It is a truth universally acknowledged, that a single Bitcoin investor in possession of a good fortune, must be in want of a fresh high – a sum of no less than $140,000, to be precise.

According to the esteemed CryptoQuant, this lofty price point is the benchmark by which long-term holders of the cryptocurrency may judge their profits, if they are to rival those of earlier times.

A Most Singular ‘Market Magnet‘ Theory

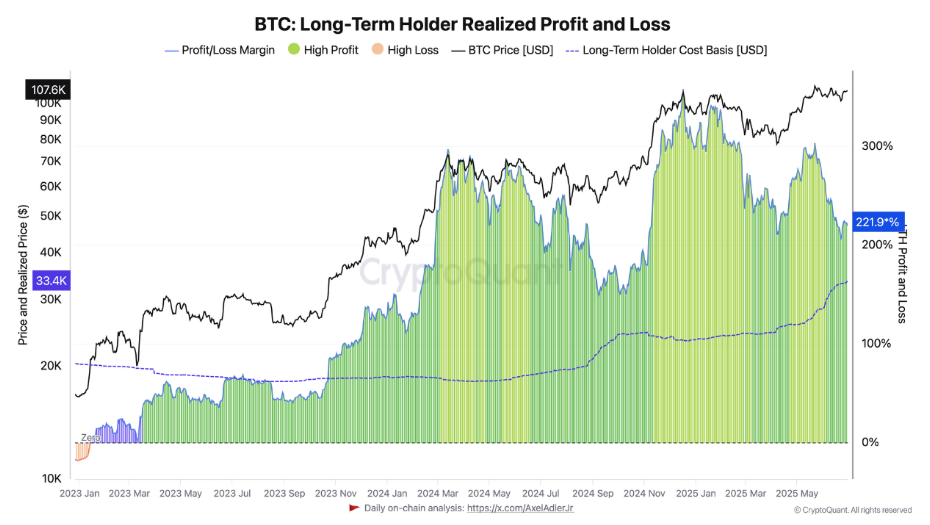

CryptoQuant, in their infinite wisdom, have employed the Market Value to Realized Value (MVRV) ratio to gauge the depth of profit currently enjoyed by holders of the coin. And what do we find? A respectable 220% profit, to be sure, but a far cry from the dizzying heights of 300% and 350% gains, seen in March and December 2024, respectively.

This disparity, dear reader, is what the erudite Darkfost, a CryptoQuant contributor of some renown, terms a “market magnet.” A siren’s call, beckoning investors to the promised land of $140,000, where unrealized profits may match the cycle’s top levels.

The Profit-Taking Trends of the Season

As Bitcoin flirts with new highs, long-term investors have been selling, their actions driving much of the selling pressure in recent weeks. Their average cost basis, or realized price, stands at a mere $33,800 – a sum that must be reached, if only to break even, for those who purchased the coin six months prior.

And so, to attain the profit levels of yesteryear, BTC must ascend to the lofty heights of $140,000. A dynamic, indeed, that prompts some traders to lock in gains, whilst others hold on, with bated breath, for greater moves.

A Super Majority, Still in the Green 🌿

Reports indicate that a super majority of Bitcoin investors sit upon unrealized profits, worth a staggering $2.5 trillion – a testament to the market’s recent rally. And yet, despite this, many investors remain sanguine, confident that fresh buying shall absorb any waves of profit-taking.

The current phase, a pause, of sorts, wherein buyers and sellers engage in a delicate dance, each sizing the other up. The question, dear reader, is whether demand shall pick up, with sufficient fervor, to drive that magnet-level price.

Analysts, those esteemed soothsayers, proclaim that Bitcoin appears poised for a post-breakout retest, having broken a multi-week downtrend, begun in mid-May.

They aver, furthermore, that the bull run may have but several months left, before a final surge, and then, a change in trend. If this view holds, that final push may be the moment when BTC nears, or even attains, the elusive $140,000. After which, history suggests a sharp peak, followed by a cool-down, of sorts.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- 🚨 Bunni DEX Bites the Dust After $8.4M Oopsie! 🚨

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

- Meme Coins: September’s Silent Revolution? 🤑

- NYC Election Drama: Million-Dollar Bets, Big Losers & Market Shenanigans! 😂💸

- Dogecoin’s Dashing Cup-and-Handle: Is $0.25 the New $10? You Won’t Believe It!

2025-07-04 01:36