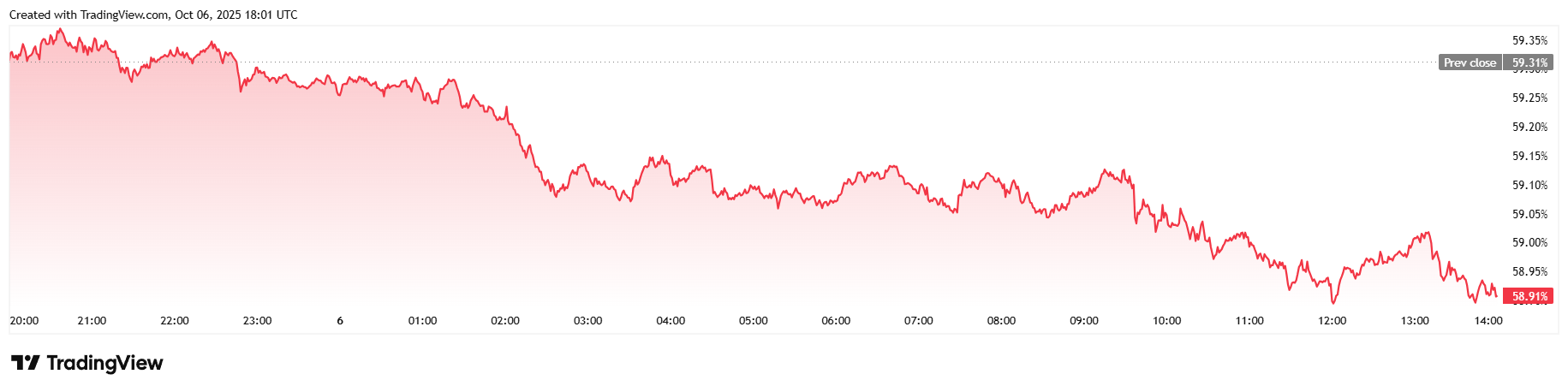

Bitcoin futures open interest shot up to $95.34 billion, a 4% increase in just 24 hours. As for liquidations? Only $58.90 million, which is tame considering the price spike. Unsurprisingly, short-sellers took a big hit, losing $45.80 million. It’s always the shorts, isn’t it?

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Starknet’s $365M Staking Spree: Bitcoin Meets Chaos!

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- Circle’s Amazing €300M Milestone with EURC! 🌍💸

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- Render Rises, Bitcoin Dips-Traders, Beware!

- CNY JPY PREDICTION

- How Trump Turned Bitcoin into a Shooting Star & Made Shorts Cry 😜🚀

2025-10-06 22:38