In what can only be described as a delightful farce, Bitcoin has once again taken a nosedive, plummeting into the kind of price range not witnessed since the dawn of the year, briefly flirting with the lowly territory of $75,000.

The recent losses-oh, the drama!-have accumulated over recent months, leaving our beloved cryptocurrency languishing far beneath its gloriously lofty peak, igniting yet another round of spirited debate about whether the bullish parade has finally come to a halt.

But fear not, dear reader! This drop was not an isolated incident; no, it appears we’re witnessing a grand performance of wider market pressures rather than a crypto-specific tragedy.

Bids Gather Like Flies Below $73k

Order books are revealing a rather robust congregation of buy interest clustered in the range stretching from about $71,500 down to the murky depths of $64,000. Market feeds suggest this demand is present but, my word, it’s rather tentative-like a shy debutante at a ball!

When bids amass on exchange books, one might think they’d act as a safety net to cushion the fall, though, as we know from experience, they can vanish faster than a magician’s assistant once sellers start to show their claws.

The situation has been exacerbated by liquidations galore: forced closures of leveraged longs reported in the millions have made for some rather spectacular short, violent drops, even when fundamental demand has decided to stay put and sip tea quietly in the corner.

This model suggests that Bitcoin’s current frolic around $74,000 is actually within the bounds of historical norms-a rather reassuring thought, wouldn’t you agree?

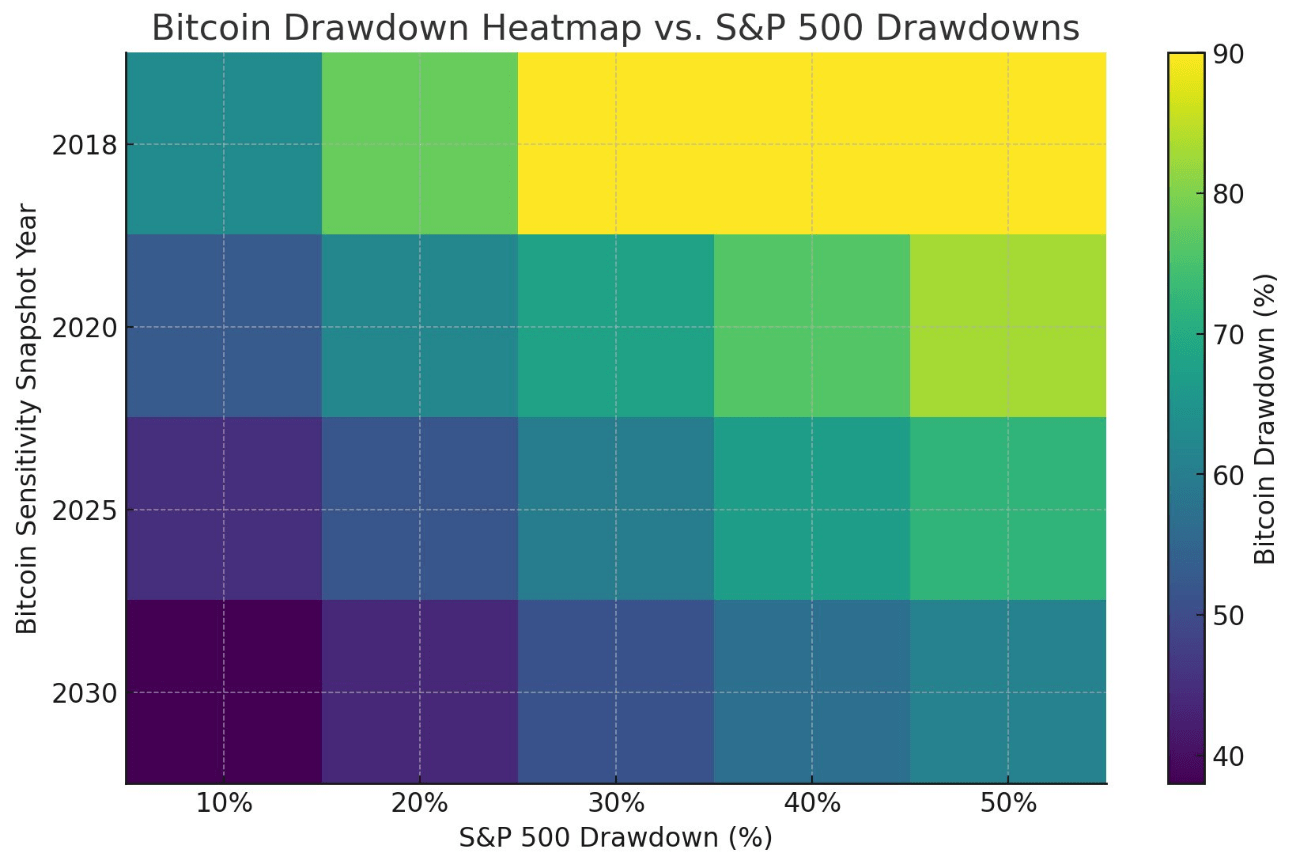

Bitcoin is down approximately 40% from its October high while U.S. equities prance around near all-time highs; the S&P 500 barely stumbles down less than 10%. Under such conditions, one could hazard a guess that a potential ~45% Bitcoin…

– Joe Burnett, MSBA (@IIICapital) February 3, 2026

Nothing To See Here, Move Along

According to our sage, Joe Burnett, vice president of Bitcoin strategy at Strive, this latest downturn is merely an encore performance fitting snugly into the patterns we’ve seen during past market cycles-how quaint!

Mr. Burnett opines that Bitcoin’s dalliance around the mid-$70,000 range reflects a drawdown size that has been observed before during periods of rapid adoption, much like a popular novel being re-released every few years.

He further elaborated that such dramatic swings tend to occur when an asset is still being priced by the capricious whims of the market, rather than settling into a boring old trading range.

Tech Stocks Cast A Shadow Over Risk Appetite

The retreat of US tech stocks, particularly those associated with the ever-enigmatic AI infrastructure, has been cited by several market commentators as a contributing factor to this raucous decline.

NVIDIA and Microsoft have taken the stage as major drags on indices, with reports indicating that lackluster sentiment surrounding earnings and costly AI escapades has left investors feeling rather cautious, if not outright terrified.

When the titans of growth wobble, investors often find themselves trimming their other risky positions, and lo and behold, crypto becomes an unwitting participant in this chaotic dance.

Ah, but there was evidence of retail dip-buying on some exchanges, along with institutional spot purchases-how positively charming!

According to Mr. Burnett, this 45% drawdown remains close to historical swings, suggesting that this volatility has some rather amusing precedents. While this perspective does little to alleviate the suffering of traders, it does place our beloved drop into a broader narrative rather than marking it as the final curtain call.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- Strategy’s Secret Bitcoin Vault: The Hidden Truths & Why They Won’t Play Fair

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Dogecoin’s Rise: A Thrilling Dance Between Support and Resistance!

- BBVA’s Crypto Chaos: Will Your Money Fly?

- Crypto Catastrophe: Kinto Token Collapses 81% After Its Ethereum Layer-2 Shuts Down!

2026-02-05 02:20