Recent on-chain data analysis indicates that Bitcoin has undergone a typical price correction within a normal range and is nearing an oversold state. 🐿️

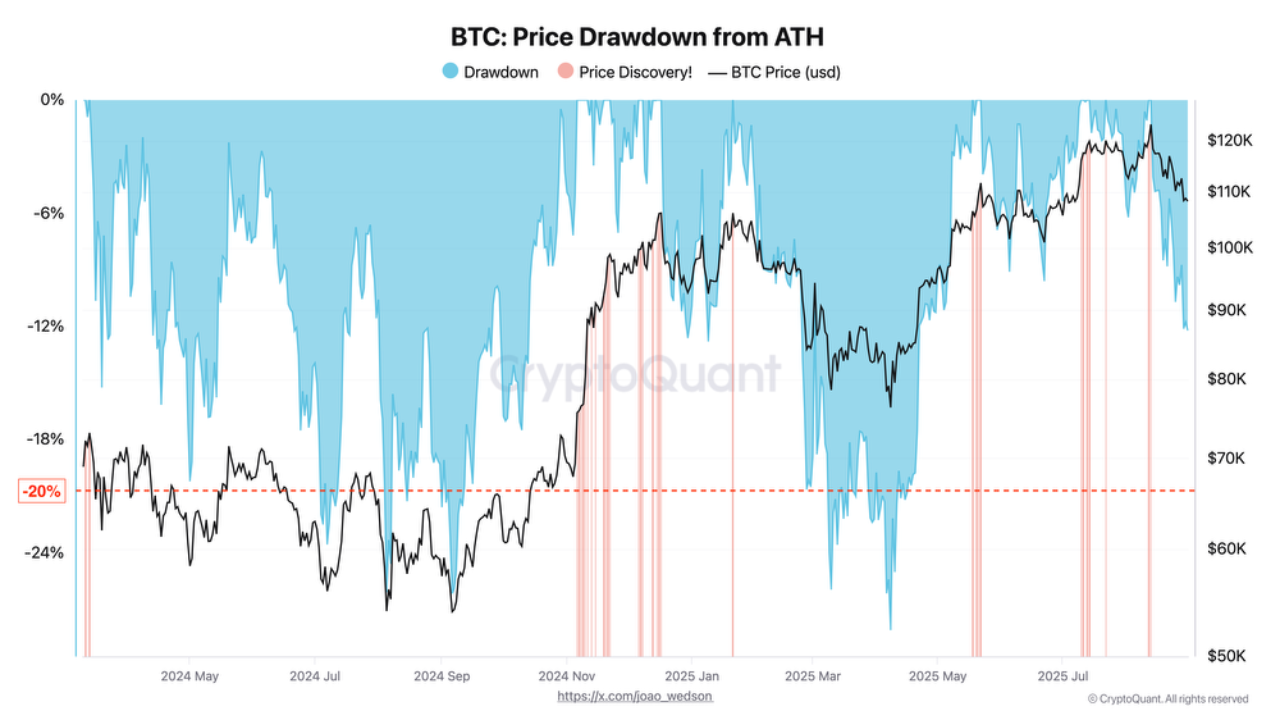

CryptoQuant analyst Darkfost released his analysis on Wednesday, noting that the price had adjusted for two weeks following its all-time high of $123,000, dropping about 12%. He says this movement is well within a normal range compared to historical data. “It’s like a squirrel losing its acorn stash-no big deal,” he quipped. 🐿️

Healthy Pattern in a Bull Market

This analysis refutes recent speculation that Bitcoin’s bullish cycle has ended, calling such interpretations excessive. He points out that since breaking its previous all-time high in March 2024, Bitcoin has experienced price fluctuations as large as a 28% drop. Typically, a “deep” correction is considered a 20-25% drop on average. “A 20-25% drop is now considered a ‘deep’ correction-imagine that!”

“This correction is nothing particularly unusual, and Bitcoin’s upward pattern could continue,” Darkfost stated. He described such corrections as a healthy and frequent phenomenon in a bull market, serving to reduce excessive leverage from derivatives and offer new entry opportunities for long-term investors. “It’s like a doctor prescribing a dose of reality-necessary, but no cause for alarm.” 💉

Bitcoin: Now in an Oversold State?

The analysis that Bitcoin is in an oversold state is also gaining traction, as the price has repeatedly bounced back instead of falling below the $107,000 level. “Bitcoin is as oversold as a used car salesman on a Monday,” one observer remarked. 🚗

Frank, a quant investor active on X, said, “Officially got the Oversold print on the short-term holder MVRV bollinger bands.” He explained that this signal has appeared three times in the last two years.

Officially got the Oversold print on the short-term holder MVRV bollinger bands. Last three instances of this:

1. Yen Carry Unwind – $49k

2. Tariff Tantrum – $74k

3. Today – $108k $BTC– Frank (@FrankAFetter) September 1, 2025

The first was during the unwinding of the yen carry trade in August 2024. The second was during the US tariff war in April of this year. The third is the current correction. “Three times in two years? It’s like a broken clock-still right twice a day!”

Bitcoin Vector, a crypto influencer on X, diagnosed that the $110,000 price level has become a strong resistance point during this correction, trapping Bitcoin in a price range. He believes that downward pressure is easing and that upward momentum will return if the daily closing price exceeds $111,000. “If Bitcoin can’t break $111k, it’s about as useful as a screen door on a submarine.” 🛥️

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- XRP’s Big Week: SEC Drama, BlackRock Rumors & A Possible $6 Party 🚀

- BlackRock & Stablecoins: A Most Convenient Arrangement 🧐

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

2025-09-02 14:49