Markets

What to know:

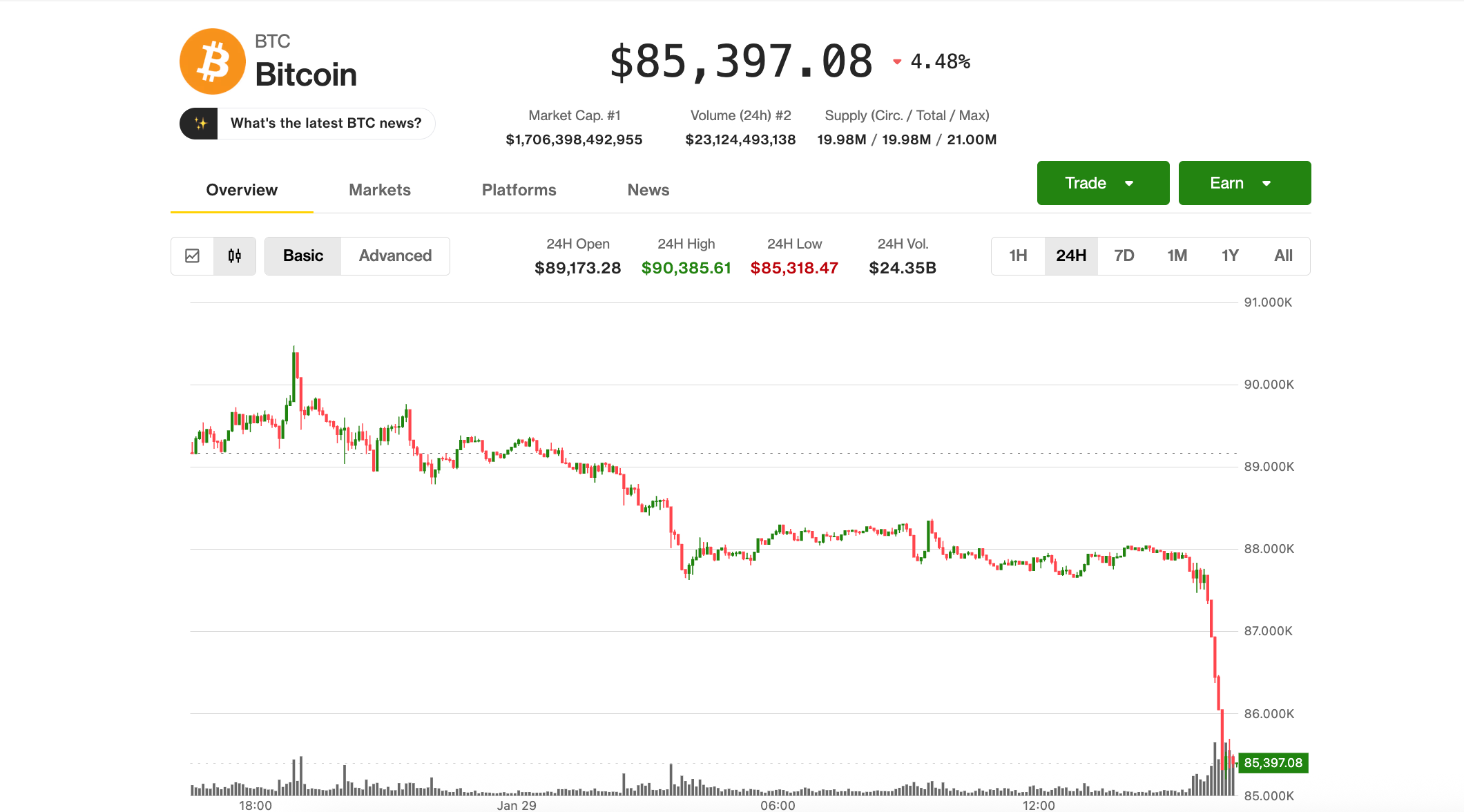

- Lo and behold, dear readers, as our beloved Bitcoin, that capricious jester of the financial realm, has decided to play a cruel trick on the unsuspecting souls of the market, plummeting to a dismal $85,200, a nadir most foul for this year.

- What a spectacle it was! The dazzling ascent of gold, that ancient symbol of wealth, was like a jubilant dance, soaring above $5,600, only to be rudely interrupted by a swift descent back to its more humble abode of $5,400. Truly, a performance worthy of the stage!

- And as if in a tragic play, the Nasdaq, that hallowed index of dreams, took a nosedive of 1.5%, dragged down by none other than Microsoft, whose shares crumbled by over 11% after revealing their less-than-stellar cloud ambitions.

In a fit of existential despair, Bitcoin fell to its lowest point since the frosty days of mid-December, shedding nearly $3,000 in a matter of hours, as if it were shedding the burden of an unworthy past.

Gold, too, performed a dramatic pirouette; one moment it basked in the glory of $5,600 per ounce, and in the blink of an eye, it found itself tumbling nearly 10% back below $5,200-ah, the irony of fortune!

Silver, not wishing to be outdone, mirrored this tragic downfall, collapsing from a respectable $121 per ounce to a mere $108. What a splendid comedy of errors!

And who could forget the unfortunate plight of Microsoft (MSFT), whose shares experienced a cataclysmic failure greater than any tragedy penned by Shakespeare, plunging more than 11%-the worst day since the dark days of March 2020-after confessing to a slowdown in its cloud ventures. Such is the nature of ambition in the tech world!

As a fitting epilogue, the crypto markets, ever the fickle companions, followed suit, with Bitcoin, having once basked comfortably above $88,000, now cascading down to a woeful $85,200, marking a disheartening 4.5% decline over the last 24 hours.

Ethereum‘s ether, Solana, and other altcoins joined in on this grand tragedy, suffering losses between 5% and 6%, as if they too were caught in the throes of a collective existential crisis.

In the world of corporate Bitcoin holders, Strategy (MSTR) faced an ignoble fate, plummeting 8%, marking its worst day since the cold December winds, now languishing at levels reminiscent of September 2024. How the mighty have fallen!

Other unfortunate names such as Bullish (BLSH), Twenty One Capital (XXI), Circle (CRCL), and Coinbase (COIN) also found themselves caught in this whirlwind of despair, each down 4%-8%, as if they were characters in a tragicomedy of epic proportions.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Blockheads at UGM: Beans & Blockchain Edition 🌾

- 🤑 Saylor’s Strategy: 3% of Bitcoin? Oh, la la! 🤑

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- Bitcoin’s Speedy Upgrade: Can $HYPER Solve Bitcoin’s Slowness?

- Crypto Catastrophe: Kinto Token Collapses 81% After Its Ethereum Layer-2 Shuts Down!

- XRP’s Open Interest Reset: A Pantomime of Profits 🎭💸

- 🚨 Bitcoin’s Wild Ride: $88,500 or Bust? Glassnode Says Hold Onto Your Hats! 🚀

2026-01-29 19:20