The market’s latest whim left Bitcoin gasping, as if a drunkard had tripped over his own greed.

At the U.S. market’s belated awakening, Bitcoin stumbled like a tipsy sailor, plummeting $1,500 in 20 minutes. Buyers, ever the timid guests, retreated, leaving long traders to scramble like ants in a rainstorm. Yet panic? No-merely a polite nudge from forced liquidations, as if the market were tidying its closet.

Bitcoin Drops 2.2% in Minutes as Long Liquidations Accelerate

On Ted Pillows’ 1-minute BTCUSDT chart, Bitcoin once lounged at $68,300-$68,400, sipping champagne. Then, a swarm of red candles descended, dragging it to $66,800-$66,900 like a toddler yanked from a candy store. One might call it a dance, but only if one enjoys waltzing with wolves.

Dropped $1,500 in 20 minutes after the US market open.

The sellers are back.

– Ted (@TedPillows)

This 2.2% freefall was a masterclass in indifference. Buyers, ever the absentee landlords, ignored the slump. Momentum, that fickle companion, clung to selling like a leech to a fool. The market, it seemed, preferred a slow, dignified collapse over a quick, messy death.

Liquidity data whispered of a fragile kingdom. Clusters of greed above $68,500-$70,000 evaporated like mist. Instead, Bitcoin sank into barren zones, where hope is scarce and stop-losses are plentiful. A liquidity vacuum, they called it-a place where dreams go to die.

Once $68,000 cracked, the floodgates opened. Longs, those overconfident optimists, were liquidated like bad debts. Stops, those silent executioners, multiplied the pain. The price, now at $66,800, had become a graveyard of hubris.

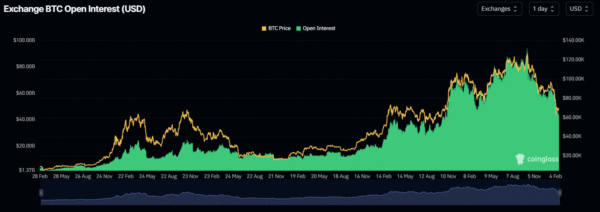

Open interest, that bloated beast, confirmed the carnage. Elevated OI, now deflating, mirrored Bitcoin’s descent. Price down. OI down. A symphony of despair, composed by overleveraged hands.

Image Source: CoinGlass

Shorts? They watched, sipping tea, as longs drowned. This was no revolution-it was a mass exodus from the Titanic. The speed? A slap in the face to anyone who thought they’d mastered the market’s whims.

Funding rates, those sly puppeteers, had been positive for days. Traders paid to hold longs, like paying a toll to a bridge that crumbles beneath you. Now, the tollbooth was closed, and the bridge was rubble.

ETF Outflows and Elevated OI Leave BTC Vulnerable to Liquidations

Positive funding + high OI = a recipe for disaster, served cold. When momentum stalls under such conditions, even a pebble can start an avalanche. The U.S. market open? Merely the spark in a powder keg of foolishness.

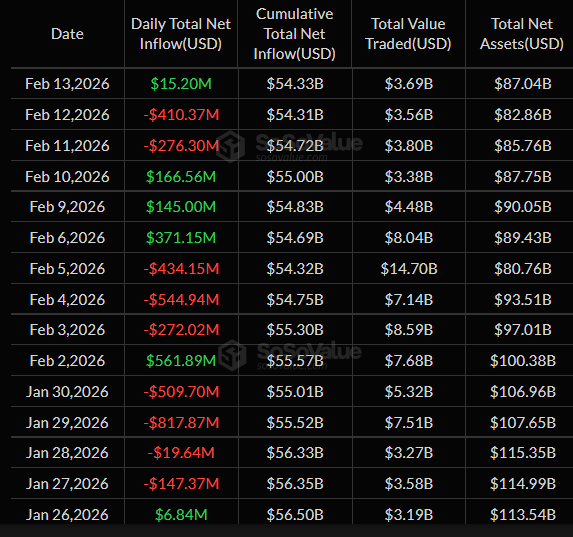

Meanwhile, Bitcoin ETFs bled $410 million and $276 million in outflows, with Feb. 13’s $15 million inflow the market’s feeble attempt to apologize for its sins. Institutional demand? A ghost story now.

Image Source: SoSovalue

With fewer buyers to cushion the fall, leveraged traders became pawns in a game of Russian roulette. Support levels broke like promises. Selling pressure? A stampede with a vendetta.

Futures dominate over options, a fact as obvious as a hangover after a bender. Positions clustered in perpetual contracts, where liquidation waves crash like a drunkard’s last stand. One might call it innovation. Or madness.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Vitalik Buterin Pushes Gas Futures Idea for Ethereum

- 🚨 Bunni DEX Bites the Dust After $8.4M Oopsie! 🚨

- FET PREDICTION. FET cryptocurrency

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- Meme Coins: September’s Silent Revolution? 🤑

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Why Cardano’s Next Move Might Make You Say ‘Wow’ or ‘Oh No’

2026-02-18 01:41